Today we're going to look at the price to earnings ratio to help all of you who would like to invest on the stock market.

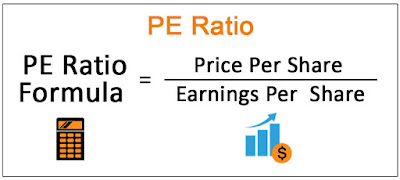

The p/e ratio is by definition a price to earnings ratio, so it is a measure of valuation in order to determine how much does it cost to own a piece of a company in relation to how much the same company earns.

In general, the lower the p/e ratio - the better it is, and the higher the p/e ratio the worse it is. And that's not necessarily true every single time, so let’s work with some examples.

We should look at company A and its whole market value. what we want to do is take the whole market value and divided by what it is able to generate in terms of income on a yearly basis.

The whole company assets are represented by many stocks and if we gather all these stocks and all the stock prices, we're going be able to have the whole market value of the company.

For our example let’s say the company has 100 stocks and during the last year the average price of each stock was $10, so the whole market value of the company is $1000.

And let’s say the company income last year was $100; This means on the grand level the company has a price to earnings ratio of 10. (1000 market value / 100 income).

Now, let’s scale down and calculate per unit. Looking at the value per unit – which is the price per share, and we're also going to look at the income generation per unit.

In our scenario the average price per stock over the last year was $10, and the earning per each stock was $1 (100 number of stock / 100 income).

So now we have to divide $10 (the average price of 1 stock) to $1 (the income per 1 stock) and get the ratio of 10.

This is how you calculate the company’s p/e ratio. In our example we got 10, which is a pretty good number

When you look at different companies all over the p/e ratio is usually around 20 to 25. And, nowadays due to the inflated stock market it skyrocketed for many companies even higher than 30.

When it's lower than that (20-25) it means that the earnings are good, and the company might be under-priced.

And when it's higher than that it can mean the company is overpriced, that there's poor performance or that the market expects the company to have higher earnings in the future

The p/e ratio is valuation metric, and it is one of the many that need to be taken into account when you decide on which company to invest into.

It is important to use it when comparing different companies inside the same industry, or inside the same sector. Also, when comparing make sure that the companies have a similar debt profile because that can offset the p/e ratio and can mess up your analysis.

And this is how you calculate the price to earnings ratio, make sure you use it when you decide on a stock investments.

What is the p/e ratio

Labels:

calculations

,

formula

,

investment

,

p/e

,

price to earnings

,

ratio

,

stock

,

stock market

,

stock price

Subscribe to:

Post Comments

(

Atom

)

No comments :

Post a Comment