We all know who Bill Gates is. He's one of the richest men in the world with a net worth of around 127 billion dollars. He did this through creating his own company Microsoft, but he also did it through very smart investing.

Lately Gates is making some very interesting investment moves. His recent 13 filings he sold and reduced 11 stock positions and he bought just one.

Let's take a look at some of these:

1. Uber the worldwide ride-hailing company - he sold a hundred percent of his position.

2. Boston properties - he did the same thing he reduced it by a hundred percent, selling 1.1 million shares.

3. Alibaba - one of China's biggest companies here sold in his recent 13th filings a hundred percent of his position.

4. Google or Alphabet (same thing) he reduced by 50%.

5. Amazon - he sold all his shares.

6. Apple – even it was not immune to the wrath of Gates investment decisions – 50% gone.

These are big moves that Gates is making. Normally when an investor sells some of his position, it's normally a couple of percent. If it's 5%, it is usually a big deal.

And Bill Gates, he's selling 100% out of his positions like Uber and Alibaba, and 50% out of big stocks like Amazon, Apple, and Google these are big moves.

Some of his other moves include

7. Liberty group - the communications company, it was reduced by 25%

8. Great Berkshire Hathaway - was reduced by 10.6%

9. Canadian national railway - the only small sale of 0.86%

And if we take a look at all of the stocks that he bought in the first quarter of 2021 it was just one a stock called Schrödinger a healthcare stock.

And what the investors really want to know is why has Gates made such big sales in these massive companies.

One of Gates’s patterns is that with a lot of stocks he sold – he did it when they're very high in price which a lot of investors avoid.

Uber, that's currently selling for 56 dollars a share, market cap is over 100 billion and it's not even generating any profits.

Amazon price wise has gone up more than 400% over the past five years. It's got a p/e of 72. That's considered very high and not good.

Apple is up over 350%, p/e ratio is 33.

Google or Alphabet is up 170% with the same p/e ratio as Apple of 33.

These stocks that Bill Gates is rushing out of, you'd have to say, he thinks they're overvalued. It's not like he's selling them because he's desperate for cash, his net worth is over $127 billion dollars.

Most probably Gates is worried about a market crash.

if you look at a lot of stocks in the market their prices are up to crazy levels, and we’re sure Bill

Gates and his investment manager Michael Larsen have been closely looking at this market.

As per the latest report they have decided to dramatically trim or exit some of their positions.

We've seen a lot of crazy behavior in the market, people just seem to have so much spare money on them and what do they do with it - they put it into stocks

Bill gates is not a fan of this uneducated investing style he linked it to a casino. He said ‘we don't think of the stock market as just performing a casino-like role, we have restrictions on gambling activities’

The current situation reminds us of the 1930s, to some degree so with all this crazy behavior that was seen in the market, Gate says it reminds him of the 1930s, something which Ray Dalio has also pointed out before

What happened back then was you had the roaring twenties, when everyone was putting their leftover cash into the market, because they thought it could only go one way and that's up but then in the late 20s and 30s, we saw one of the biggest market crashes that the world has ever seen.

That’s a big reason why Gates has decided to trim his positions.

So, look at the only position that Gates is buying - Schrödinger the drug discovery and material science company.

Schrödinger - they use computer simulation to design different medicines and drugs to help cure diseases. They also use computer stimulation to design different types of materials too.

And Bill Gates is someone who is well educated in healthcare and he’s invested in a relatively small company, five billion dollars in market cap.

They sell for 76 dollars a share, and revenue wise they're doing pretty good as well. Their revenue has been growing steadily over the past couple of years, as they look to discover new drugs.

Schrödinger earnings are decreasing and that's just because they are reinvesting every single dollar.

Back in 2018 Bill Gates was asked if in the near future there will be another financial crisis, similar to the 2008? And Gate said “yes, it is hard to say when, but this is a certainty.”

With the amount of stocks that he has sold recently there is a lot of people questioning if that when is 2021?

Let's look at some statistics of the overall market in 2021.

1. The market cap to GDP ratio. Warren Buffett said on it that it's probably the best single measure of where valuation stand at.

And it is very high right now, it's eighty percent higher than the zero percent equal fair value market range, and it's miles above what it was in the 2008 financial crisis

It's even higher than what it was in the 2000 internet bubble.

And we all know what happened to stocks after that. This indicator says prices are high and is very worrying sign.

2. Looking at the market p/e ratio it tells a similar story. It's currently sitting at the 40 mark now. This is near the 2000 technology bubble but not quite as high as what things were in the 2008 housing bubble.

Nevertheless, a market p/e ratio of 40 is high if you consider the average that it has been throughout history - that's 15. So, it's more than double that, and therefore Bill Gates portfolio right now is conservative.

His top 10 stocks that makes up 95 percent of his overall portfolio are value-oriented safe place

His number one position even though he sold some is still Berkshire Hathaway.

Next it goes Waste management, Caterpillar (conservative), Canadian national railway (conservative), Walmart, Ecolab, Crown castle, Fedex, UPS - all conservative.

And the last one is Schrödinger. Apart from Schrödinger which is his 10th largest position that is a very safe portfolio.

When looking at Bill Gates’s stock positions - he's got a very guarded and cautious portfolio for the current market conditions and we should keep a close eye on the upcoming future as it might not be so bright for the stock market.

Why Bill Gates sold out his stocks (Mar ’21)

What is the p/e ratio

Today we're going to look at the price to earnings ratio to help all of you who would like to invest on the stock market.

The p/e ratio is by definition a price to earnings ratio, so it is a measure of valuation in order to determine how much does it cost to own a piece of a company in relation to how much the same company earns.

In general, the lower the p/e ratio - the better it is, and the higher the p/e ratio the worse it is. And that's not necessarily true every single time, so let’s work with some examples.

We should look at company A and its whole market value. what we want to do is take the whole market value and divided by what it is able to generate in terms of income on a yearly basis.

The whole company assets are represented by many stocks and if we gather all these stocks and all the stock prices, we're going be able to have the whole market value of the company.

For our example let’s say the company has 100 stocks and during the last year the average price of each stock was $10, so the whole market value of the company is $1000.

And let’s say the company income last year was $100; This means on the grand level the company has a price to earnings ratio of 10. (1000 market value / 100 income).

Now, let’s scale down and calculate per unit. Looking at the value per unit – which is the price per share, and we're also going to look at the income generation per unit.

In our scenario the average price per stock over the last year was $10, and the earning per each stock was $1 (100 number of stock / 100 income).

So now we have to divide $10 (the average price of 1 stock) to $1 (the income per 1 stock) and get the ratio of 10.

This is how you calculate the company’s p/e ratio. In our example we got 10, which is a pretty good number

When you look at different companies all over the p/e ratio is usually around 20 to 25. And, nowadays due to the inflated stock market it skyrocketed for many companies even higher than 30.

When it's lower than that (20-25) it means that the earnings are good, and the company might be under-priced.

And when it's higher than that it can mean the company is overpriced, that there's poor performance or that the market expects the company to have higher earnings in the future

The p/e ratio is valuation metric, and it is one of the many that need to be taken into account when you decide on which company to invest into.

It is important to use it when comparing different companies inside the same industry, or inside the same sector. Also, when comparing make sure that the companies have a similar debt profile because that can offset the p/e ratio and can mess up your analysis.

And this is how you calculate the price to earnings ratio, make sure you use it when you decide on a stock investments.

Should I invest in Bitcoin in 2021

Hello dear money-loving friends. And today we will be sharing another dose of wisdom related to Bitcoin and the Bitcoin market. Our guest star today is Ben Armstrong, also known as BitBoy crypto. Ben is an expert in crypto currency and started investing in Bitcoin in 2012. Today he is teaching crypto currency enthusiast in the crypto secrets over his portal and YouTube channel.

So, without further ado here is what he will share with us:

Whether you are brand new to Bitcoin or you've been here for a while, this article is for you, especially if you are interested in investing in Bitcoin in 2021 and beyond.

Keep in mind there's no simple guidebook that guarantees 100% successful investment into Bitcoin, nevertheless we will try our best to explain the fundaments and the tricks.

You are most likely reading this because you want to make money in cryptocurrency. And the safest and most surefire bet to do that with is the oldest crypto, Bitcoin.

It still stands true despite the fact there's a lot of noise about other cryptocurrencies.

Let me start by answering the question – where can you buy bitcoin? For people wanting to get started in Bitcoin, the easiest two places to do that are with Binance.US and Coinbase.

And now let’s cover the basics.

1. What is Bitcoin?

Before we talk about investing in Bitcoin, we have to understand what Bitcoin is.

You will hear almost everyone to say that Bitcoin is a digital currency. That's the standard company line. And that’s what the idea was in the beginning.

But, It isn’t a currency. Same way gold isn't a currency.

Now, you could go into a car dealership with a few gold bars and maybe trade it for a ride, but it isn’t going to be the dealership's first choice.

They want currency, not an asset. Bitcoin is a digital asset. Think of it like a stock, a bond, gold, oil shares, etc.

But it's a special kind of asset, called a store of value.

You can take money, put it into Bitcoin and hypothetically, it should maintain a level of value.

The volatility of Bitcoin, which we'll talk about later, can make this a tricky proposition because I'm sure as you've heard, the price goes way up and way down.

You don't see these types of swings with most store of value assets.

It wasn't always this way with Bitcoin though. It was spurred out of the 2008 financial crisis.

An anonymous person dubbed Satoshi Nakamoto penned what we now know as the Bitcoin whitepaper.

The guy wrote a paper describing a new currency he wanted to create. The title was "Bitcoin: A Peer-to-Peer Electronic Cash System".

The original intention of Bitcoin was for it to be a currency we could all send directly to each other without the need of a third party like a bank or a credit card processor.

It was time to do something different than "the way it was always done before". This would be a decentralized currency ran on something called blockchain technology.

No one party or entity could have access to make changes to the network, meaning it would be extremely secure and private.

But over time, Bitcoin has morphed into something else.

While it's still decentralized, it's no longer private. Companies like Chainalysis have discovered

ways of tracking transactions.

And the dream of being electronic cash is over, in my opinion. Why?

Because people realize today that Bitcoin works best when they hold it, not spend it. And that volatility is not likely to change anytime soon.

Bitcoin has become the modern version of gold. Digital gold, as we call it.

But unlike gold, there's a known finite supply. Part of the secret recipe for Bitcoin's success has been the fact there are only 18.6 million of them in circulation, and there will ever only be 21 million coins.

And they won't all make it into the circulating supply until 2140, 120 years from now.

Of course, new coins come into the supply through what we call Bitcoin mining.

It's basically specially designed computers solving hard math problems, in order to earn fractions of a Bitcoin.

With gold, while, of course, literally there is a finite supply in the universe, we have no idea what that is.

There could be thousands of tons of gold under the sea floor, and we know that there are millions, if not billions, of tons of gold floating around in our own solar system, much less the universe.

Space mining is coming eventually. But with Bitcoin, not only we do know the supply, we also know the schedule at which it comes into the supply.

The fact is we've never seen an asset in the history of mankind that was specially designed to be the optimum form of money on the planet.

And while the value proposition of Bitcoin has changed from money to a store of value, the same thing rings true.

This is the greatest asset we've ever seen in the history of the world.

2. The question is: did you miss the boat on Bitcoin?

That’s a very tough question and can both be answered with yes and no.

Let's get one thing out of the way here. Bitcoin is the greatest appreciating asset in history. It's made over 100,000% gains since 2011.

The actual overall gains can't even really be calculated. I mean, at one time, you get four Bitcoin for a penny.

Hard to even process that. Bitcoin basically broke the investment paradigm. In the last three years alone, it's up 421%.

So, while the opportunity at the absolute largest gains in world history may be over, Bitcoin still offers you better investment opportunities than anything on the stocks or bonds market.

But think about this. By the end of Feb ‘21, literally any person ever who's invested in Bitcoin is in profit.

And yes, the price is pretty high at over $50,000 right now, but for most of us in crypto full time, we believe the price is going to be a minimum six figures by the end of this year.

I believe, it will be closer to $300,000. But, of course, that's not financial advice.

Still a long way to go from that. One thing though you have to understand about Bitcoin is that it goes in cycles.

So, even if you buy it now and it goes down, as long as you don't sell at a loss, history has shown that it will continue climbing much higher.

Honestly, I'm starting to believe that if companies, governments, and investment funds continue adopting Bitcoin that in 10 to 20 years, we could be looking at a $10 million-Bitcoin.

Having the opportunity to own one Bitcoin can bring generation-changing wealth in the future.

Only the truly elite will own one full Bitcoin. You may have heard of other cryptocurrencies, such as Ethereum, Chainlink, Cardano, XRP, Bitcoin Cash or others.

These are what we call altcoins, or any coin other than Bitcoin. To be totally honest with you, my personal portfolio is loaded down with altcoins, and I advocate a lot for them.

Altcoins offer much more reward than Bitcoin, but they also boast much more risk than Bitcoin.

And this is where the volatility of Bitcoin really shines. You see, we like volatility in crypto. It's what gives us life-changing money.

But some people simply cannot handle that risk. Bitcoin plays out pretty much the same way every four years though.

It's based on something we call:

3. Bitcoin halving

This is where the amount of Bitcoin produced through mining gets cut in half.

In the beginning, there were 50 Bitcoin produced per block mined.

In 2012, it cut down to 25 BTC. Then in 2016, to 12.5 BTC. Then last year, on May 11, 2020, the Bitcoin halving dropped the amount to 6.25 BTC per block.

That equals about 900 Bitcoin per day currently produced.

In 2024, that will be cut to about 450 Bitcoin per day.

By the last Bitcoin cycle in 2136 to 2140, there will only be one-half of one Bitcoin produced total!

So, the supply and demand principles of the Bitcoin halving scheduled every 200,000 blocks means the value proposition of Bitcoin should continue to increase following those halving events.

The only thing is about a year and a half after the halving when Bitcoin investing is at its peak, the supply shock of the halving wears off, and the price starts dropping.

The retail frenzy ends. People start selling off their Bitcoin, plummeting the price.

These are the types of things you need to know as an investor. Bitcoin drops an average of 85-87% every bear market.

Every four years. The current Bitcoin bull run according to the historical Bitcoin cycles should end around September or October of 2021.

So, you need to be prepared. You can do as the kids say and HODL through the bear market, which lasts about two years, or sell at the top, like the smart kids, and wait for prices to drop to buy more for the next Bitcoin bull run in 2024.

But this cycle could be different because of companies like MicroStrategy, Tesla and PayPal.

These companies have bought tons of Bitcoin and will not sell it in the bear market.

So, we could see a less volatile drop, maybe 60% instead of 87%.

But other cryptocurrencies, the altcoins, don't have that same level of corporate and institutional buying happening.

Ethereum, the No. 2 overall cryptocurrency, certainly does have some level of institutional buying, but virtually none of the coins below it do.

On average, altcoins drop 95% in a bear market. Sometimes 99%.

The point is while the rewards of being early on some other coins are very high, the risk of losing almost everything is guaranteed unless you sell at the right time.

The volatility to the downside is really what separates Bitcoin from other cryptocurrencies and makes it the "safest" bet.

4. If you still would like to get into Bitcoin and/or crypto, here is how to do it

There are basically three ways.

Number one and the best way is to buy Bitcoin directly on a site or exchange where you have the opportunity to own your own asset, not let it sit in the hands of others.

The two places I have already suggested buying Bitcoin from directly for United States citizens are Binance US and Coinbase.

If you buy your Bitcoin directly with your debit card, credit card or bank account, you also have the option to withdraw it to what we call a Bitcoin wallet.

This could be a hot wallet, which is an online web-based wallet, or a cold storage wallet.

These are mostly USB hardware devices, but there are a few other types like paper wallets. Owning your own Bitcoin is important.

A second way to invest in Bitcoin is through third party apps and sites like Robinhood and PayPal.

By investing in Bitcoin and through these places, you're basically investing in a derivative version of Bitcoin.

You own them on paper, but you cannot withdraw these assets.

You make money on the gains or lose money on the downward moves of Bitcoin, but you cannot ever move your Bitcoin somewhere else.

This is probably the worst way to invest in Bitcoin because you have zero ownership.

And a third way to invest in Bitcoin is through the Grayscale Bitcoin Trust on the stock market. The ticker is GBTC.

Each share of the stock is backed by actual Bitcoin that Grayscale owns.

This means that Grayscale actually owns the Bitcoin behind their shares.

Investing in the Bitcoin stock is a great way for traditional investors to get into Bitcoin and crypto.

From the crypto enthusiast's perspective, these types of investment vehicles are bridges to get investors to a place where they understand the potential of crypto.

This leads them to study more of it, and many end up realizing the importance of owning their own Bitcoin.

5. The most important aspect in Bitcoin investment

Remember the Bitcoin cycles. This bull run will come to an end.

And when it does, you have to be prepared to move out of the markets and invest into what we call stablecoins.

These are coins where the price is stable no matter what the direction of the overall crypto market is.

Another option is you can move into other assets like cash, gold or stocks while the Bitcoin market drops and consolidates.

This will allow you to pick new entry points and you could go from owning one Bitcoin to possibly owning 5 to 10 Bitcoin if you time it right.

When the next bull run comes around in 2024, you could be poised to change your financial future, for you and your family.

Best investments in 2021 and beyond

Hello our money-making, and money-loving friends. Today we will be staring a young bright start who teaches Personal Finance, Productivity and Minimalism. He is also an investor himself and always giving great investment advice.

He is Nate O’Brien, and here is what he says about himself:

For as long as I can remember, I’ve had a passion for personal finance, productivity, and personal development. In 2017, I started one of my first YouTube channels from my college dorm room at Penn State University. The goal was to teach as many people as possible about the inner workings of personal finance while keeping the content 100% free.

Nowadays his channel subscribers are over 1 million and he is producing invaluable content. And here are Nate’s advice for best investments in 2021 and beyond.

(Disclaimer: all the advice are just opinion and are not meant to be taken as a professional advice. Be careful, you may lose money when investing!)

Nate O’Brien:

Hi everyone! Today, I'm going to share five investments that I'm holding for life and maybe you want to consider as well. A quick disclaimer: I’m just a random guy on the Internet so just use the info for entertainment purpose.

Let's start with some of the things that we take into consideration here when I think about investments that I might want to hold for 20 or 30 or 40 years. One of them is the potential longevity of certain industries or companies. What you're going to find is that these five different types of investments it's probably going to be comprised mostly of different types of funds like exchange traded funds or mutual funds. It's not so much speculative penny stocks or companies that I think are going to go to the moon tomorrow or something, it's more about companies that I see a lot of long-term growth potential with.

I. Investing in healthcare

The first one that I've invested into, that I'm probably going hold for a long time is the Vanguard healthcare ETF (VHT) and there's a couple of reasons why I like investing into the healthcare industry. Some of these are obvious, like the fact that healthcare is always going to be something important to most people but also - thinking about different types of industries - the healthcare industry has the best chance of surviving for a long time. In terms of priorities for most of the people healthcare is certainly up there. I like investing into healthcare companies more than energy companies because I feel like there's less of the possibility of becoming totally decentralized in health care industry.

As a contrasting example, if I'm investing into an energy industry ETF or an energy fund that owns a lot of different types of energy stocks, I don't really know where this is going in the future. I don't know how oil and gas companies are going to be looking in 20 or 30 years, but also it could be something that I could see being totally decentralized, where people just have their own solar panels, and there's no massive energy companies that are sort of making money of it.

That’s why I think that the healthcare industry has a lot of growth potential for it but also when we consider the aging population not just of America, but in most of the world - most of the world is getting older – and those are all healthcare consumers.

Also, if we look at one of the largest demographics it's baby boomers in America. Turns out baby boomers have some money and when they get older, they also have a lot of money they're going to be spending on health care. They're going to be opening their wallets and making sure that they are in good health which is going to cost money whether it's physical therapy or different types of medicine. There's a lot of money in health care overall and I can see that trend continuing in the future.

Another reason why I like the healthcare industry and invested in something like this Vanguard healthcare ETF is because it does offer a decent amount of stability. Looking over the last year

And thinking about what happened with the recession and the economy, healthcare was still very prioritized on our list among everything else.

Some of the companies within the Vanguard healthcare fund are

Johnson & Johnson, Pfizer, and Merck. Companies who made vaccines for COVID-19 but also several different biotech companies. We have over 400 companies that are within this ETF. An ETF is an exchange traded fund, it's basically just a big basket of stocks.

Let’s look at different criteria within this healthcare ETF, one of them being that the expense ratio is 0.1% so it's one tenth of one percent. This is what I would consider to be a very low expense ratio. You always want to take these into consideration when you are looking at different types of funds or investments that you are getting into. With the one tenth of a percent expense ratio – it means that if you had one thousand dollars in this fund over the course of a year you would probably be paying about one dollar to Vanguard as their fee to manage the fund for you.

Also looking at overall performance over the past 10 years or so and we can see that it's done well since 2004. Just remember that past performance does not mean future performance just make sure you don't see something and think it went up 20 so it's going to go up 20 next year too. That's not how the stock market works, but overall, I think the Vanguard healthcare ETF has lot of stability.

II. Real estate investment

The second one that I wanted to discuss is investing into real estate. Look, I don't really want to be a landlord, I figured this out for myself. I don't want to be somebody who owns properties, I don't want to have to deal with tenants, but also, I don't want to have to deal with property managers if I buy a property and then somebody else is running it and taking care of it. There are still things that come up that I have to deal with, so I though how to get into real estate without actually having to own a physical property and this is when I looked into something like the Vanguard real estate ETF (VNQ).

Real estate is very much a tangible asset. And something I really worry about a lot in the economy, especially in today's world is inflation. There is always a possibility to have hyperinflation. Think about the fact that more than 22 percent of US dollars were printed in 2020. What's happening right now in the economy is the government is saying ‘hey let's make more stimulus packages it's going to get us more approval’ right it doesn't matter

The problem is that those money are just pulled out of thin air. There is no balance of the budget, e.g. ‘to get the 1.9 trillion dollars, maybe we should cut defense spending or cut different types of spending’. The government is just making more money out of thin air and

If you are holding cash in US dollar in 10 years that's going to be worth a hell of a lot less.

That’s why I love investing in real estate or have some exposure to real estate. Real estate will

probably keep up with inflation (that’s not certain fact), historically it had, because we're not making any more land and there's a lot more people coming onto this Earth every day.

There are a couple of different ways you can invest in real estate. For me, as I mentioned, I just like to go for the Vanguard real estate ETF, but maybe you want to buy physical properties yourself and be a landlord. I have lots of friends who do that, and it is especially good if you have some time on your hands too, and maybe you have a job but you're looking for something extra to do on the side.

You could also get into specific REITs, and REITs are Real estate investment trusts, and you could get into specific REITs that focus more so on specific areas. You might want to buy a REIT for a company that is specifically focused on maybe apartments in Texas or apartments in California or New York apartments. You can invest into those specific companies as well if you think those are going to boom or do well long term.

One thing that I will caution you on is about the future with office buildings and even with retail. I try to focus on some type of residential real estate, people always need a roof over their head, they always need a place to sleep and so. For me that provides some level of stability

The Vanguard real estate ETF hold several different types of real estate, so they own residential they have a lot of different other properties too, and the expense ratio on is 0.1% – 0.2% so also what I would consider to be a very low expense ratio. The fees on it are low and as usual you can buy this on Robinhood or anywhere else.

III. Invest in the most successful US companies

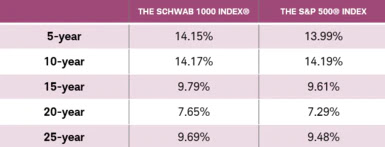

The next I would like to share with you, and it is a great way to get a lot of exposure to the thousand largest companies in America that are publicly traded is the Schwab 1000 fund (SNXFX). It is probably my favorite one and I think this is probably the largest one that I own. It contains the 1000 largest US companies, and you can check that it covers approximately 90% or more of the total US stock market cap so I feel safe being in something like this. Sure, there are times when this fund goes down, if you look at it back in March ’20, it went down just like the rest of the stock market did. It is something that of course I'm holding for a very long period.

Let's just check their top 10 holdings within this fund. It's Apple, Microsoft, Amazon, Facebook, Tesla, Alphabet (which is essentially Google and all their holdings), Berkshire Hathaway, Johnson & Johnson, and then J.P. Morgan Chase so they do own, or more precisely they are kind of having hands in a lot of different types of companies throughout America, and this gives us an overall just kind of broad way to invest into American companies.

IV. Invest in markets outside of US

But let's say that maybe you don't have too much of a bullish feeling about American companies, and maybe you think that America is on the downfall, and there's not a lot of growth left in America, or maybe you don't want to be so exposed to American companies.

So lately I've been shifting outside of American investments and looking for some ones in emerging markets in different parts of the world and that's why the one that I'm going to share with you is what is known as the Vanguard emerging market ETF (VWO). It is going to hold a lot of companies from different areas in the world like China, Brazil, Taiwan, and South Africa. So, a ton of different areas. This is what would be known as an international or global ETF and the expense ratio on it is also 0.1%. Again, very low, that’s what I like about Vanguard funds as you probably already noticed.

Let's check some of the different holdings that this ETF owns. You might notice some of these companies and you might recognize them especially looking at their top 10 holdings here like Alibaba, and maybe you recognize jd.com or Neo which is the popular stock that a lot of people have been investing into so just looking at these you can see probably a good amount of these are based in China, but there are ones from other countries here as well.

The fund is comprised of 5048 different companies, it's one of the largest most diversified ETFs that I've seen out there. Most other ETFs that I'm investing into might have 400 or 500 companies, but this one has over 5 000 which is a lot. And it is both good and bad. The good thing about a fund that holds 5 000 different companies is that maybe there's some companies within there that can really boom and really take off and be the next Amazon, and the bad is there's also going to be kind of not-so-good companies in there as well.

It gives us a lot of exposure, and it gives us some level of stability. Historically thougt these

emerging markets haven’t been performing as well as some different US ETFs that I've checked in the past 10 or 15 years. Nonetheless I still think that there's a lot of room for growth for the next couple of decades, especially in areas where maybe their GDP per capita is still 1/3 of America’s and they still have a lot of room to run to catch up to the GDP per capita in some of those countries. So maybe their growth rate will be a lot faster. Look at a place like india for example, where their growth rate seems to be a lot faster with their GDP growth.

V. Investing in bonds

And the last one I want to mention here it's going to be brief because it's not my favorite but maybe for people who want to be a lot more risk-averse and they're worried about maybe valuations of certain companies we have something like the Vanguard total bond market ETF (BND).

As you can see, I'm kind of a fan of Vanguard funds, I don't buy them through Vanguard though. And this one isn't my favorite, but I still wanted to include it on this list because like I mentioned not everybody wants to be exposed so much to stocks and maybe they want something that's seen as traditionally safer than the stock market. And those are bonds.

Bonds have not been a favorite for most investors in the past couple of years and this is because yields on these bonds have been low, sometimes these yields can be below 1% so it's not that attractive, especially when I factor in the fact that they also have the risk of defaulting on those loans.

Is it even worth that 1% when you average it out, especially when you get some of these different bond market ETFs fail and they can't pay, then you end up losing money? You won’t get your money back. For example, that’s what happened with Puerto Rico back years ago, when they defaulted on a lot of loans.

Don't just think that bonds are totally safe and are like deposits. It's one of the biggest misconceptions.

People mostly believe that bonds are guaranteed money, that it's safer than stocks. And it's not always safer and it depends on who's issuing the bond. If it’s apple or a highly reputable company that’s a good indicator but it also could be a company that's a small cap company with bad reputation. Those are risky because if they're issuing a bond the yield usually would be higher, but also riskier.

The Vanguard total bond market ETF is comprised mostly actually of government bonds, so this is probably just what I would mention is like a kind of a safe bet if you want to just park some money in there but you're not going to really see a lot of growth there.

it's kind of almost fixed like you're getting 2% percent yield, and in the worst-case scenario you may end up losing a lot of that money so I included it only for people who might really want to play it safe with minimum return on investment.

Well, thanks for reading all those thoughts and advice, I appreciate your time and if you found any value make sure you share the article and drop a comment below.

Top 10 money questions asked online

Dear money-making friends. Today we would be focusing on the ten most often asked money questions online and some short answers or points for each of them.

Many of those questions will probably be no surprise for you, and it is interesting what people are looking for and what their needs are in terms of financial information and queries online.

So here we go with the top money questions list

1. How can I make money online?

It is obvious the majority of the population nowadays read stories about people getting rich online every day. And it is understandable that people don’t want to work for somebody and try their luck in the online business.

The straightforward answer is -> you can make money online, the same way you make money everywhere else. You need knowledge, skills and good business sense in order to get rich and out-compete the others. It doesn’t matter if you do e-com, marketing, ads, affiliate or simply sell products and services online – the foundation of making money online is to create a niche, difficult to penetrate by the competitors, and to serve your users better and more efficiently. Then you can charge percentage of the volume and make money.

2. How to invest in stocks?

The second question is also obvious. The majority of the people are just lazy and would like to simply put their money ‘somewhere’ and start earning – easy, with small hassle.

Investing in stocks is not difficult. But if you are going to win or lose out of it depends entirely on the timing. Did you know that, in order to be successful with stocks, in the last 10 years, there are about 20-30 days which you wouldn’t miss in order to make money (remember those March days in 2020, do you?). All the other days are close to irrelevant. If you missed trading on those ‘special’ days – your investment will barely make you any money (in the best possible case scenario). So, the answer is – to be successful on the stock market you need to learn and keep a close eye on your investments. Analyze, calculate, and look at the trends daily, not to miss the ‘special’ days.

3. What sort of a house can I afford?

A very reasonable question, as people intend to borrow money from the banks in order to buy their homes.

Let us give you a different perspective. What if we tell you that it is not a good idea to borrow money from the bank, unless you already have most of the funds to cover for your home. Let’s say you would like to purchase a $200 000 house. The worst thing that could happen is to go to the bank with your savings of $10 000 and ask for $190 000 mortgage plan. The bank will offer you an expensive and lengthy plan, and the risk for something bad happening and for you losing your home is big. Instead, you should be aiming to have at least $110 000 or even close to $150 000 before borrowing the rest of the money.

Now, I know what you are thinking. Are you crazy? There is no way I can save $110 000, and besides even if I am able to – the house will be more expensive by time I manage to come up with the savings. On the first point – how then you expect to repay the bank – and keep in mind you would probably need to pay twice as much (if not more) than what you borrowed? On the second point - well, the housing market also has it’s ‘special moments’ (years). Do you remember 2007 – all the markets are cyclic, which means that when the market goes up, you should be saving money (and avoid buying), only to buy when the market crashes. Smart renting while you wait, and low mortgage are usually the better decisions.

4. How to pay for my college without going broke?

Another very important question. Nowadays the college costs have risen dramatically, and many students are either left out of the system or broke with enormous debt.

The other perspective is not to be in a hurry with your college degree. It is perfectly fine, and often advisable to skip college in your teenage years and go for some experience gathering, e.g. working in an area you would like to specialize and learn the trait from a master and make some invaluable connections. This would usually be much more beneficial, and also let you save some money for the future to get your degree.

5. Should I pay off my credit card or save money?

This is a very good question. As a general rule – you would like to get rid of any debt as quickly as possible in order to stop generating interest on it and pay much more in the future.

As a general rule of thumb, always try to have savings enough to endure 6 months without income. Those would help you survive, without going broke in case anything bad happen to you or (God forbid) your family.

6. How to get my student loan forgiven?

Student loan could be an enormous burden. In some cases, people might qualify for their loan being forgiven. The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your direct loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

7. What is the best bank for college students?

Before committing to a bank, analyze well. Many of the banks offer quite good offers, especially for students, and special discounts and low rates on all services and loans for students. So, don’t be shy – dedicate a couple of days and research all the banks in the area, do all those calls and gather the information. This will also test and improve your soft and negotiations skills to try and find the best offers for you and your financial needs.

8. How much do YouTubers make?

Another topic, which shows that many people are after quick money in the entertainment business.

Do you know that less than 1% of the YouTubers actually make some meaningful amount of money from their channels? It again, depends on the niche, on your style, experience, and most importantly on the timing. In order to be a successful YouTuber you would need a terrific amount of traffic in an area easy to monetize. If you would like to be one of those successful and rich people – start analyzing niches, and start thinking ‘what problems can you solve for your audience?’ and ‘is there anybody who would pay for you to solve those problems?’

9. When should I retire?

Retirement stories of young chaps living in luxury at their late 20s or early 30s are all over the net.

The reality is there is no better source of income than ‘the active source’ of income, where you actively solve problems to users and customers and charge for it. Nevertheless, a good formula is to multiply your monthly spending by the number of months (years) you expect to live up to, to check if you have enough money. Then add at least 30% on top of that for any emergency or family needs, etc...

10. How much should I spend for my wedding?

It’s an understandable question, for all of you with traditional relationship.

Keep in mind, though, nowadays a lot of couples prefer to just stay in relationship, without getting married to save on all those wedding costs, rings, etc… And there is a good point in it. Statistically, most of the marriages end up in a divorce anyway, so why spending huge amount of money getting married on the first place, then spend thousands of dollars in a divorce trials, etc… it’s much better to have a contract with your partner, related to rising your kids and move forward, without the unnecessary complications and spending.

How to manage your money

Let’s talk about what personal finance is, and more specifically about the 50/30/20 rule.

Your full income of money is 100%. And 50% of those will go to your needs. This is all about budgeting and understanding where all your money is going in an ideal, personal budget portfolio. So, 50% are ‘needs’, 30% will go to ‘wants’, and 20% will go to ‘savings.’

Now, let’s dive deeper to understand each one of those categories. Keep in mind we would be giving examples in after tax income – which means net income, you will have some gross pay, but in the end what matters is the money you take home – your net income.

1. So - 50% of the income will go to ‘needs.’ Those are:

- Groceries

- Housing

- utilities

- Health insurance

Literately – ‘need’ means something you really can’t live without or something that will greatly inconvenience you, and even the lack of it harms you.

2. The next area is ‘want.’ Let’s see what we consider as ‘wants’, as we will put 30% of our income there. There is a great difference between ‘need’ and ‘want’, and you should always try to understand it. Simply put – ‘want’ is everything you desire but can live without it. Or something that causes mild inconvenience in your life. It’s not necessarily a matter of survival if you give up on something you want.

- Shopping – e.g., new pair of shoes, or modern clothes.

- Dining out – it’s easier for most of the people in the US to buy dish, than cook themselves

- Hobbies – everything you do for fun and not earn money with it

3. The last 20%, although it sounds basic, should go to ‘savings.’ Or paying off debt. Examples:

- Emergency fund (6-12 months of living expenses).

- Credit cards

- Student loans

- Deposits

- Retirement plan

- Investments

You might be thinking, you know all of that but until you sit down and write down the 3 categories and track monthly your spending – you will not be able to get the full picture and make corrective adjustments in order to be able to save more money and achieve your financial dreams.

How banks create money

Today we will explain how banks create money out of thin air. Yes, you might not believe it, banks create money out of thin air.

To explain how this is possible let's talk about what a bank does. A bank accepts deposits from the customers but doesn't just hold that money. If all banks did was holding other people's money, there would be no profit in that. Instead what a bank does it takes that money and it loans most of it out. You might wonder, why can't it loan all of it out? And the answer is because sometimes customers come back and they want to withdraw some of that money.

So, if you and I and everybody else goes to the bank the same time to get our money out, the bank does not have that money. They wouldn't be able to pay us, and the bank would default. That's called a bank run and it's bad.

In the United States there is a Deposit Insurance to make sure bank runs don't happen, but the point is the bank doesn't hold all those deposits. They loan it out. The amount of deposits that the bank needs to hold by law is called a required reserve. In the United States it's 10%. This means that the other 90% is something called excess reserves and they're free to loan that out.

Let's say someone goes into a bank and deposit a hundred dollars from their pocket into the bank. This won't change the money supply because money from your pocket is part of money supply, so is demand deposits inside banks. So far there's been no change in the money supply but here's where the magic happens - the bank is going to hold a certain percentage by law let's say 10% so they're going to hold $10. That means they are going to loan the other 90 out.

The person who deposited $100 has $100 in the account but the person who borrowed the 90 also has now $90. That $90 is money that was created from thin air and did not exist until the loan occurred.

If that person's going to spend that $90 and eventually that $90 can make its way back into another bank that other bank is going to take that $90. It's going to hold 10% and require reserves so 9 dollars it holds, and it's going to loan the other $81. Out of that 81 new dollars is new money supply - it was not created until the loan occurred.

Eventually the person who borrow the money is going to take it and spend it and that's going to make its way to a new bank and the same thing is going to happen again and again, and again, and again.

Now it turns out that the Initial deposit of $100 is actually going to become $900 of new money created.

The way you could calculate it is by looking at something called the money multiplier, which is one over the reserve ratio. In this case when the reserve ratio is 10% that meant the money multipliers 1 over 0.1 so it's 10. If you are asking yourself ‘if the initial amount deposited was $100 and the multiplier is 10 why didn't a thousand dollars of new money get created?’ And the reason why is - because the initial hundred dollars was actually part of the money supply to start off with, so the only amount of new money that was created was from the initial loan of $90. The calculation is $90 times 10 equals $900 of new money created.

And that explains the whole idea of fractional reserve banking! Banks hold a portion of deposits and they loan the rest out and whenever they loan it out, they create new money.

Change yourself to make more money

Hello dear money-making friends. Today we are presenting you with 4 steps by John Assaraf, on how to change yourself to make more money.

A lot of people ask me: Can train the brain to help you make a lot of money or not? And the answer is Yes. Maybe I can share a technique with you about how I started training my brain to help me make more money.

Step 1.

It starts with setting some goals for the lifestyle I want to live. And my advisor, Walter Schneider, many years ago is a very successful businessman. He say: to achieve your goals, first you have to know what they are. So, let's say you set a financial goal, say $ 100,000 a year. That's about $8,000 a month, or about $2,150 per week that you want to earn. And let's say you don't earn it right now.

One of the things you can do is to start training your brain to help you earn that money is first and foremost to be clear about the amount of money you want to earn, whether it be a week, a month or a year.

Step 2.

Make a simple assertion like this: "I'm very happy and it's wonderful I make $10,000 a month” - simple affirmation. Now, I want you to read that affirmation every morning 5 to 10 times, and every night before you go to bed, 5 to 10 times. And when you read that affirmation, I want you to close your eyes, and I want you to practice mental repetition. You receive that money in the form of a check, either cash, or through your bank account, and see that money goes into your bank account. I want you feel how does it feel when continuous each month has 10, 000 dollars gets transferred into your account every month

And you can choose whatever amount you want this way. and when you close your eyes, and you imagine that money is going into your account, what I also want you to visualize is the impact of that money will be in your life, in the life of your family and friends, in the community in which you live and the charities you are trying to support. Totally like in a movie about psychology add to the emotions, as if you were a Hollywood actor or actress are pretending that is actually happening.

So, you read your affirmation ‘I am very happy and feel great for the fact now I make 10,000 dollars per month’ and when you do it and repeat it, your brain exercise visualization - what does it look like.

And that means use your brain to look and feel as if it were real right now. That activates different parts of your brain, namely left frontal cortex. It's the genius, CEO, Einstein - part of your brain. That might really help you out how to achieve that goal and dream. So, if you do it every morning and every night before bed, in the morning while walking, at night before going to bed, you will start to master your brain with an affirmation, with a mind exercise, and you will be aware of your brain.

Step 3.

And if you want an extra step, what I want you to do is take a vision board, or create one on your computer, or a physical table, and cut out some images of what lifestyle earning 10,000 dollars per month allows you to live.

What kind of car do you want to drive?

What kind of places do you want to go on vacation?

What house would you like to live in?

What kind of charity would you like to support?

Get pictures of the results when you earn 10,000 dollars per month or $100,000 per year (or more) and begin to see yourself in that scenario and act as if it were real right now, and then

Step 4.

Every day ask yourself one question:

‘What can I do today to make that money REALISTIC’

And do one or two action steps to make it happen. Hence the physical activity in addition to mind training, with affirmations and mental exercise, visualization, is one of the best to start training your brain to achieve financial goals you have.

‘Rich’ vs ‘Poor’ mindset

We continue delivering you great articles about successful financial mindset. This time the brilliant ideas are shared by Robert Kiyosaki. Enjoy.

The most obsolete idea is - go to school, get a job, work hard, save money, get out of debt and invest for the long-term in the stock market.

Why would you save money when they're printing trillions of dollars? The gap between the 1% and 99% is massive. It's not just money, you have to step back and look at the bigger picture.

So, what do you do?

In every one of us there's a poor person, there's still a poor person inside me. There's also a middle-class person, and the middle-class person wants security they want that steady paycheck. And there's a rich person. And they're all inside of us except that... It's not taught.

You're taught to go to school, get a job and get a paycheck. Not taught how to get rich. If you've read Rich Dad Poor Dad, my rich dad refused to pay me. He said the paycheck was one of the most damaging things you can take in your life. He says the moment you take a paycheck you're an employee and that's the mindset. So, my rich dad never paid me. It drove my poor dad, you know, a government employee nuts. "You got to pay people, you got to pay people", he used to yell. And rich dad was not saying that the paycheck was bad, he says he didn't want to be a slave to money.

So, as an entrepreneur, you know, if rich dad folded – ‘I just try another company. I don't need a paycheck. I don't need anybody to take care of me. If my government doesn't like me. I move to another country, because they need entrepreneurs there.’

The entrepreneur is not so much the business, the entrepreneur is really the mindset and the skill sets and the different set of rules. You see, I don't operate small business. As it does not operate in the same rules as big business.

Entrepreneur is a mindset first, a skill set and rules. And depending upon whether you're an employee or small business the rules are different, the mindsets are different, the skill sets are different.

If I could say one thing to somebody whose never been an entrepreneur and they're thinking about making the leap of faith into becoming an entrepreneur, well, I'll just tell them the same thing that happened to me. You know, my last paycheck, I still remember it clearly, it was one of the worst and the best days of my life and I was in Puerto Rico, I was working for Xerox and my boss gave me my last… it wasn't a paycheck, it was a bonus check. I think it was about 30,000 bucks… taxable, that's the only problem with that. So, I get this check and I went, "Holy mackerel." You know, I mean, so I was excited, but I was also disturbed. And so this other guy comes up to me, his name was John, and John says to me says to me "you're going to be back." I asked "Why?", and he says, "because you're going to fail." I looked at him and I said, "look... few expletive words… because that's what he did, he left Xerox, failed and he came back. I said, look... you fail and you came back but I'm going to fail and I'm never coming back… and that's the attitude.

If you say, well, if I fail, I'll go back to mommy and daddy, then that's what you'll do. So, if you fail, that's when I became an entrepreneur because I had no money. I had no money for years. Yeah, I didn't have a paycheck. But that's what my rich dad encouraged me to do. He says, when you don't have this paycheck you get hungrier, smarter and it's a test of your character.

Will you become a crook?

Will you become dishonest?

Will you cheat and steal?

… Or will you become a better human being?

So really that's the benefit of becoming an entrepreneur, you really find out who you are when you don't have anything. So, you always have to look at the big picture. Too many people look at, well, what's, what's going to happen to me? When you look at the big picture, you're also going to know that when something bad happens something good is going to happen too. But you got to prepare for whatever is coming. If you think the next 20 years will be like the last 20 years, you're going to get creamed.

You know, when you and I go to the supermarket and we buy a carton of milk we always check for the expiration date. But most people do not check for the expiration date on their brains. Instead of getting out of debt I get into debt. I just refinanced 300 million in debt I went from 5% to 2.5% interest - I made a fortune.

Every month more money comes in because my cost of money has gone down. So, while some financial experts are saying get out of debt, I'm saying learn how to use debt. See when I came back from serving in Vietnam in January of 73 and the first thing my rich dad said to me was, Go to school to learn how to invest in real estate.

It wasn't real estate; it was how to use debt and taxes debt and taxes make the rich richer. Debt and taxes make the poor and middle class poorer. So, all the rich guys who are doctors and lawyers or... you know, those guys, they're getting creamed - and they don't know why. Doctors for examples - they're making more money but the take-home is less.

You know, my doctor just yelled at me, he's happy, he says - Oh, guess what I finally made a million dollars. And I said - well how much you pay in tax? He says, $750,000 in taxes. So, his net was about $400,000. That's not bad, but when I make a million bucks, I keep a million bucks. And the reason is because I don't make it by working for money.

If you work for money your taxed. So that's why lesson number one in ‘Rich Dad Poor Dad’ is the rich don't work for money. What we do instead is we create businesses as entrepreneurs. We acquire real estate. I don't invest in the stock market, and the reason is because as entrepreneur I have more control over my income, how much I make and how much I pay in taxes. And because I'm an entrepreneur as well as an investor in real estate. I pay zero tax.

Every time I make let's say a million dollars as an entrepreneur, I immediately invest it in real estate, and I have a 4 to 1 step up. So, I put a million dollars in real estate, I get four million from the bank. That's why I love banks. But the banks are screwing everybody else you know, terrible but it's good for me.

When money is printed it's good for me, and when money is printed it's bad for people that work for money. This is because, when they print, savers get creamed and people who work for money get creamed. When they print debtors get rich. You see, debt and taxes make the rich richer and debt and taxes make the poor and middle class poorer.

When we have obsolete ideas, we get obsolete results. So, what's happening for most people the idea of going to school, getting a job, working hard, saving money, getting out of debt, buying your house because you believe it's an asset and investing for a long term. It's obsolete.

The world has changed, the world changed in 1971 when President Nixon took us off the gold standard and money became debt. On top of that, the education was more important years ago. Nowadays, it's just obsolete.

You know, there's Moore's law… Moore's law states information doubles every 18 months. In other words, everything is obsolete after 18 months. And this is a recent phenomenon. When you come out of school, you're already obsolete, and that's why I'm the old guy. I meet my friends; I went to Harvard… like what - 50 years ago?"

Today the banks are charging you interest to keep your money. In other words, the banks don't want your money because they've printed too much of it. And that's why there's bubbles and stocks and bubbles in real estate and all this. People are dumping the cash, because as I said in here, ‘Savers are losers and cash is trash’.

And yet people are like: ‘Well, I want a high-paying job.’ Well, that's an obsolete idea. Get out of debt, it's an obsolete idea. You should learn how to get into debt. How to you use debt to get rich. And they'll never teach you about taxes. The reason the 1% is way up there and the 99% are going down is because when they print money - two things happen - inflation and taxes.

And any entrepreneur that thinks ‘I'm just going to make money and start a business and make a lot of money’ they really should smell the roses instead. You know, that's not what the real entrepreneurs are doing. Do you know, there's 28 million small business owners in America and 24 million are one person entrepreneurs? They're called non-employee entrepreneurs. That's what happens when people don't really understand what an entrepreneur does and how money works nowadays. Most people are self-employed, but they're not really entrepreneurs. The self-employed pay the highest taxes of all and nobody tells them that!

It's also called the entrepreneurial spirit but what we're talking about was there's no such thing as a bad economy. We all have an external economy, but we also have an internal economy, and the will power is to change our internal economy.

I can see the good, and I can see the bad. I don't really give a damn. Because I'm going to be rich anyway.

But a poor person with a poor personal economy. All they're going to see is a bad economy. Because they don't know how to make money in any economy. And a middle-class person, they have a middle-class economy. You know what they want is a nice house, a steady paycheck and the job and the car. And when you take their job away to them that's disaster. And since an entrepreneur doesn't have a job anyway, it's no big deal.

All I'm saying to people is what Bucky Fuller taught me. There’re always two sides, and if you think the economy is bad, it's because your economy is bad. If you think that steady employment is important - then you'll see an economy without jobs. It’s always about your economy versus the external economy. Where you control vs where you can't control. And you can control it - it's called an internal focus vs an external focus.

The real entrepreneur has an internal focus but if they fall, they say, ‘Oh, this is good because I'm going to go up higher.’ You know, the average person will fall and say ‘Oh, I'm going to take some Prozac’. Or, they just claim that mistakes don't matter. Mistakes matter, it means you didn't know something.

A real entrepreneur whether they fall, or they just go, they always can go up. They can stand back up and go higher. That no matter what happens to them they got stronger and better, and smarter and happier.

On the contrast - a person with a weak internal mindset is that they're so afraid of what happens, and it generally happens. Like, people who are afraid of losing their jobs they generally lose their jobs.

The entrepreneur first job is control inside here, not outside there. The moment you take that paycheck you're an employee. You've got to be stronger than that. It's about inside control.

Success mindset

Today we will focus on the teachings of one great leader, teacher and author - John Maxwell. Let's reflect on how successful and rich people think compared to the unsuccessful and poor.

I would teach you how to think correctly. The largest gap between successful and unsuccessful people in life is the thinking gap. I'm not talking about being smart, I'm not talking about an IQ, I'm talking about 'how you think', 'how I think'. Successful people think differently than unsuccessful people.

Wise thinking leads to wise living stupid thinking leads to poor living. If you want to have a fulfilled life you have to fill your mind correctly. Right now, you need to focus on today and what I realized so many leaders don't understand is that truly today matters, and we overestimate what we could do tomorrow we over exaggerate what we did yesterday, but we underestimate what we can do right now. The only time you have, the only time I have is now. So, the question for all of us is ‘what am I doing with now?’.

The great leaders they're present in the moment and because of that they maximize the moment so if you're attempted to take that far away glances, well, glance… but get right back to the present moment because today you're preparing to make tomorrow a success.

Well we all want to be motivated and yet so many times we fail to find the secret of motivation and so let me give it to you quickly. JUST DO IT! Motivation is not the cause of action it's the byproduct of action, and there's a lot of difference. If I think motivation is the cause of my action then I'm going to wait to be motivated before I do something but if I realize it's the byproduct of my action than I'll start doing something. Then guess what? Motivation will come and zap you and all of a sudden you feel good, and you're glad you're doing it. You're saying, ‘Wow this is truly wonderful’. So, let it be the byproduct to your life, let it be the foundation for the actions that you take.

Nothing comes to you until you commit yourself. Nothing comes to you if you're just going to try but you're not committed. Nothing comes to you if you're just thinking about it. It's not until you take the action step. It's not until you take the direction, ‘do the thing’ starts to flow through you.

But I'm saying don't cheat yourself out of the possibility of the potential that's on the other side of commitment. Stay with it long enough to find out if there's any fruit in it. You can do goal-setting with a pencil but you have to do go-getting with your legs. You got to take action and it's the action that separates us. The greatest gap in this world is the gap between knowing and doing. Knowing is goal-setting, doing… now that’s goal achieving.

People that are knowledgeable about habits say that it takes 30 days for an action to become a… habit. And habits can be good, and habits can be bad. So, over a period of time you can either be developing habits that are going to help or habits that are going to hurt you. People that grow develop habits that help. The great value of a good habit is you don't have to think about it. That’s why it's a habit. In other words, once you began to, over days and times and periods, begin to practice something that’s good - after a while it becomes automatic to you. It becomes who you are. In fact, I always tell people ‘practice a good habit long enough to make it yours’ and once it's yours now it's automatic. Every day you'll do what you should do.

Often, I have the expression that everything worthwhile is up the hill. That's a fact. You've never heard someone talk about accidental achievements. You've never heard someone that got to the top of the mountain and somebody asked him ‘how did you get there?’, kind of look confused to say ‘I have no idea’. The reason they know how they got there is because they had to walk all the way up the mountain. Nobody lifted them. There were no shortcuts. There's not an elevator, there's not an escalator. It's all effort to get you to the top of the mountain.

What I want you to understand is that inspiration does a lot better when it's coupled with the perspiration. There are a whole lot of people they want to be inspired in great things, but they don't want to do the hard work to achieve those great things. It's not either/or it's both/and. So, I really trust today that you will just kind of roll up your sleeves, look at something you haven't tackled for a while, and dive in! You'll be amazed that once after you do the work you will get inspired. Don't wait to get inspired before you do the work!