Here is another financial question from a close friend.

He has some amount of earnings apart from the ones that he saved for his necessities. He would like to invest the earnings in some real estate or alternatively in stocks. He has some knowledge on stocks but, heard some people reporting bad experiences when the stock market crashed before. So, we have gathered different opinions over the net, answering the question: What is a better option – real estate or stocks?

“It's really tough to make a decision between the real estate or stock. The bare minimum you should do is to study the last decade's value of land or real estate versus the stocks. The stock market condition is heavily inflated, nowadays, but the same could be said for the estate properties too. Do your homework and take an advice of a financial consultant, then make your decision.”

“It all depends on your interests and there can’t be one straightforward answer because a lot of it comes down to your personality, preferences, and style. However, many people feel Real estate is often a more comfortable investment for the lower and middle classes and is always evergreen.”

“Ups & downs occur in both the stock market and the real estate market. Before investing in anything, you need some knowledge and to study the market to be prepared in case of emergencies or market collapse. If you already have knowledge in stocks, this is a good factor to consider investing on the stock market, compared to the real estate investing.”

“In every sort of investment, you have to make sure that you possess the knowledge about the area you would be investing in to. Consulting a financial consultant is also a good idea. In the case of a real estate investments, it is a fact that nowadays every Metropolitan city is growing by fits and starts and those cities are adorning themselves with multi-storied buildings. A huge amount of land which were barren for a long time has been used for industrial purposes. So, do your study about the neighborhood you would be investing in, and only then invest carefully.”

“Stock trading is certainly the better option and is much lucrative than real estate investment. Get in touch with a professional to get the minimum training or join a group of investors to learn more, share ideas and knowledge.”

“Investing in real estate is a great way to obtain cash flow, real estate investments will be a better option. Some advantages of real estate investments are:

1. Cash Flow

2. Capital Gains

3. Leverage

4. Inflation Resistance

5. Tax Incentives.”

“Investing in real estate gives higher returns than typical investments like stocks. These are the most considerable advantages of making an investment in income-producing real estate. The income stream it produces tends to be extremely stable and predictable. The income stream is partially passive. The underlying property will typically appreciate over time. There are tax benefits to investing in real estate that is not available with most other investments. Rental properties when purchased correctly generate significant cash flow. As good as the returns in real estate are when investing with cash, they can also be compounded significantly by using leverage.”

“Stocks are good if you can keep yourself updated, all the time, and would love to keep a close eye on the stock market. Otherwise invest in real estate.”

Invest in Real Estate or Stocks

Which is riskier for investing - Cryptocurrency or the Stock Market?

A question from the FB page today:

Jerome shared with us he started learning about the Stock Market and recently about cryptocurrencies. He also managed to save some money aside and wonders where to invest with less risk of losing it.

First let us say that there is always a risk to lose all your investments, investing in Cryptocurrencies and in the Stock Market. With that being said, there are a wide variety of possible stock market investments, with a wide range of possible risks.

Some stock market investments are pretty safe and are likely quite a bit safer than investment in cryptocurrency. Some stock market investments are pretty risky and are likely quite a bit riskier than investing in cryptocurrency.

So, ‘Risk; is a relative term. The stock market would indeed be very risky is you are buying stock without knowing what you are doing and without analyzing the companies upfront.

Very often people buy stock based on somebody’s else opinion. Instead, should you learn how to determine yourself what would be good stocks to buy. You also set up safeguards to keep you from losing all your money.

For instance, when you buy a stock, you set a Stop Order. Let's say you buy shares of a stock at $20 a share. You've determined, by (for instance) studying the charts of that stock, that you would be willing to risk losing $2 a share in case its performance goes down. (Which is 10% of its price and your total investment)

So you buy the stock at $20 a share and set a stop order at $18 a share. In the worst-case scenario, the price of the stock drops under $18 a share, and the stock automatically sells itself. You lost only $2 a share.

But, if your research on the stock is correct, the price of the shares will go up long-term. Another example: the price of the shares rises to $30 a share. You've already determined if the stock goes that high, you will reset your stop order for $25 a share. That way, if the price goes down below $25, it automatically sells, and you've lost nothing, and even made some profit.

Those are just some examples for using safeguards when trading. When you invest long-term you might decide ETFs are the better option. Long-term they always go up (as the economy will overall go up long-term).

The big problem with the long-term investment would be the inflation or more specifically the hyperinflation. So be sure to read about those in the previous topics where we discussed them and gave good advice - how to protect yourself.

On the other end, the cryptocurrencies are extremely volatile which creates huge fluctuations in their price – some people made a fortune there, but the majority lost their money.

In general, nowadays, investing in well-performing stocks, companies and ETFs should be considered less risky than investing in cryptocurrencies.

Will the next market crash be worse than 1929 or 2000

Jeremy Grantham is a co-founder and chief investment strategist of Boston’s GMO. Jeremy believes that in 2021 - U.S. stocks have become an epic bubble and will burst so badly to outshine the crashes of 1929 and 2000.

Here is what Jeremy Grantham outlines

1. What happens when the market crashes

I believe that the bull market, started in March 2009, the longest bull market in history, have matured into a speculative fever of rare proportions, a fully-fledged epic bubble. It would be surprising if we have one that long that didn’t end up with animal spirits beginning to freak out a bit.

Achievement like that normally takes a friendly economy and even friendlier FED behavior, but this one managed to do with somewhat wounded economy on a global basis. We even had more spectacular FED and Government friendliness. The usual moral hazard that has been going on since Greenspan arrived the 90s.

The result of that is that confidence has risen and risen and risen until finally people are reaching for the greatest demonstration of confidence, they have had in their investment career. They are borrowing more money to throw it into the market, their belief in the market is profound, the common wisdom is that the FED on your side, how can you lose. And nowadays there appear to be no doubters at all.

The belief is that – all you need is the FED on your side and the stocks will rise forever.

And some of the signs to look for a bubble are, e.g. look at over-the-counter trading. Last Feb it traded about 80mil shares for the month, and it worked its way steadily through the year until Nov, when it was about 380mil. And then in Dec it went to 1.15 trillion shares for the month, having tripled and tripled again in just a month. These are spectacular performances.

My own stock at Quantum scape came into the market at 10 and shot up to 130, and it became bigger than GM or Panasonic. And it is a brilliant company, but it already admitted it won’t be producing any batteries for 4 years. So, no sales, no income for 4 years and yet bigger than GM.

There has been nothing like that in 1929, nothing of that scale. Nothing like that in 2000 either. 1929 run into great depression and global trade problems, so you really want to the first leg down, which was big enough.

The analogy with 2000 is better, and it went down 50% back then. And the reason it went down only 50% and bounced back relatively quickly was because FED came charging into the rescue. And you can have a lot of rescues when you start at a 16% long government bond for example in 1982. You can have a bull market as you go down from 16 to 12 and another bull market from 12 to 8, and 8 to 4.

And now we are down at about 2.5% and you have to realize that most of the easy pickings of saving the game by ramping rates down is behind us. At the lowest rates in history, you don’t have a lot in the bank to throw on the table.

The idea that the real world doesn’t count and all you need is money – to generate real wealth – I am pretty sure most of the people feel it’s an illusion. The situation where we have a deadly virus, and the economy is obviously on its knees and the FED is doing everything it could – and would that be enough to save the system?

In the end the system is about the amount of people working and producing, the amount of capital spending, the quality of education and production of the workforce.

COVID-19 brought spectacular excesses on the part of the FED and the Government writing checks. Unprecedented, and the combination was very powerful.

And the market had the opportunity to crash a couple of times, e.g. in 2018 – the last time. And those bull markets can go on forever. You don’t know how high and how long they could go.

In the back of everyone with bear’s mindset must be surely Japan in 1989. During that time, they managed to get to 65 times the market earnings. It has never previously gone over 25. So, the markets are unpredictable – when we avoid the burst of euphoria.

Tesla is an emblematic as crazy investor behavior. At the same time, anyone who has bet against Elon Musk has lived to regret it so far. Going short is only for experts because you can get into bankruptcy very quickly. My recommendation is to not go short individual stocks.

When you reach such levels of hyper-enthusiasm, the bubble has always, without exception broken in the next few months, not few years.

“You can’t maintain the level of near ecstasy for a long time. It can’t be done because you’ve put in your last dollar. You are all in. What are you supposed to do – beyond that point? Time comes when you can’t borrow any more money and can’t take any more risk.”

How do you keep this level of enthusiasm going indefinitely?

And if the Government is going to write unprecedentedly large checks, then indeed the all-in position can expand one last desperate notch. The sad truth about the so-called stimulus is it didn’t increase capital spending significantly; it didn’t significantly increase the real production. This will lead to an even more spectacular bust.

The flow of dividends and earnings – that’s the only think you can end up eating, and sooner or later the stock market – will once again – sell on the future flow of dividends.

On 23 Mar 20 the FED managed to engineer a revival of the credit market and ultimately a spectacular rebound in stocks. But if we go before COVID you would notice we have already lost considerable power on the economy. We had fewer people working and we had a reduced stream of goods and services.

This is a monetary game, and you can keep these little monetary bubbles going for just so long, as long as you keep confidence rising. And when confidence reach extraordinarily high levels – the history books are clear – it’s very difficult to increase the confidence further.

2. Investing in 0-rate world

Although there are many arguments why the current valuation might be even low, e.g. discounting future cash flow at a lower rate – I don’t find them appealing enough.

Seen 30 years bonds yield dropping down from 16% to about 2%. In about 2000/2001 those were about 4.1/4.2% and we thought this will be the lowest forever and now it is even lower, and negative all over the world. We have got an artificial interest rate structure, driven down into negative territory, e.g. 20% of government bonds have a negative real return. In other words, you pay to lend them your money, not the other way around.

The same happened with cash – it is deeply negative. Many people literally pay the banks to deposit money, instead of earning anything out of that deposit.

Selling everything in the high will work just fine, however there are major discrepancies as there were in 2000, between US tech, which is overpriced. So, the value of the low-growth stocks is about as cheap relative to the high-growth stocks. All of them are at risk at some degree.

The good news is that oversee they don’t have the same bull market and the same overpricing as we in the US. You can go to the emerging markets – they are not that expensive, compared to S&P they are as cheap as ever could be.

As you won’t be able to make a decent return 10-20 years on US growth stocks (they are heavily overpriced now).

The higher you bid up the price of an asset, the lower the long-term return you will get. There is nothing you can do to change the equation. Every day the market goes higher, you know one thing for sure – that the long-term return will be less than it was the day before.

Growth stocks have outperformed (over the course of the bull market) value stocks by almost 400 basis points. What if, after the bubble pops growth, growth is still ahead and there is no redemption for the value investor? It will be historically unprecedented for that to happen.

“I have no confidence and have not had any for over 20 years in price-to-book and P/E and price-to-cash flow, price-to-sales, even, as a measure of true value. A measure of true value is the long-term discounted value of a future stream of dividends.”

A growth-stock is of course worth a higher ratio than the low-growth stock, but that doesn’t mean they can’t be overpriced. And value should be cheap for what you are. You should build-in the growth, build-in the quality.

I am also worried about an inflation. We don’t live in a world where output doesn’t matter, and we can just print paper forever. Sooner or later, this will bring huge inflation, that we haven’t seen in 20 years. Everywhere across the globe the price of critical food and metals is going up. Together with the rapidly declining growth rate in the workforce, towards zero and negative.

So, this is a bad time to be caught over speculating.

It is very difficult to allocate in a world of zero rates, stimulus, declining productivity, potential for inflation. Secondly, of course, diversifying – it’s always a huge advantage, and third – the low-growth stocks in the emerging market world are perfectly reasonable if you need to own stocks, and most people do, that would be the way to go.

It will take trillions of dollars to decarbonize the global system – all those companies, doing that, will raise and grow significantly. Those will dominate everyone’s portfolio. Find a good climate change fund and invest into it.

If you think about investing into Bitcoin or any other cryptocurrency – ask yourself – what is the future value of the dividend stream of it? It is nil, it will never pay you a dividend. If you are desperate, can you eat it? Its entire value is on the greater fool. Bitcoin could be worth a million dollars a unit if you find someone to pay it.

And we could think in a similar way about Gold. The difference is that Gold has had a 12,000-year test, and it passed it very well. And Gold also has some other fallback qualities – it doesn’t tarnish, it’s unique, everything ever made of gold is still around and will be around for a very long time. On top of that Gold is heavily used in manufacturing and production of expensive goods and materials. Bitcoin lacks all those.

Bitcoin is 100% faith. Come the next market phase where faith is at a minimum, what do we think will happen to something whose entire reason for existing is faith and nothing but faith?

3. What US government is doing for the economy

Ironically, I believe that Alan Greenspan is responsible for the current situation we are. The FED policy of acting and talking along the lines of moral hazard played a tremendous role.

Alan bragged that he contributed to the strength of the economy through the wealth effect. And there is such effect indeed. If you have the market doubled – 3 or 4% of that gets spent and helps the economy. But the cost of this is tremendous – we live in a real world of people and production and overinflating the value of something does not justify the little growth.

In the end it will all get to a negative wealth effect when the market regulates itself.

Another example are SPACs. Those should be a completely illegitimate instrument. They are just an excuse for people with reputation and marginal ethics to raise a lot of money and take 20% of it for themselves, and a complete rip-off in the sense that the professional hedge funds always liquidate before taking any real risk. And of course, SPACs will make money in the late stages of the bubble, but if you look at the first six years, they had a sub-average return for taking all the risk.

SPACs don’t have enough legal requirements, enough restraints, enough checking. They’re a thoroughly reprehensible instrument and should be disallowed.

The IPO should also be reformed. IPO is a license to reward the fidelities of the world at open. Direct listing made a little easier would be the way to go, but SPACs are terrible.

If you are looking for the very early warning signs of a bubble breaking you find the stocks that have done the best, some particular SPACs, and Tesla, and Bitcoin – and you see that they start to have these big daily drops, and then they recover, and they drop, and they recover.

And the market in 2000 didn’t go together – they took out pets.coms and shot them, the rest of the market continued to go up. Then they took out the junior growth stocks and shot them and the market kept going up, and then they took medium growth stocks and shot them too, and finally by the summer they were shooting the ciscos and the entire tech part of the market. And that had been 30% at the market peak of the total market cap. And yet the S&P by September was at the co-equal high of March which meant that the other 70% had continued to rise.

So bubbles don’t necessarily break on mass, but having sliced off the tech, and the dot coms, then finally the 70% like a giant iceberg rolled over on mass and went down for two and a half years by 50%.

4. US capitalism crisis

The right way to fix the economic inequality is to stop nurturing the moral hazard, and start leading and managing through a monetary policy as opposed to fiscal policy.

By simply pushing up asset prices, you make it difficult to impossible for people to get into the game. The purchase of a house is too expensive, the purchase of anything in stocks is much higher per unit of dividend.

Secondly, the compounding of wealth is reduced. If you have a 6% yield on your assets, you can reinvest them and you can double your money in 12 years. If you turn it into a 3% yield by doubling the price, you are worth more on paper but in real life you only eat the dividends and now they are 3% a year and you double your money in 24 years. So, in 48 years, you are down to a quarter of what you would have been, and so on.

And the gap becomes ruinously wide. The higher the asset price, the lower the rate at which you can compound wealth. And the rich get richer, as you price down the yield, and the poor get squeezed. You are not creating any real value; you are not creating more production and government spending is quite different.

Instead of writing check to everybody, if we write checks for particular infrastructure – we will be doing necessary investing. If we invest into an efficient grid – everybody benefits. So, the Government should come with a strong public spending program, emphasized at the repairing bridges and roads, and green infrastructure, research, training and retraining of people for green jobs.

A corporation in the mid 60s felt it had responsibilities to its workers, it was on the cusp of starting a nice pension fund, a defined benefit. The corporation felt the duty towards the city and the country. All of that is largely gone, but it didn’t go overnight. The idea that the corporation should only care about maximizing profits is a terrible business formula.

If you say as an individual ‘My only interest is to maximize my advantages,’ which is what they say at the corporate level, you are a sociopath. And we are not, as individuals, like that. A lot of us do the odd altruistic act and those are incredibly important in the long run.

Why Bill Gates sold out his stocks (Mar ’21)

We all know who Bill Gates is. He's one of the richest men in the world with a net worth of around 127 billion dollars. He did this through creating his own company Microsoft, but he also did it through very smart investing.

Lately Gates is making some very interesting investment moves. His recent 13 filings he sold and reduced 11 stock positions and he bought just one.

Let's take a look at some of these:

1. Uber the worldwide ride-hailing company - he sold a hundred percent of his position.

2. Boston properties - he did the same thing he reduced it by a hundred percent, selling 1.1 million shares.

3. Alibaba - one of China's biggest companies here sold in his recent 13th filings a hundred percent of his position.

4. Google or Alphabet (same thing) he reduced by 50%.

5. Amazon - he sold all his shares.

6. Apple – even it was not immune to the wrath of Gates investment decisions – 50% gone.

These are big moves that Gates is making. Normally when an investor sells some of his position, it's normally a couple of percent. If it's 5%, it is usually a big deal.

And Bill Gates, he's selling 100% out of his positions like Uber and Alibaba, and 50% out of big stocks like Amazon, Apple, and Google these are big moves.

Some of his other moves include

7. Liberty group - the communications company, it was reduced by 25%

8. Great Berkshire Hathaway - was reduced by 10.6%

9. Canadian national railway - the only small sale of 0.86%

And if we take a look at all of the stocks that he bought in the first quarter of 2021 it was just one a stock called Schrödinger a healthcare stock.

And what the investors really want to know is why has Gates made such big sales in these massive companies.

One of Gates’s patterns is that with a lot of stocks he sold – he did it when they're very high in price which a lot of investors avoid.

Uber, that's currently selling for 56 dollars a share, market cap is over 100 billion and it's not even generating any profits.

Amazon price wise has gone up more than 400% over the past five years. It's got a p/e of 72. That's considered very high and not good.

Apple is up over 350%, p/e ratio is 33.

Google or Alphabet is up 170% with the same p/e ratio as Apple of 33.

These stocks that Bill Gates is rushing out of, you'd have to say, he thinks they're overvalued. It's not like he's selling them because he's desperate for cash, his net worth is over $127 billion dollars.

Most probably Gates is worried about a market crash.

if you look at a lot of stocks in the market their prices are up to crazy levels, and we’re sure Bill

Gates and his investment manager Michael Larsen have been closely looking at this market.

As per the latest report they have decided to dramatically trim or exit some of their positions.

We've seen a lot of crazy behavior in the market, people just seem to have so much spare money on them and what do they do with it - they put it into stocks

Bill gates is not a fan of this uneducated investing style he linked it to a casino. He said ‘we don't think of the stock market as just performing a casino-like role, we have restrictions on gambling activities’

The current situation reminds us of the 1930s, to some degree so with all this crazy behavior that was seen in the market, Gate says it reminds him of the 1930s, something which Ray Dalio has also pointed out before

What happened back then was you had the roaring twenties, when everyone was putting their leftover cash into the market, because they thought it could only go one way and that's up but then in the late 20s and 30s, we saw one of the biggest market crashes that the world has ever seen.

That’s a big reason why Gates has decided to trim his positions.

So, look at the only position that Gates is buying - Schrödinger the drug discovery and material science company.

Schrödinger - they use computer simulation to design different medicines and drugs to help cure diseases. They also use computer stimulation to design different types of materials too.

And Bill Gates is someone who is well educated in healthcare and he’s invested in a relatively small company, five billion dollars in market cap.

They sell for 76 dollars a share, and revenue wise they're doing pretty good as well. Their revenue has been growing steadily over the past couple of years, as they look to discover new drugs.

Schrödinger earnings are decreasing and that's just because they are reinvesting every single dollar.

Back in 2018 Bill Gates was asked if in the near future there will be another financial crisis, similar to the 2008? And Gate said “yes, it is hard to say when, but this is a certainty.”

With the amount of stocks that he has sold recently there is a lot of people questioning if that when is 2021?

Let's look at some statistics of the overall market in 2021.

1. The market cap to GDP ratio. Warren Buffett said on it that it's probably the best single measure of where valuation stand at.

And it is very high right now, it's eighty percent higher than the zero percent equal fair value market range, and it's miles above what it was in the 2008 financial crisis

It's even higher than what it was in the 2000 internet bubble.

And we all know what happened to stocks after that. This indicator says prices are high and is very worrying sign.

2. Looking at the market p/e ratio it tells a similar story. It's currently sitting at the 40 mark now. This is near the 2000 technology bubble but not quite as high as what things were in the 2008 housing bubble.

Nevertheless, a market p/e ratio of 40 is high if you consider the average that it has been throughout history - that's 15. So, it's more than double that, and therefore Bill Gates portfolio right now is conservative.

His top 10 stocks that makes up 95 percent of his overall portfolio are value-oriented safe place

His number one position even though he sold some is still Berkshire Hathaway.

Next it goes Waste management, Caterpillar (conservative), Canadian national railway (conservative), Walmart, Ecolab, Crown castle, Fedex, UPS - all conservative.

And the last one is Schrödinger. Apart from Schrödinger which is his 10th largest position that is a very safe portfolio.

When looking at Bill Gates’s stock positions - he's got a very guarded and cautious portfolio for the current market conditions and we should keep a close eye on the upcoming future as it might not be so bright for the stock market.

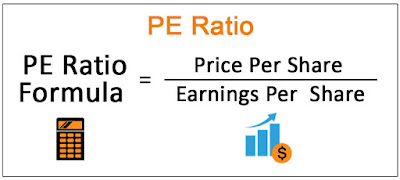

What is the p/e ratio

Today we're going to look at the price to earnings ratio to help all of you who would like to invest on the stock market.

The p/e ratio is by definition a price to earnings ratio, so it is a measure of valuation in order to determine how much does it cost to own a piece of a company in relation to how much the same company earns.

In general, the lower the p/e ratio - the better it is, and the higher the p/e ratio the worse it is. And that's not necessarily true every single time, so let’s work with some examples.

We should look at company A and its whole market value. what we want to do is take the whole market value and divided by what it is able to generate in terms of income on a yearly basis.

The whole company assets are represented by many stocks and if we gather all these stocks and all the stock prices, we're going be able to have the whole market value of the company.

For our example let’s say the company has 100 stocks and during the last year the average price of each stock was $10, so the whole market value of the company is $1000.

And let’s say the company income last year was $100; This means on the grand level the company has a price to earnings ratio of 10. (1000 market value / 100 income).

Now, let’s scale down and calculate per unit. Looking at the value per unit – which is the price per share, and we're also going to look at the income generation per unit.

In our scenario the average price per stock over the last year was $10, and the earning per each stock was $1 (100 number of stock / 100 income).

So now we have to divide $10 (the average price of 1 stock) to $1 (the income per 1 stock) and get the ratio of 10.

This is how you calculate the company’s p/e ratio. In our example we got 10, which is a pretty good number

When you look at different companies all over the p/e ratio is usually around 20 to 25. And, nowadays due to the inflated stock market it skyrocketed for many companies even higher than 30.

When it's lower than that (20-25) it means that the earnings are good, and the company might be under-priced.

And when it's higher than that it can mean the company is overpriced, that there's poor performance or that the market expects the company to have higher earnings in the future

The p/e ratio is valuation metric, and it is one of the many that need to be taken into account when you decide on which company to invest into.

It is important to use it when comparing different companies inside the same industry, or inside the same sector. Also, when comparing make sure that the companies have a similar debt profile because that can offset the p/e ratio and can mess up your analysis.

And this is how you calculate the price to earnings ratio, make sure you use it when you decide on a stock investments.

Best investments in 2021 and beyond

Hello our money-making, and money-loving friends. Today we will be staring a young bright start who teaches Personal Finance, Productivity and Minimalism. He is also an investor himself and always giving great investment advice.

He is Nate O’Brien, and here is what he says about himself:

For as long as I can remember, I’ve had a passion for personal finance, productivity, and personal development. In 2017, I started one of my first YouTube channels from my college dorm room at Penn State University. The goal was to teach as many people as possible about the inner workings of personal finance while keeping the content 100% free.

Nowadays his channel subscribers are over 1 million and he is producing invaluable content. And here are Nate’s advice for best investments in 2021 and beyond.

(Disclaimer: all the advice are just opinion and are not meant to be taken as a professional advice. Be careful, you may lose money when investing!)

Nate O’Brien:

Hi everyone! Today, I'm going to share five investments that I'm holding for life and maybe you want to consider as well. A quick disclaimer: I’m just a random guy on the Internet so just use the info for entertainment purpose.

Let's start with some of the things that we take into consideration here when I think about investments that I might want to hold for 20 or 30 or 40 years. One of them is the potential longevity of certain industries or companies. What you're going to find is that these five different types of investments it's probably going to be comprised mostly of different types of funds like exchange traded funds or mutual funds. It's not so much speculative penny stocks or companies that I think are going to go to the moon tomorrow or something, it's more about companies that I see a lot of long-term growth potential with.

I. Investing in healthcare

The first one that I've invested into, that I'm probably going hold for a long time is the Vanguard healthcare ETF (VHT) and there's a couple of reasons why I like investing into the healthcare industry. Some of these are obvious, like the fact that healthcare is always going to be something important to most people but also - thinking about different types of industries - the healthcare industry has the best chance of surviving for a long time. In terms of priorities for most of the people healthcare is certainly up there. I like investing into healthcare companies more than energy companies because I feel like there's less of the possibility of becoming totally decentralized in health care industry.

As a contrasting example, if I'm investing into an energy industry ETF or an energy fund that owns a lot of different types of energy stocks, I don't really know where this is going in the future. I don't know how oil and gas companies are going to be looking in 20 or 30 years, but also it could be something that I could see being totally decentralized, where people just have their own solar panels, and there's no massive energy companies that are sort of making money of it.

That’s why I think that the healthcare industry has a lot of growth potential for it but also when we consider the aging population not just of America, but in most of the world - most of the world is getting older – and those are all healthcare consumers.

Also, if we look at one of the largest demographics it's baby boomers in America. Turns out baby boomers have some money and when they get older, they also have a lot of money they're going to be spending on health care. They're going to be opening their wallets and making sure that they are in good health which is going to cost money whether it's physical therapy or different types of medicine. There's a lot of money in health care overall and I can see that trend continuing in the future.

Another reason why I like the healthcare industry and invested in something like this Vanguard healthcare ETF is because it does offer a decent amount of stability. Looking over the last year

And thinking about what happened with the recession and the economy, healthcare was still very prioritized on our list among everything else.

Some of the companies within the Vanguard healthcare fund are

Johnson & Johnson, Pfizer, and Merck. Companies who made vaccines for COVID-19 but also several different biotech companies. We have over 400 companies that are within this ETF. An ETF is an exchange traded fund, it's basically just a big basket of stocks.

Let’s look at different criteria within this healthcare ETF, one of them being that the expense ratio is 0.1% so it's one tenth of one percent. This is what I would consider to be a very low expense ratio. You always want to take these into consideration when you are looking at different types of funds or investments that you are getting into. With the one tenth of a percent expense ratio – it means that if you had one thousand dollars in this fund over the course of a year you would probably be paying about one dollar to Vanguard as their fee to manage the fund for you.

Also looking at overall performance over the past 10 years or so and we can see that it's done well since 2004. Just remember that past performance does not mean future performance just make sure you don't see something and think it went up 20 so it's going to go up 20 next year too. That's not how the stock market works, but overall, I think the Vanguard healthcare ETF has lot of stability.

II. Real estate investment

The second one that I wanted to discuss is investing into real estate. Look, I don't really want to be a landlord, I figured this out for myself. I don't want to be somebody who owns properties, I don't want to have to deal with tenants, but also, I don't want to have to deal with property managers if I buy a property and then somebody else is running it and taking care of it. There are still things that come up that I have to deal with, so I though how to get into real estate without actually having to own a physical property and this is when I looked into something like the Vanguard real estate ETF (VNQ).

Real estate is very much a tangible asset. And something I really worry about a lot in the economy, especially in today's world is inflation. There is always a possibility to have hyperinflation. Think about the fact that more than 22 percent of US dollars were printed in 2020. What's happening right now in the economy is the government is saying ‘hey let's make more stimulus packages it's going to get us more approval’ right it doesn't matter

The problem is that those money are just pulled out of thin air. There is no balance of the budget, e.g. ‘to get the 1.9 trillion dollars, maybe we should cut defense spending or cut different types of spending’. The government is just making more money out of thin air and

If you are holding cash in US dollar in 10 years that's going to be worth a hell of a lot less.

That’s why I love investing in real estate or have some exposure to real estate. Real estate will

probably keep up with inflation (that’s not certain fact), historically it had, because we're not making any more land and there's a lot more people coming onto this Earth every day.

There are a couple of different ways you can invest in real estate. For me, as I mentioned, I just like to go for the Vanguard real estate ETF, but maybe you want to buy physical properties yourself and be a landlord. I have lots of friends who do that, and it is especially good if you have some time on your hands too, and maybe you have a job but you're looking for something extra to do on the side.

You could also get into specific REITs, and REITs are Real estate investment trusts, and you could get into specific REITs that focus more so on specific areas. You might want to buy a REIT for a company that is specifically focused on maybe apartments in Texas or apartments in California or New York apartments. You can invest into those specific companies as well if you think those are going to boom or do well long term.

One thing that I will caution you on is about the future with office buildings and even with retail. I try to focus on some type of residential real estate, people always need a roof over their head, they always need a place to sleep and so. For me that provides some level of stability

The Vanguard real estate ETF hold several different types of real estate, so they own residential they have a lot of different other properties too, and the expense ratio on is 0.1% – 0.2% so also what I would consider to be a very low expense ratio. The fees on it are low and as usual you can buy this on Robinhood or anywhere else.

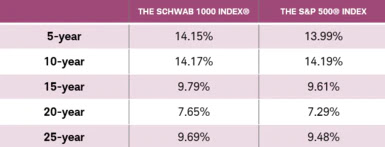

III. Invest in the most successful US companies

The next I would like to share with you, and it is a great way to get a lot of exposure to the thousand largest companies in America that are publicly traded is the Schwab 1000 fund (SNXFX). It is probably my favorite one and I think this is probably the largest one that I own. It contains the 1000 largest US companies, and you can check that it covers approximately 90% or more of the total US stock market cap so I feel safe being in something like this. Sure, there are times when this fund goes down, if you look at it back in March ’20, it went down just like the rest of the stock market did. It is something that of course I'm holding for a very long period.

Let's just check their top 10 holdings within this fund. It's Apple, Microsoft, Amazon, Facebook, Tesla, Alphabet (which is essentially Google and all their holdings), Berkshire Hathaway, Johnson & Johnson, and then J.P. Morgan Chase so they do own, or more precisely they are kind of having hands in a lot of different types of companies throughout America, and this gives us an overall just kind of broad way to invest into American companies.

IV. Invest in markets outside of US

But let's say that maybe you don't have too much of a bullish feeling about American companies, and maybe you think that America is on the downfall, and there's not a lot of growth left in America, or maybe you don't want to be so exposed to American companies.

So lately I've been shifting outside of American investments and looking for some ones in emerging markets in different parts of the world and that's why the one that I'm going to share with you is what is known as the Vanguard emerging market ETF (VWO). It is going to hold a lot of companies from different areas in the world like China, Brazil, Taiwan, and South Africa. So, a ton of different areas. This is what would be known as an international or global ETF and the expense ratio on it is also 0.1%. Again, very low, that’s what I like about Vanguard funds as you probably already noticed.

Let's check some of the different holdings that this ETF owns. You might notice some of these companies and you might recognize them especially looking at their top 10 holdings here like Alibaba, and maybe you recognize jd.com or Neo which is the popular stock that a lot of people have been investing into so just looking at these you can see probably a good amount of these are based in China, but there are ones from other countries here as well.

The fund is comprised of 5048 different companies, it's one of the largest most diversified ETFs that I've seen out there. Most other ETFs that I'm investing into might have 400 or 500 companies, but this one has over 5 000 which is a lot. And it is both good and bad. The good thing about a fund that holds 5 000 different companies is that maybe there's some companies within there that can really boom and really take off and be the next Amazon, and the bad is there's also going to be kind of not-so-good companies in there as well.

It gives us a lot of exposure, and it gives us some level of stability. Historically thougt these

emerging markets haven’t been performing as well as some different US ETFs that I've checked in the past 10 or 15 years. Nonetheless I still think that there's a lot of room for growth for the next couple of decades, especially in areas where maybe their GDP per capita is still 1/3 of America’s and they still have a lot of room to run to catch up to the GDP per capita in some of those countries. So maybe their growth rate will be a lot faster. Look at a place like india for example, where their growth rate seems to be a lot faster with their GDP growth.

V. Investing in bonds

And the last one I want to mention here it's going to be brief because it's not my favorite but maybe for people who want to be a lot more risk-averse and they're worried about maybe valuations of certain companies we have something like the Vanguard total bond market ETF (BND).

As you can see, I'm kind of a fan of Vanguard funds, I don't buy them through Vanguard though. And this one isn't my favorite, but I still wanted to include it on this list because like I mentioned not everybody wants to be exposed so much to stocks and maybe they want something that's seen as traditionally safer than the stock market. And those are bonds.

Bonds have not been a favorite for most investors in the past couple of years and this is because yields on these bonds have been low, sometimes these yields can be below 1% so it's not that attractive, especially when I factor in the fact that they also have the risk of defaulting on those loans.

Is it even worth that 1% when you average it out, especially when you get some of these different bond market ETFs fail and they can't pay, then you end up losing money? You won’t get your money back. For example, that’s what happened with Puerto Rico back years ago, when they defaulted on a lot of loans.

Don't just think that bonds are totally safe and are like deposits. It's one of the biggest misconceptions.

People mostly believe that bonds are guaranteed money, that it's safer than stocks. And it's not always safer and it depends on who's issuing the bond. If it’s apple or a highly reputable company that’s a good indicator but it also could be a company that's a small cap company with bad reputation. Those are risky because if they're issuing a bond the yield usually would be higher, but also riskier.

The Vanguard total bond market ETF is comprised mostly actually of government bonds, so this is probably just what I would mention is like a kind of a safe bet if you want to just park some money in there but you're not going to really see a lot of growth there.

it's kind of almost fixed like you're getting 2% percent yield, and in the worst-case scenario you may end up losing a lot of that money so I included it only for people who might really want to play it safe with minimum return on investment.

Well, thanks for reading all those thoughts and advice, I appreciate your time and if you found any value make sure you share the article and drop a comment below.

The dark side of a company bankruptcy

Nowadays, in the full unstableness of the market and the economy as a whole, some companies declare bankruptcy, and those are good examples of what is going to happen with your stocks, in a case of any company declaring bankruptcy.

Companies like JCPenney and Hertz and are declaring bankruptcy and you wouldn’t believe what happened to the shares price… It skyrockets instead of crashing down. So, in case of not aware of what usually happens when a company declares bankruptcy, there it is...

There are two options for a company to declare bankruptcy – using Chapter 7 or Chapter 11. If a company declares Ch.11 bankruptcy, what basically happens is – the company is asking for a chance to reorganize and recover. It asks protection from the court from the creditors. If the company survives, your shares may also survive too. But there is a very small chance of that happening. The company may cancel existing shares, making yours worthless. This is what happens in most of the cases. If the company declares bankruptcy under Ch.7, the company acknowledges the inability to function anymore. Rarely, any shareholders get something, as the creditors of the company are served first.

So essentially when a company announces bankruptcy the shares have zero value or close. You might be thinking – what if the company survives bankruptcy in the future and manage to cut costs and reorganize and survive somehow? You might think that the value of the shares will rise significantly. But, in reality, it turns out that the shares are almost always deleted during bankruptcy. The existing shares are just completely wiped out, most of the time. And if the company does survive the business owners, who credited the company in the past just create new shares for themselves. The new shares are not shared with the old shareholders.

A good example of the dark side of a company bankruptcy is the case with United Airlines. They went bankrupt in 2002. And four years later in 2006, the company managed to stabilize, and new shares went public. The same shares are still trading today but none of these new shares were given to the old shareholders. The people who held shares before and during bankruptcy lost everything. For them, it doesn't matter that the company survived.

So, nowadays, as an investor - you buy shares in Hertz, hoping for the company to survive, keep in mind that it probably won’t even matter as if the company does really survive, the business owners will most probably simply issue new shares and none of those will be shared with the old shareholders.

The stock exchange usually delists such shares and tries to stop them from trading. But some companies are fighting the delisting, as they would like to squeeze the most out of the market and the naïve investors.

The bottom line is that owners of common stock often get nothing when a company enters bankruptcy. Those shareholders are usually the last in line for compensation.

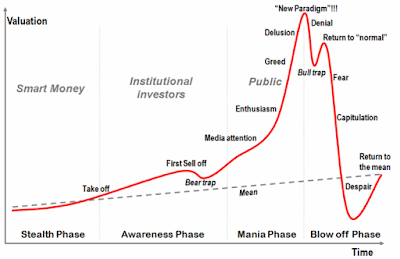

The Stock Market is a bubble - and it will burst

We are currently in a pandemic situation. The economy is struggling, unemployment is rising, and there is a lot of uncertainty. On top of that the S&P 500 recovered so quickly from the mini-crash in Mar 2020, and it looks like it have entered a bubble.

Let’s quickly explain the nature of the stock market. There are consistent patterns that emerge in every bubble in history and these consistent patterns are emerging again right now. Unfortunately – every time the investors believe in “but now it’s different” mantra, repeating the same mistakes again and again.

Above you see a chart representing the life-cycle of the stock market. This chart shows the stages of every bubble in history. It starts with the early stealth phase. Next comes the awareness phase as the investments begin to attract attention. Followed by the mania phase – where the bubble grows extensively. Finally the blow-off phase or the so-called crash.

The chart shows perfectly well - how every single bubble in history has grown and burst.

Above is an example of the dot-com bubble. Notice how the charts are pretty much identical. Did people learn from previous bubbles? Well, not so much it seems, at least not enough to avoid it playing out the stock market in the same way again and again.

Above is another example. We have the notorious Bitcoin bubble. This time it's overlaid on the stages of our bubble charts and we can see how closely it does follow it. It is clearly the same pattern so whether it was the "dot-com bubble" or the "Bitcoin bubble" the truth is the majority of the investors never learn and the same patterns are repeated over and over.

Every now and then new technology is invented, it changes the world and the majority of investors think “this time is different”. It’s also important to note that the burst of the bubbles are not always the end. For example the Bitcoin is obviously very contentious as it has shown tremendous staying power since the bubble burst, and maybe hasn't had as much time as the others to prove its worth.

The key point is that many investors fall victim to the same patterns because they think “this time is different”. This mantra have caused every bubble in history to get out of hand, and it is a well-documented pattern with lots of analysis.

Finally, keep in mind that we have clear signs that (in Jun 2020) we are currently in the mania phase of the bubble chart and as the charts show - the crash usually isn't too far behind. So, if you are an investor – be careful and don’t get overexcited.

Investing tips by Tony Robbins

We will be presenting 3 key tips for beginner investors and everyone who would like to start investing in the stock market, presented by the greatest coach of all time - Tony Robbins.

Here is what Tony said about investing:

The average person thinks finance is so complex because frankly the industry tries to make it sound complex. They use words that you don't know so you don't know what to do... What happens is we just give them our money and say deal with it.

1. You need to know that you can't wait until you have a ton of money to start investing.

If you can invest in business, even a small amount, you can grow. It doesn’t matter how small it is, the important thing is to automate it.

You got to take a percentage of what you earn and pretend it's a tax. You should not waste that money. It automatically goes straight to the investment account and you never see it as money you can spend. When you save 20% and you compound it, the numbers are incredible. And then the problem is: If you do that first step, but you don't do the second step which is:

2. Become an insider and understand the rules of the money game. I'll give you 2 or 3 of the Myths, really fast:

2.1. One, the myth that someone says give me your money and I'm going to beat the market. Over any ten year period of time, 96% of the mutual funds will not even match the market.

Warren Buffet flat out used to confirm the same trend. 96% of his money, all that money does not go with any mutual fund, it goes straight into the index.

What the index is you get a piece of all the largest companies in the world but it costs almost nothing to get in. You hire someone because you are thinking "I have a family, I have a business, I have a life, I'm not an investor- I'm going to hire someone who's a professional, it makes sense they would do better than me."

Unfortunately that's wrong.

Only 4% of the mutual funds will beat the market. 4% chance of finding the right mutual fund, the chance is so slim that it will happen.

2.2. And, the second myth is after getting terrible performance, people think "Maybe, fees don't really matter" or they'll tell you it's only 1%. And on Forbes, it says the average fee is 3.12%,

1% versus 3% is a big difference. And it really matters - just like you grow by compounding, your fees also compound. If you have 3 people and one gets 1% fees, another 2% the other 3%, and they all get the same return. And, they start out with 100,000 dollars at 35, accumulating for 30 years until they are 65 years old. If it is average 7% compounded, they all get 7% return and when they go to retire, the person who had 1% in fees is going have 574,000 dollars. The person who had 3% in fees will have only 224,000 dollars. This is 77% less money!

If I said to you: "Here's the deal, let's do an investment. You put up all the money, you put up all the money, you put up all the risk, I'll put up no money and I'll put up no risk. If you lose I win, and if you win I win and if you win, over the life of the time I'll get 60% of what you earn." That's a mutual fund with 3%.

3. Instead, you could own the stock market – invest in the S&P500, you could own a piece of all 500 big companies through like the Vanguard 500 and you get the best of all the business - Apple, Exxon, etc… All these companies – you invest into and it cost you only .17%. And if you go to a normal mutual fund you might own the same companies for 3.17%. That's like buying a Honda Accord for $20,000 in the first scenario or $350,000 in the second for the same car.

That happens every day with finances because people don't know how to look at this so when they read the book Money Master the Game: 7 Simple Steps to Financial Freedom that will never happen to them again.

Top tips for Investing in the stock market by Warren Buffett

Sharing the 5 top tips for investing in the stock market, presented by not anybody else, but the one and only – Mr. Warren Buffett himself.

1. I don't know when to buy stocks, but I know whether to buy stocks. Some people should not own stocks as they just get too upset with the price fluctuations. If you're going to do dumb things because your stock goes down, you shouldn't own the stock at all. I mean that if you buy your house at $20,000 and somebody comes along the house and says I'll pay you $50 – well, just don't sell it.

2. The best thing with stocks is to buy them consistently over time you want to spread the risk as far as the specific companies you're in by being versatile and you diversify over time by buying this company stock this month, that company stock next month. Year after year after.

3. If you save money you can buy bonds, you can buy a farm, you can buy an apartment house or buy a part of the American business. And if you buy a 10-year bond now you're paying over 40 times earnings for something which earnings can't grow, and you know if you compare that to buying equities good businesses. I don't think there's any comparison.

4. You are making a terrible mistake if you say out of a game. Probably you think, it is going to be very good over time because you think you can pick a better time to enter the stock exchange market. The later you start, the worse you will be: in terms of knowledge, experience, and money.

5. I know what markets are going to do over a long period of time. They're going to go up, but in terms of what's going to happen in a day or a week or a month or a year, even I've never felt that I knew it and I've never felt that was important. Keep in mind that in 10 or 20 or 30 years, I believe, stocks will be a lot higher than they are now.

Investing, money and stock markets during a national emergency (e.g. coronavirus crisis COVID-19)

It is March 2020, the coronavirus (COVID-19) pandemic is the “scariest bug” on all the media, and most of us are already “imprisoned at home” due to the national emergency quarantine state, declared in many countries across the globe. And of course, it’s not only the healthcare. The major collapse on all the markets has been unprecedented for years. In the mid of March, as measured by most of the indices and markets (e.g. S&P 500) the financial and stock exchange markets officially entered a “bear market” state. In other words, the stock markets have now fallen 20% or more since their recent all-time highs.

Most of the investors have panicked, due to the financial uncertainty, so we have gathered leading economists' opinions to answer the question “What to do with your investments during national emergency crises?”, like the one followed the recent coronavirus (COVID-19) global outbreak.

Joachim Klement (Investment strategist, a trustee of the CFA Institute’s Research Foundation and formerly head of strategy research at UBS Wealth Management), gives the simplest possible answer for most of the investors:

“Just, don’t look at your portfolio. The idea is - nothing that happens today, tomorrow or over the rest of 2020 will matter after 10 years. That “is the most important rule in bear markets. The best way to invest for most investors is to become a “buy and hold investor”. In other words, the best strategy is to buy a well-diversified portfolio that meets the needs of the investor and then stick to it for a very long time, through the ups and downs of the market. At the same time, the investors should avoid getting distracted by short-term market moves.”

The only sensible alternative, Joachim Klement mentions, is to use a highly sophisticated mathematical system. Such a system would support investors in getting out of the market and getting back in. One such respected and popular one, is the trading rule popularized by Cambria Investments’ Mebane Faber. The general advice there is selling stocks as soon as they fall below their 200-day moving average, and not buying them again until they rise back above that level.

“And with the coronavirus emergency state, following that rule,” according to Klement, “would not be possible. As the indices fell decisively below the 200-day average many days ago. Selling now leads in a steep loss in equities and other assets, as nobody can say if markets will go up or down from here (short-term), so investors will realize past losses, and not be in the market for a while. And this will inevitably mean missing the bottom of the market and will get back into the market at a stage when a lot of the recovery has already passed.”

So, he concludes, there is only one sensible option – do not look and don’t worry too much.

--

The same opinion comes from Jim Paulsen (chief investment strategist at the Leuthold Group):

“I think what we need somebody to calm us down, like our mom and dad tell us it’s going to be OK.” He implies that we should not panic and rush into reckless actions, and just have faith the markets will recover after the coronavirus crisis.

--

Gita Gopinath, IMF chief economists, opinion:

“It was hard to predict what might happen. The pandemic did not look like a normal recession. Data from China has shown a much steeper drop in services than a normal downturn would predict. There’s not an easy answer” Ms Gopinath continued, adding: “There should be a transitory shock if there is an aggressive policy response that can stop it, morphing into a major financial crisis.”

Gita Gopinath also concluded - there is no reason why the economic effects of a health crisis should linger, in the way that long periods of slow growth have tended to follow financial crises, as households and companies work off their debts.

--

Kenneth Rogoff (Harvard University professor, (predecessor at the IMF)) said:

“A global recession seems baked in a cake at this point with odds over 90%”

--

Maurice Obstfeld (professor at University of California, Berkeley) opinion:

“Recent events were a wicked cocktail for the global growth. I do not see how, given the events in China, Europe, and the US, you are not going to see a severe slowdown across the globe.”

--

Raghuram Rajan (professor at Chicago Booth School of Business and a former Indian central bank governor), opinion:

“The depth of any economic hit would depend on the authorities’ success in containing the pandemic, which he hoped would be decisive and rapid. Anything prolonged creates more stress for the system.”

“Long outbreak could also lead to a second round of consequences, where workers were dismissed and there was another fall in demand, eroding long-term confidence,” he warned. “These kinds of effects — companies closing down — depend on how prolonged the first round is, and what steps we all take to alleviate that first round. It is up in the air”

--

Olivier Blanchard (senior, at the Peterson Institute) opinion:

“There was no question in my mind that [global economic] growth will be negative for the first six months of 2020. The second half would depend on when peak infection was reached, he said, adding that his “own guess” was that this period would probably be negative as well.”

--

Other representatives of the IMF said that the impact of the virus will be “significant” and that growth in 2020 will be lower than in 2019, which was 2.9%.

--

Erik Nielsen (chief economist of Italy’s UniCredit) noted

“Four consecutive quarters of negative global growth followed the 2008 financial crisis,” but mentioned he expected “the impact of coronavirus to last only a couple of quarters.” But he also predicted that the quarterly fall could be as deep as the 3.2% contraction that the global economy experienced in the first quarter of 2009.

--

Gilles Moec (chief economist at French insurer Axa) mentioned

“Trying to plot the disruption from the virus was almost impossible. Our forecasting models are not set up to deal with this scenario.”

--

Other economists were also clear that the economic effects of coronavirus will be serious. Vítor Constancio (former vice-president of the European Central Bank), said:

“The recession is coming from a demand deficiency and the disturbance on the supply chains. The most affected sectors will be leisure amenities, tourism, travel, transportation, energy, financials.”. Vitor, also added: “It is possible that banks’ risk aversion and lack of market liquidity for bond issuance may affect credit and provoke liquidity squeezes.”

--

We also included the answers of three major questions, coming from financial online groups and boards:

1. How much longer are the stock markets going to decline? How great is the decline going to be?

No one knows, and that’s part of the fear that is feeding the markets to go even lower, sinking into an official “bear market.” The key is how long will this health crisis last? How many people will be impacted? And how quickly can the economy bounce back? Right now, no one has enough data to answer those questions, so the market is pricing in the worst-case scenario. What pretty much every economist and Wall Street type We’ve spoken to has said is:

“The US and the affected countries should do a two-week shutdown, similar to Italy. It will be painful. And it will require government help for people not working and businesses really hurt. But the hope is that would stop the flow of COVID-19 and boost confidence in the government’s response to this crisis.”

2. How worried should we be?

The United States is in a bear market, and it’s almost certain Q2 will be negative growth. The question is whether the United States will go into a recession (two consecutive quarters of negative growth). The reason there is such high concern on Wall Street today is investors don’t think the government response is sufficient — from Congress or the White House. A list of worries includes the coronavirus spread, oil price war, and the inadequate government response. So, the key in the coming days is whether Congress can set aside partisanship and pass a fiscal stimulus bill and whether the White House and Congress can backstop the health system sufficiently to start halting the spread of the virus.

3. What market segments will be most likely to weather the uncertainty we are seeing now? The prediction is for people to keep using their mobile phones and online services, whereas cruise ships will take a while to come back, right?

That’s correct. This is the Clorox and Netflix economy right now. The other somewhat surprising winner in all of this is real estate. Mortgage and refinance applications are through the roof. The 30-year fixed-rate hit an all-time low of 3.29 percent, so housing and home-related stocks and parts of the economy are likely to do well. I was just talking to a roofer. His business is down this week, but he’s got a lot of people calling and telling him they want him at their place as soon as this health crisis subsides.

--

As a final statement – the investors need nerves of steel during the coronavirus-provoked-crisis. The short-term effects of the COVID-19 crisis on the economy can’t yet be measured but are likely to be severe. Nevertheless, worrying too much could lead to a weakening of the immune system, so we advise you to stay on the positive side, be safe and stay at home until the coronavirus provoked crisis is under control and the virus is no longer a threat.

I would like to buy and sell shares online

The article will cover some of the rules for buying and selling shares online.

* The first thing you need is a bank account and also in Internet access on your computer.

* The set-up with most of the traders is free.

* There is usually a small fee for every trade/transaction (about £1-3).

* The trading itself is easy and intuitive. You will be offered a price for the shares requested and have a couple of seconds (10-30) to decide if you would like to complete the trade or not.

* The actual payment transaction is done a couple of days later (depending on your account settings).

* With some traders there are rules of how many times you could reject the offer so you don’t constantly bother them just to check the shares price.

* Some traders also have minimum trade quantity – so you have to buy a minimum of 100 shares for example.

* If you have an account with most of the major banks – you should be able to set up an online trading account with them.

* Do not expect to earn tons of money quickly – it really takes time (and some luck) to be a successful shares trader.

* Keep in mind that you could always lose your money (or at least part of it) – so do not invest money you cannot afford to lose.

* There is always a chance. Nevertheless - you should read analysis and have a strategy for every company you are investing in (to minimize the impact of having bad luck).