Here is another financial question from a close friend.

He has some amount of earnings apart from the ones that he saved for his necessities. He would like to invest the earnings in some real estate or alternatively in stocks. He has some knowledge on stocks but, heard some people reporting bad experiences when the stock market crashed before. So, we have gathered different opinions over the net, answering the question: What is a better option – real estate or stocks?

“It's really tough to make a decision between the real estate or stock. The bare minimum you should do is to study the last decade's value of land or real estate versus the stocks. The stock market condition is heavily inflated, nowadays, but the same could be said for the estate properties too. Do your homework and take an advice of a financial consultant, then make your decision.”

“It all depends on your interests and there can’t be one straightforward answer because a lot of it comes down to your personality, preferences, and style. However, many people feel Real estate is often a more comfortable investment for the lower and middle classes and is always evergreen.”

“Ups & downs occur in both the stock market and the real estate market. Before investing in anything, you need some knowledge and to study the market to be prepared in case of emergencies or market collapse. If you already have knowledge in stocks, this is a good factor to consider investing on the stock market, compared to the real estate investing.”

“In every sort of investment, you have to make sure that you possess the knowledge about the area you would be investing in to. Consulting a financial consultant is also a good idea. In the case of a real estate investments, it is a fact that nowadays every Metropolitan city is growing by fits and starts and those cities are adorning themselves with multi-storied buildings. A huge amount of land which were barren for a long time has been used for industrial purposes. So, do your study about the neighborhood you would be investing in, and only then invest carefully.”

“Stock trading is certainly the better option and is much lucrative than real estate investment. Get in touch with a professional to get the minimum training or join a group of investors to learn more, share ideas and knowledge.”

“Investing in real estate is a great way to obtain cash flow, real estate investments will be a better option. Some advantages of real estate investments are:

1. Cash Flow

2. Capital Gains

3. Leverage

4. Inflation Resistance

5. Tax Incentives.”

“Investing in real estate gives higher returns than typical investments like stocks. These are the most considerable advantages of making an investment in income-producing real estate. The income stream it produces tends to be extremely stable and predictable. The income stream is partially passive. The underlying property will typically appreciate over time. There are tax benefits to investing in real estate that is not available with most other investments. Rental properties when purchased correctly generate significant cash flow. As good as the returns in real estate are when investing with cash, they can also be compounded significantly by using leverage.”

“Stocks are good if you can keep yourself updated, all the time, and would love to keep a close eye on the stock market. Otherwise invest in real estate.”

Invest in Real Estate or Stocks

How to protect yourself from hyperinflation

And another question from the FB page. Jane is asking ‘with all this money printing that's been happening already, how can we make sure that we are protected from inflation or even worse – hyperinflation?’

And we will be presenting a couple of points to help you guys be protected from hyperinflation.

1. Put yourself close to the raw materials

Stay close to land or anything that could be transformed like lumber. If you look at lumber - you need to have land, you need to cut down the tree it goes through a process and is transformed into standardized logs. Then it goes into producing furniture, then into storage and then you buy the final product at your store.

If you look at it there's a lot of added value that goes through the process of just taking lumber and selling it. And if you can get closer to the lumber then hyperinflation will have less of an impact on you because what you will do essentially is you will cut your own trees down, you will buy the machinery to cut it and make it and you'll learn how to process.

You'll get it at a lot cheaper price and it's the same with everything other raw material. If you can get closer to land transform it, sell it - you can protect yourself from hyperinflation. It's an easier way to protect yourself. The same goes for agriculture, forest, oil commodities, etc.

2. Learn new skills in high demand

In case of hyperinflation - all service in high demand will increase quickly. For example, the maintenance on your car - an essential service that you need it's going to be in high demand, because if people need it, they'll pay a lot more for the service

And if you can learn how to do maintenance on your cars, oil change, construction on your house, etc. this will have a lot of value.

Let’s say that right now it costs about $100 an hour – car maintenance and $65 an hour for construction. In case of a high inflation or hyperinflation - this is going to go a lot higher, and if you learn how to transform your time into value, then you can protect yourself.

All those skills that you learn you essentially can transform into money then or you can do your own house, you can do your own floors, you can buy your own product and work with it.

All of these decrease the impact of hyperinflation when you learn something, when you transform, when you look at doing the oil change. It takes 15 minutes to do your old change and you save about 30 to 40 USD.

And you multiply that by 4 - that's a lot of value in a little bit of time, that you can transform your time into.

3. Use debt to your advantage

So, the inflation devalues the value of currency. This is something that a lot of wealthy people utilize. They use debt to get richer, because if you're saving money then that currency is being devalued at a very fast rate.

And if you're investing and you're using debt and if you can have long-term fixed debts, you could use that debt and use inflation to pay it off. But make sure that interest rates are lower than inflation if inflation is at 5-10%, make sure that your interest cost is lower.

Hyperinflation destroys the value of the currency by like 50% a month. That’s the worst-case scenario, if you have $100000 in the bank what's going to happen it goes from 100k to 50k, than it goes down to 25k and then 12,5k in just a couple of months.

When you use debt, that inflation will devalue the value of that long-term debt.

4. Invest in hard assets

invest in real estate, invest in gold, in silver, invest in land and commodities.

The only thing you need to be careful with gold and silver right is the huge premium when you want to buy it. There's not a lot of people that are selling it and if they're selling it, they're selling it with a huge premium.

And you would need insurance to store that gold so if you have it at home. There's a lot of companies that insure all your assets at home.

So gold, silver and land commodities, real estate are the best to invest in when hyperinflation or even high inflation hits.

--

So, those 4 points cover at least the basics on how to protect yourself from inflation or hyperinflation, let us know in the comments which one is your favorite.

What is the state of the US real estate market (May ’21)

Today’s topic is about the US hyperinflation, and how is it going to impact the real estate market. And let’s start by quickly mentioning that the real estate market is crazy right now and the real estate prices are up 20%. Also, we’ve got stocks mostly up with some small exception, we've got commodity prices up. We're seeing prices of everything going up and it's because of the FEDs money printer.

The whole situation is leading people with assets and wealth to have more of it, which allows them to shop for more real estate. More institutional buyers get into the rental real estate market. More people buying houses directly from ‘open door ‘or ‘zillow’ instant offers. Large landlord entities taking those properties away from other home buyers.

And this all creates more demand for real estate and drives up prices even more. Everybody with a pre-approval letter is immediately going to shop for a home. And the market is on pins and needles waiting to see what happens with longer term inflation. We have most investors right now knowing that we have massive inflation happening and we expect this inflation to continue due to supply shortages.

Over the near term the Federal Reserve takes the stance not to worry, as this is only transitory, and these issues are going to go away. We're told that these issues will not stay for the long term, inflation will come down, we'll balance out around two percent. And the rates will be risen slowly.

A lot of people in the investing markets, however, don't believe this. They're concerned that the Federal Reserve is going to lose control, that we're going to have hyper-inflation and maybe the mortgage rates are going to go through the roof and real estate prices will be going down.

We already know that there is a clear link between mortgage rates and home prices, or rental property prices, or cap rates on commercial real estate. Quick easy rule is the rule of 10x! For every 1% that mortgage interest rates increase - home prices rental property prices go down 10%.

If you get a half percent increase in rates, prices tend to go down five percent. A quick example of this happening in history – look at May of 2018. What you're going to find is the Federal Reserve started raising interest rates, resulting in real estate prices falling instantaneously within a matter of a few weeks. We saw real estate prices tank 10% - 12%. They recovered by the end of the year but only because the FEDs started reversing course.

Fast-forward to May 2021, the FEDs are saying ‘we're considering maybe injecting less cash into the markets.’ And the first target they'll likely look at is reducing their purchases of mortgage-backed securities. And here's what's happening right now. The Federal reserve is buying 40 billion a month of mortgage-backed securities.

When they stop buying these bonds mortgage rates are going to go up. And if you want to get into the real estate – you probably want to get into real estate before the taper. You can then lock in a 30-year fixed rate mortgage but be prepared for some potential volatility.

There are a two possible scenarios to occur in the following months. Scenario one is the inflationary direction. By September or October ‘21, the taper may have already started getting priced in. Mortgage rates might be higher, but the market's going to anxiously be looking if the rates are going to continue going up. And it will heavily depend on the inflation – is it going to stay, go up or down. This will determine if there is to be a crash or even further inflation.

In short-term – if you're trying to buy now, you probably want to get in before the FED starts talking about tapering mortgage-backed securities. Once that happens, probably the mortgage rates are going to jump up a good chunk, probably half percent would not be unreasonable, very quickly within a day.

You just want to lock in then, if you're thinking about buying after September, October, wait for September, October watch what happens – we will probably know then if the inflation is temporary. At that time, we would be getting the Q3 reports – so we will get an overview how are companies seeing inflation, what are company margins looking like, is inflation here to stay, is inflation starting to inflict downwards.

If we start seeing an inflection to the downside we might be at a place where we say the FED was right - we didn't get big long-term inflation. If that scenario happens - real estate prices could stay stable and potentially continue to trend in the current direction. Probably, not at those 20% rates, but more like 4-5% natural growth if the supply stabilizes.

The second scenario is if in September, October we start seeing inflation ramp up and not down. The short-term transitory nature of inflation we're expecting doesn't happen to be short-term – but long-term instead. It happens to be systemic and lasts for 3-4-5 years.

The FED has to then raise rates much sooner than expected. That will force mortgage rates up even faster so the taper's going to push rates up. The FED freaking out pushes rates up and real estate prices could literally collapse.

if the fed had to raise rates say 2% in the matter of a month, be prepared for that potential change in market value. If you are locked in on a 30-year fixed rate mortgage - doesn't matter. Your payment doesn't change, nobody can margin call you, you're not going to lose your house

And if you have short-term variable rate - financing rates might change, and you should be prepared to have to start paying more on your mortgages. This is a risk factor if you have a 30-year fixed-rate mortgage you don't have that issue you can ride this out if you're looking to buy after September, October ’21.

The market is weird, right now, and a good advice would be only to buy properties if you can get them a hundred thousand dollars under market value. As an example, a property in California that is closed on $500 000, and could be sold at about $700 000, once the renovation of about $40 000 – $50 000 is done is a good investment.

Best investments in 2021 and beyond

Hello our money-making, and money-loving friends. Today we will be staring a young bright start who teaches Personal Finance, Productivity and Minimalism. He is also an investor himself and always giving great investment advice.

He is Nate O’Brien, and here is what he says about himself:

For as long as I can remember, I’ve had a passion for personal finance, productivity, and personal development. In 2017, I started one of my first YouTube channels from my college dorm room at Penn State University. The goal was to teach as many people as possible about the inner workings of personal finance while keeping the content 100% free.

Nowadays his channel subscribers are over 1 million and he is producing invaluable content. And here are Nate’s advice for best investments in 2021 and beyond.

(Disclaimer: all the advice are just opinion and are not meant to be taken as a professional advice. Be careful, you may lose money when investing!)

Nate O’Brien:

Hi everyone! Today, I'm going to share five investments that I'm holding for life and maybe you want to consider as well. A quick disclaimer: I’m just a random guy on the Internet so just use the info for entertainment purpose.

Let's start with some of the things that we take into consideration here when I think about investments that I might want to hold for 20 or 30 or 40 years. One of them is the potential longevity of certain industries or companies. What you're going to find is that these five different types of investments it's probably going to be comprised mostly of different types of funds like exchange traded funds or mutual funds. It's not so much speculative penny stocks or companies that I think are going to go to the moon tomorrow or something, it's more about companies that I see a lot of long-term growth potential with.

I. Investing in healthcare

The first one that I've invested into, that I'm probably going hold for a long time is the Vanguard healthcare ETF (VHT) and there's a couple of reasons why I like investing into the healthcare industry. Some of these are obvious, like the fact that healthcare is always going to be something important to most people but also - thinking about different types of industries - the healthcare industry has the best chance of surviving for a long time. In terms of priorities for most of the people healthcare is certainly up there. I like investing into healthcare companies more than energy companies because I feel like there's less of the possibility of becoming totally decentralized in health care industry.

As a contrasting example, if I'm investing into an energy industry ETF or an energy fund that owns a lot of different types of energy stocks, I don't really know where this is going in the future. I don't know how oil and gas companies are going to be looking in 20 or 30 years, but also it could be something that I could see being totally decentralized, where people just have their own solar panels, and there's no massive energy companies that are sort of making money of it.

That’s why I think that the healthcare industry has a lot of growth potential for it but also when we consider the aging population not just of America, but in most of the world - most of the world is getting older – and those are all healthcare consumers.

Also, if we look at one of the largest demographics it's baby boomers in America. Turns out baby boomers have some money and when they get older, they also have a lot of money they're going to be spending on health care. They're going to be opening their wallets and making sure that they are in good health which is going to cost money whether it's physical therapy or different types of medicine. There's a lot of money in health care overall and I can see that trend continuing in the future.

Another reason why I like the healthcare industry and invested in something like this Vanguard healthcare ETF is because it does offer a decent amount of stability. Looking over the last year

And thinking about what happened with the recession and the economy, healthcare was still very prioritized on our list among everything else.

Some of the companies within the Vanguard healthcare fund are

Johnson & Johnson, Pfizer, and Merck. Companies who made vaccines for COVID-19 but also several different biotech companies. We have over 400 companies that are within this ETF. An ETF is an exchange traded fund, it's basically just a big basket of stocks.

Let’s look at different criteria within this healthcare ETF, one of them being that the expense ratio is 0.1% so it's one tenth of one percent. This is what I would consider to be a very low expense ratio. You always want to take these into consideration when you are looking at different types of funds or investments that you are getting into. With the one tenth of a percent expense ratio – it means that if you had one thousand dollars in this fund over the course of a year you would probably be paying about one dollar to Vanguard as their fee to manage the fund for you.

Also looking at overall performance over the past 10 years or so and we can see that it's done well since 2004. Just remember that past performance does not mean future performance just make sure you don't see something and think it went up 20 so it's going to go up 20 next year too. That's not how the stock market works, but overall, I think the Vanguard healthcare ETF has lot of stability.

II. Real estate investment

The second one that I wanted to discuss is investing into real estate. Look, I don't really want to be a landlord, I figured this out for myself. I don't want to be somebody who owns properties, I don't want to have to deal with tenants, but also, I don't want to have to deal with property managers if I buy a property and then somebody else is running it and taking care of it. There are still things that come up that I have to deal with, so I though how to get into real estate without actually having to own a physical property and this is when I looked into something like the Vanguard real estate ETF (VNQ).

Real estate is very much a tangible asset. And something I really worry about a lot in the economy, especially in today's world is inflation. There is always a possibility to have hyperinflation. Think about the fact that more than 22 percent of US dollars were printed in 2020. What's happening right now in the economy is the government is saying ‘hey let's make more stimulus packages it's going to get us more approval’ right it doesn't matter

The problem is that those money are just pulled out of thin air. There is no balance of the budget, e.g. ‘to get the 1.9 trillion dollars, maybe we should cut defense spending or cut different types of spending’. The government is just making more money out of thin air and

If you are holding cash in US dollar in 10 years that's going to be worth a hell of a lot less.

That’s why I love investing in real estate or have some exposure to real estate. Real estate will

probably keep up with inflation (that’s not certain fact), historically it had, because we're not making any more land and there's a lot more people coming onto this Earth every day.

There are a couple of different ways you can invest in real estate. For me, as I mentioned, I just like to go for the Vanguard real estate ETF, but maybe you want to buy physical properties yourself and be a landlord. I have lots of friends who do that, and it is especially good if you have some time on your hands too, and maybe you have a job but you're looking for something extra to do on the side.

You could also get into specific REITs, and REITs are Real estate investment trusts, and you could get into specific REITs that focus more so on specific areas. You might want to buy a REIT for a company that is specifically focused on maybe apartments in Texas or apartments in California or New York apartments. You can invest into those specific companies as well if you think those are going to boom or do well long term.

One thing that I will caution you on is about the future with office buildings and even with retail. I try to focus on some type of residential real estate, people always need a roof over their head, they always need a place to sleep and so. For me that provides some level of stability

The Vanguard real estate ETF hold several different types of real estate, so they own residential they have a lot of different other properties too, and the expense ratio on is 0.1% – 0.2% so also what I would consider to be a very low expense ratio. The fees on it are low and as usual you can buy this on Robinhood or anywhere else.

III. Invest in the most successful US companies

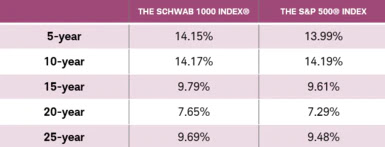

The next I would like to share with you, and it is a great way to get a lot of exposure to the thousand largest companies in America that are publicly traded is the Schwab 1000 fund (SNXFX). It is probably my favorite one and I think this is probably the largest one that I own. It contains the 1000 largest US companies, and you can check that it covers approximately 90% or more of the total US stock market cap so I feel safe being in something like this. Sure, there are times when this fund goes down, if you look at it back in March ’20, it went down just like the rest of the stock market did. It is something that of course I'm holding for a very long period.

Let's just check their top 10 holdings within this fund. It's Apple, Microsoft, Amazon, Facebook, Tesla, Alphabet (which is essentially Google and all their holdings), Berkshire Hathaway, Johnson & Johnson, and then J.P. Morgan Chase so they do own, or more precisely they are kind of having hands in a lot of different types of companies throughout America, and this gives us an overall just kind of broad way to invest into American companies.

IV. Invest in markets outside of US

But let's say that maybe you don't have too much of a bullish feeling about American companies, and maybe you think that America is on the downfall, and there's not a lot of growth left in America, or maybe you don't want to be so exposed to American companies.

So lately I've been shifting outside of American investments and looking for some ones in emerging markets in different parts of the world and that's why the one that I'm going to share with you is what is known as the Vanguard emerging market ETF (VWO). It is going to hold a lot of companies from different areas in the world like China, Brazil, Taiwan, and South Africa. So, a ton of different areas. This is what would be known as an international or global ETF and the expense ratio on it is also 0.1%. Again, very low, that’s what I like about Vanguard funds as you probably already noticed.

Let's check some of the different holdings that this ETF owns. You might notice some of these companies and you might recognize them especially looking at their top 10 holdings here like Alibaba, and maybe you recognize jd.com or Neo which is the popular stock that a lot of people have been investing into so just looking at these you can see probably a good amount of these are based in China, but there are ones from other countries here as well.

The fund is comprised of 5048 different companies, it's one of the largest most diversified ETFs that I've seen out there. Most other ETFs that I'm investing into might have 400 or 500 companies, but this one has over 5 000 which is a lot. And it is both good and bad. The good thing about a fund that holds 5 000 different companies is that maybe there's some companies within there that can really boom and really take off and be the next Amazon, and the bad is there's also going to be kind of not-so-good companies in there as well.

It gives us a lot of exposure, and it gives us some level of stability. Historically thougt these

emerging markets haven’t been performing as well as some different US ETFs that I've checked in the past 10 or 15 years. Nonetheless I still think that there's a lot of room for growth for the next couple of decades, especially in areas where maybe their GDP per capita is still 1/3 of America’s and they still have a lot of room to run to catch up to the GDP per capita in some of those countries. So maybe their growth rate will be a lot faster. Look at a place like india for example, where their growth rate seems to be a lot faster with their GDP growth.

V. Investing in bonds

And the last one I want to mention here it's going to be brief because it's not my favorite but maybe for people who want to be a lot more risk-averse and they're worried about maybe valuations of certain companies we have something like the Vanguard total bond market ETF (BND).

As you can see, I'm kind of a fan of Vanguard funds, I don't buy them through Vanguard though. And this one isn't my favorite, but I still wanted to include it on this list because like I mentioned not everybody wants to be exposed so much to stocks and maybe they want something that's seen as traditionally safer than the stock market. And those are bonds.

Bonds have not been a favorite for most investors in the past couple of years and this is because yields on these bonds have been low, sometimes these yields can be below 1% so it's not that attractive, especially when I factor in the fact that they also have the risk of defaulting on those loans.

Is it even worth that 1% when you average it out, especially when you get some of these different bond market ETFs fail and they can't pay, then you end up losing money? You won’t get your money back. For example, that’s what happened with Puerto Rico back years ago, when they defaulted on a lot of loans.

Don't just think that bonds are totally safe and are like deposits. It's one of the biggest misconceptions.

People mostly believe that bonds are guaranteed money, that it's safer than stocks. And it's not always safer and it depends on who's issuing the bond. If it’s apple or a highly reputable company that’s a good indicator but it also could be a company that's a small cap company with bad reputation. Those are risky because if they're issuing a bond the yield usually would be higher, but also riskier.

The Vanguard total bond market ETF is comprised mostly actually of government bonds, so this is probably just what I would mention is like a kind of a safe bet if you want to just park some money in there but you're not going to really see a lot of growth there.

it's kind of almost fixed like you're getting 2% percent yield, and in the worst-case scenario you may end up losing a lot of that money so I included it only for people who might really want to play it safe with minimum return on investment.

Well, thanks for reading all those thoughts and advice, I appreciate your time and if you found any value make sure you share the article and drop a comment below.

10 Money questions to answer by age of 30

As usual, we continue our never-ending mission to provide you with the best money-related answers to the top money questions. Today we will cover the top 10 most important money questions you need to answer by 30.

1. What is your net worth?

It is surprising how many young people do not know, neither care about their financial worth. Although it might be true that your personality worth cannot be measured in money, you need to be aware at every moment what is your financial stats. In terms of money – net worth means the monetary sum of all your assets (real estate, car, furniture, cash, saving accounts, investments, stocks) minus all your liabilities (debt, financial obligation, mandatory spending).

Precise calculation of your net worth is not an easy task. You need to consider the current market value of your assets, not the price you bought them for, but the price you can sell for. Calculating and understanding your net worth provides you with complete insight on how you are doing, and helps you elaborate your future financial goals.

2. What is your credit score and why is it important?

(we already deeply answered the money question in What is a credit score? article)

Your credit score number is a three-digit indication to potential lenders of your ability to repay money you borrow. The FICO score is the most commonly used, ranging from 300 (worst) to 850 (best) and is calculated based on the following factors: payment history, length of credit history, credit utilization ratio, the mix of credit types in use and number of credit inquiries.

You should aim for an excellent FICO score It includes anything from 750 to 850. The next category down is between 700 and 749. It is still considered good, but it might not get you approved for the best deal the lender offers Anything below 700 – you should consider fixing and improving before even consider borrowing money. Otherwise, even if you qualify for a loan, you might not be getting the lowest possible interest rates on that loan. Mortgage lenders and credit card companies usually reserve their lowest rates and largest loans for people who have exhibited a quality track record when handling credit.

3. How much money do you have, saved in your emergency fund?

It is advisable to have enough money in your emergency fund to cover your living expenses for you and your family for about 6 months. It might sound a lot, but you will be grateful to have access to the money in bad or even worst-case scenarios – losing your job, coping with emergency repairs, or even medical conditions.

Your first goal should be saving 100USD, then eventually growing the saving to 500-1000USD, until you reach the sum of your 6-months expenses. For some people this could be as low as 1000USD, for others it could go up to 10000USD and above. The worst case that could happen to you is the need to declare bankruptcy (we will cover extensively the disadvantages of bankruptcy, and those are not trivial), due to some extreme event.

4. Where do you put an excessive amount of money; you will need in 1 to 10 years?

Plan carefully your financial future. If you are going to need the money in 1 or 2 years, consider buying a Certificate of deposit. They provide a better interest rate than saving accounts (also have some disadvantages). If your timeframe is longer, consider investing in stocks, shares, and bonds. Just be aware that, while the stock market has historically gone up over time, it can go up or down in the short run. Keep in mind that past performance doesn’t guarantee future returns. While stocks may provide higher growth opportunities than Certificates of deposit and Bonds, you want to allow enough time to ride out the downturns and may consider relocating funds into more conservative options to cope with shorter periods of time. Investing in a mix of stocks and bonds is advisable as it lowers your risk.

5. What dividends and interest money do you get?

Interest money is usually paid by the bank on your deposited money, while dividends are periodically paid by companies to you as a shareholder. Dividends are typically paid in cash or additional stock shares. If you are an investor, this is a good way to collect some income while still investing for higher returns. Always keep in mind that dividends might be subject to taxes.

6. How do you diversify your financial assets?

Diversification means spreading your investments across a variety of assets. Those include cash (in different currencies), real estate, stocks, bonds, certificates of deposits, and so on. You don’t want to be putting all your eggs (erg… we mean ‘money’ :)) in one basket. An example of a good stock market allocation would be to invest in companies in the US and abroad, small, medium, and large, well-established (usually considered safer), and rapidly growing businesses. Ideally, you are aiming for a well-diversified portfolio, including deposits, cash, real estate, other properties, to cover for market fluctuations – when some go down, others go up.

7. When are you going to be debt-free?

Calculating your numbers is only one part of the equation. You also need a solid repayment plan with a solid end date. Create your schedule and include a plan for repaying mortgages, student loans, and other loans. If you managed to secure the best term loans and the rates are very low - you might not need to bother paying your debt faster.

On the topic of the credit cards – be very careful with them. If you only pay the minimums, you’re wasting a lot of money on interest and losing a lot of money you should not. Always be careful with credit cards and always pre-calculate how your financial balance change if you are up to paying more and faster.

8. How much money can you comfortably spend on housing and mortgage?

As a general guideline, experts’ advice is to limit your housing expenses to a maximum of 30% of your income. Many lenders obey that number and don’t even consider approving mortgages unless your proposed home expense compared to income ratio is 30% or less.

It doesn’t matter if you rent, lease, or own the place. Always try to lower your housing costs as upkeep and repayments could become huge and threaten your financial stability.

9. What types of insurance do you have and need?

Again, the experts suggest considering life insurance, home insurance, and automobile insurance as the minimum – in order to avoid sinking down in cases of emergency.

If you own your home or car, often you’re required to have insurance, and the minimum mandatory requirements vary depending on your location and specific case. Renters insurance may seem optional, but sooner or later you will realize that it is essential to protect your personal belongings, not to mention some modern buildings require it. Life insurance is a great way to ensure your relatives will be covered in the worst-case scenario. Consider it – especially if you have kids dependent on you.

10. How much do you save for retirement?

There is no golden money advice, as everyone has different goals for retirement finance, but most of the experts suggest you save between 10 and 20 percent of your annual income. Again, it depends on your vision and goals. Some people prefer investing, instead of putting money into retirement plans. Nevertheless, retirement plans are a good option. If you can’t afford much try to just save something there and increase a little with time when possible.