Here is another financial question from a close friend.

He has some amount of earnings apart from the ones that he saved for his necessities. He would like to invest the earnings in some real estate or alternatively in stocks. He has some knowledge on stocks but, heard some people reporting bad experiences when the stock market crashed before. So, we have gathered different opinions over the net, answering the question: What is a better option – real estate or stocks?

“It's really tough to make a decision between the real estate or stock. The bare minimum you should do is to study the last decade's value of land or real estate versus the stocks. The stock market condition is heavily inflated, nowadays, but the same could be said for the estate properties too. Do your homework and take an advice of a financial consultant, then make your decision.”

“It all depends on your interests and there can’t be one straightforward answer because a lot of it comes down to your personality, preferences, and style. However, many people feel Real estate is often a more comfortable investment for the lower and middle classes and is always evergreen.”

“Ups & downs occur in both the stock market and the real estate market. Before investing in anything, you need some knowledge and to study the market to be prepared in case of emergencies or market collapse. If you already have knowledge in stocks, this is a good factor to consider investing on the stock market, compared to the real estate investing.”

“In every sort of investment, you have to make sure that you possess the knowledge about the area you would be investing in to. Consulting a financial consultant is also a good idea. In the case of a real estate investments, it is a fact that nowadays every Metropolitan city is growing by fits and starts and those cities are adorning themselves with multi-storied buildings. A huge amount of land which were barren for a long time has been used for industrial purposes. So, do your study about the neighborhood you would be investing in, and only then invest carefully.”

“Stock trading is certainly the better option and is much lucrative than real estate investment. Get in touch with a professional to get the minimum training or join a group of investors to learn more, share ideas and knowledge.”

“Investing in real estate is a great way to obtain cash flow, real estate investments will be a better option. Some advantages of real estate investments are:

1. Cash Flow

2. Capital Gains

3. Leverage

4. Inflation Resistance

5. Tax Incentives.”

“Investing in real estate gives higher returns than typical investments like stocks. These are the most considerable advantages of making an investment in income-producing real estate. The income stream it produces tends to be extremely stable and predictable. The income stream is partially passive. The underlying property will typically appreciate over time. There are tax benefits to investing in real estate that is not available with most other investments. Rental properties when purchased correctly generate significant cash flow. As good as the returns in real estate are when investing with cash, they can also be compounded significantly by using leverage.”

“Stocks are good if you can keep yourself updated, all the time, and would love to keep a close eye on the stock market. Otherwise invest in real estate.”

Invest in Real Estate or Stocks

Which is riskier for investing - Cryptocurrency or the Stock Market?

A question from the FB page today:

Jerome shared with us he started learning about the Stock Market and recently about cryptocurrencies. He also managed to save some money aside and wonders where to invest with less risk of losing it.

First let us say that there is always a risk to lose all your investments, investing in Cryptocurrencies and in the Stock Market. With that being said, there are a wide variety of possible stock market investments, with a wide range of possible risks.

Some stock market investments are pretty safe and are likely quite a bit safer than investment in cryptocurrency. Some stock market investments are pretty risky and are likely quite a bit riskier than investing in cryptocurrency.

So, ‘Risk; is a relative term. The stock market would indeed be very risky is you are buying stock without knowing what you are doing and without analyzing the companies upfront.

Very often people buy stock based on somebody’s else opinion. Instead, should you learn how to determine yourself what would be good stocks to buy. You also set up safeguards to keep you from losing all your money.

For instance, when you buy a stock, you set a Stop Order. Let's say you buy shares of a stock at $20 a share. You've determined, by (for instance) studying the charts of that stock, that you would be willing to risk losing $2 a share in case its performance goes down. (Which is 10% of its price and your total investment)

So you buy the stock at $20 a share and set a stop order at $18 a share. In the worst-case scenario, the price of the stock drops under $18 a share, and the stock automatically sells itself. You lost only $2 a share.

But, if your research on the stock is correct, the price of the shares will go up long-term. Another example: the price of the shares rises to $30 a share. You've already determined if the stock goes that high, you will reset your stop order for $25 a share. That way, if the price goes down below $25, it automatically sells, and you've lost nothing, and even made some profit.

Those are just some examples for using safeguards when trading. When you invest long-term you might decide ETFs are the better option. Long-term they always go up (as the economy will overall go up long-term).

The big problem with the long-term investment would be the inflation or more specifically the hyperinflation. So be sure to read about those in the previous topics where we discussed them and gave good advice - how to protect yourself.

On the other end, the cryptocurrencies are extremely volatile which creates huge fluctuations in their price – some people made a fortune there, but the majority lost their money.

In general, nowadays, investing in well-performing stocks, companies and ETFs should be considered less risky than investing in cryptocurrencies.

Warren Buffett: how to invest during high inflation?

As inflation is a very hot topic in the mid of 2021, we've seen the FED saying, ‘this inflation we're seeing now is short term, and there is nothing to worry about’, on the other hand we've seen Warren Buffett talking about how he's seeing big inflation throughout Berkshire Hathaway's businesses. We've also got Michael Burry making a new big-short on bonds.

So how does high inflation affect the investors and what's the best way to deal with a period of high inflation?

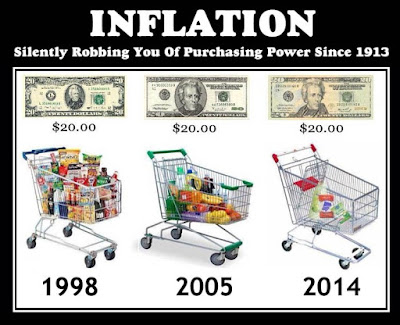

All the investors want to do is - commit a certain amount of money to an investment and get more money back at some point in the future. But when we talk about inflation and investing it's more helpful to think of investing like - giving up a certain amount of buying power now, to have more buying power in the future. Like giving up the purchasing power to buy 100 apples now in the hope that we have the purchasing power to buy 150 in the future

While you may make a 20% gain on an investment on paper over a few years if inflation is running rampant, there's a potential that your real return is zero. E.g. you could buy 100 apples before, then you make 20% on your, investment then you sell it, but after that you can still only buy 100 apples now. You've had no gain in purchasing power.

This is what Warren Buffett talked about in 1979. He said that a business with per-share net worth compounded at 20% annually, would have guaranteed its owners a highly successful real investment return, but now such an outcome seems less certain for the inflation rate coupled with individual tax rates will be the ultimate determinant as to whether our internal operating performance produces successful investment results.

It is just as the original 3% savings bond, a 5% passbook savings account, or even an 8% US treasury note have in turn been transformed by inflation into financial instruments that chew up, rather than enhance purchasing power over their investment lives

A business earning 20 on capital can produce a negative real return for its owners under inflationary conditions not much more severe than what presently prevail. And this was in 1979 and the inflation rate was 11%.

Buffett says the combination of the inflation rate plus the percentage of capital that must be paid by the owner to transfer into his own pocket the annual earnings achieved by the business, i.e ordinary income tax on dividends and capital gains tax on retained earnings - can be thought of as an investor's misery index when this exceeds the rate of return earned on equity by the business the investors purchasing power real capital shrinks even though he consumes nothing at all.

Inflation is a crummy time for investors because when you take into account its rate - you can think about the annual percentage loss of purchasing power. If you couple that with either taxes you have to pay on income received through dividends and the capital tax the capital gains tax you have to pay when you sell then your real return on your investment could be negative even if the business is going well.

In 1980 Warren Buffett made the following analogy ‘the average tax paying investor is now running up a down escalator which pace is accelerated to the point where his upward progress is nil.’

And even if you are not an investor inflation can be a crappy time for businesses as well. Inflation eats away at the purchasing power as well and businesses generally need to buy a lot of stuff to keep operating. And if this stuff is now all of a sudden more expensive, they're trapped in a dilemma either they pay the higher price to operate, therefore making less profit or they raise the prices (produce more inflation) and hope that their sales volume doesn't shrink.

Inflation can also put upward pressure on interest rates which can make it harder for companies to access loans or make pre-existing loans more expensive to pay off, and this makes it much harder for the investor to pick great stocks that are going to compound money over time.

Warren Buffett explains what type of businesses tend to do well even in periods of high inflation. Such favored business must have two characteristics:

1. An ability to increase prices rather easily even when product demand is flat and capacity is not fully utilized, without fear of significant loss of either market share or unit volume

2. An ability to accommodate large dollar volume increases in business often produced more by inflation than real growth with only minor additional investment of capital

So, on the first one - an ability to increase prices and face no consequences. The business is feeling higher costs which hurt their margins so why not push those extra costs onto the customer if they can.

And you may think –‘ that is ridiculous, no company could do that, and the customers would just go and buy the cheaper product elsewhere, but not if the company has a moat.

If you're a small production company you've spent money to train all 50 of your employees to use Photoshop and Premiere pro and After effects - that took time, and it took money. Adobe suddenly decides to up the subscriptions ten dollars more per month.

Your company management might be thinking – ‘let's switch to a cheaper alternative, maybe you find a cheaper alternative, twenty dollars a month cheaper, great but it doesn't have all the same features as what the team's already using. Plus, it's going to cost two hundred dollars per employee to train them on the new software, not to mention the downtime your business will experience to get that training done and to switch everybody over.

If you think about the clients - they are already stressing you out, they're trying to get their productions finished, and at the end of the day it's just not worth switching. So, what can you do? You just pay the increased subscription, and you stick with Adobe, and pay more.

Another example: Apple has such a strong brand mode and a strong ecosystem that it's completely normal for them to squeeze a little bit more, and a little bit more out of all their customers each year.

In 2012 iPhone average selling price was just over $600. At the end of 2018, it was almost $800. Nowadays, it's even higher, and that's not even considering the plethora of add-on subscriptions. Apple will somehow force upon you whether it be AppleCare or iCloud or Apple Music, there's no escape and that's the point. So, during inflationary times look to the companies with very strong moats which can raise prices without consequences.

Secondly, you want the business to have an ability to accommodate large dollar volume increases in business with only minor additional investment of capital. So, if your business is not just able to pass on extra costs to the consumer, that means that you're going to have to cope with those costs, which means lower margins to generate your profit. It means you need to be able to increase the amount of business you're doing.

Essentially, what Buffett is saying here is - you want companies that are growing and are also easily scalable. For example - a shipbuilding company would struggle on this point. It costs a lot to build a big ship, you're not going to make huge margins doing it, but it's also very hard to increase the number of ships you're delivering each year. That would take enormous investment, into new shipyards and it'll be slow to wind up.

And if you consider a company like Facebook on the other hand if they can’t pass on the extra cost to their customers (which are the advertisers), they could just choose to bump up the frequency of sponsored posts or of other ads. When a user is scrolling Instagram or Facebook they see three ads, instead of seeing two, and Facebook could do that very easily, and very quickly.

3. And Buffett has one more piece of advice for those seeking the best strategy during a time of inflation. Invest in yourself!

Sometimes there's just no escaping. Stock market investing in these times can be hard, so and given the fact that we're dealing with fairly high levels of inflation what can we do?

To improve your own earning power, know your own talents. Very few people maximize their talents and if you increase your talents, they can't tax it while you're doing it, they can't take it away from you. If you become more useful in your activities your profession - doctor, lawyer, auto repair, etc… - that’s the best protection against a currency that might decline at a rapid rate and the best investment.

And a good passive investment – is an investment in a good business. If you own an interest in a good business, you're very likely to maintain purchasing power no matter what happens to the currency.

Warren Buffett is indirectly acknowledging that it's hard to do well as a stock market investor when inflation just keeps ramping up. It's a bad time and your real return can be zero, so probably a better thing to do is invest in yourself, up-skill so that you can achieve a higher level of income. And your personal buying power would not fall - make yourself more valuable.

Overall, Warren Buffet gives us those 3 invaluable points. Those just come back down to the competitive advantage of you and your business – have a moat, be able to scale quickly and cheaply, and the last one is to invest in yourself.

How to protect yourself from hyperinflation

And another question from the FB page. Jane is asking ‘with all this money printing that's been happening already, how can we make sure that we are protected from inflation or even worse – hyperinflation?’

And we will be presenting a couple of points to help you guys be protected from hyperinflation.

1. Put yourself close to the raw materials

Stay close to land or anything that could be transformed like lumber. If you look at lumber - you need to have land, you need to cut down the tree it goes through a process and is transformed into standardized logs. Then it goes into producing furniture, then into storage and then you buy the final product at your store.

If you look at it there's a lot of added value that goes through the process of just taking lumber and selling it. And if you can get closer to the lumber then hyperinflation will have less of an impact on you because what you will do essentially is you will cut your own trees down, you will buy the machinery to cut it and make it and you'll learn how to process.

You'll get it at a lot cheaper price and it's the same with everything other raw material. If you can get closer to land transform it, sell it - you can protect yourself from hyperinflation. It's an easier way to protect yourself. The same goes for agriculture, forest, oil commodities, etc.

2. Learn new skills in high demand

In case of hyperinflation - all service in high demand will increase quickly. For example, the maintenance on your car - an essential service that you need it's going to be in high demand, because if people need it, they'll pay a lot more for the service

And if you can learn how to do maintenance on your cars, oil change, construction on your house, etc. this will have a lot of value.

Let’s say that right now it costs about $100 an hour – car maintenance and $65 an hour for construction. In case of a high inflation or hyperinflation - this is going to go a lot higher, and if you learn how to transform your time into value, then you can protect yourself.

All those skills that you learn you essentially can transform into money then or you can do your own house, you can do your own floors, you can buy your own product and work with it.

All of these decrease the impact of hyperinflation when you learn something, when you transform, when you look at doing the oil change. It takes 15 minutes to do your old change and you save about 30 to 40 USD.

And you multiply that by 4 - that's a lot of value in a little bit of time, that you can transform your time into.

3. Use debt to your advantage

So, the inflation devalues the value of currency. This is something that a lot of wealthy people utilize. They use debt to get richer, because if you're saving money then that currency is being devalued at a very fast rate.

And if you're investing and you're using debt and if you can have long-term fixed debts, you could use that debt and use inflation to pay it off. But make sure that interest rates are lower than inflation if inflation is at 5-10%, make sure that your interest cost is lower.

Hyperinflation destroys the value of the currency by like 50% a month. That’s the worst-case scenario, if you have $100000 in the bank what's going to happen it goes from 100k to 50k, than it goes down to 25k and then 12,5k in just a couple of months.

When you use debt, that inflation will devalue the value of that long-term debt.

4. Invest in hard assets

invest in real estate, invest in gold, in silver, invest in land and commodities.

The only thing you need to be careful with gold and silver right is the huge premium when you want to buy it. There's not a lot of people that are selling it and if they're selling it, they're selling it with a huge premium.

And you would need insurance to store that gold so if you have it at home. There's a lot of companies that insure all your assets at home.

So gold, silver and land commodities, real estate are the best to invest in when hyperinflation or even high inflation hits.

--

So, those 4 points cover at least the basics on how to protect yourself from inflation or hyperinflation, let us know in the comments which one is your favorite.

How to invest in gold

A question from Facebook. Alan is asking ‘How to invest in gold?.’ Probably Alan has been scared from the money-printing machine and the risk of inflation. And the question is probably in the heads of thousands of our readers.

So, today we will write about the topic on gold investment and how to invest in gold as a beginner. In May 2021 gold has recently hit an 11-year high trading at above $1900 an ounce.

1. Investing in physical bullion

This is the actual metal, and it is going to be either in coin or bar form, typically if you're buying from a reputable source this can be anywhere from a quarter of an ounce all the way up to 400-ounce bricks.

If you can afford a 400-ounce brick of gold, that’s great and as of mid-Jun ’21 this would be at about $750 000.

Physical bullion is priced about 1-10% over spot price. Typically, it's 1-5% percent at any given time but in 2021, with endless money printing, a lot of people are not trusting fiat currency and there's a lot of demand for precious metals ,that's why the price is going up, and now the dealers whether it's a coin shop or an online broker are charging closer to 10$ over spot.

If you don't know what spot price is, say gold is trading at a thousand bucks an ounce for example. If you add 10% premium to that you're probably going to be getting into that gold for about 1100 an ounce.

You also need to buy quality, as the most popular types are coming from mints or they're coming from highly reputable sources. So, you should only be investing in investment grade gold that's the whole point of the investment. You're looking for purity of 99.5% or higher.

Many investors only buy 99.9% or higher, and the most popular ways to invest in this as we mentioned are coins, because of its divisibility and its ability to be stored very easily.

If you want to make a comparison to silver, it's trading at about 1 ounce of gold can buy you about 50 ounces of silver. It means 50-times more space if you are to store silver. So gold is highly divisible and takes less space than silver to store for the same amount of money invested.

You can buy from any reputable online or offline merchant, and check if they discretely and quickly ship to you.

2. Investing in gold ETFs and gold funds

They trade exactly as stocks and ETFs, and are referred as paper-gold. And there are 3 types of these ETFs.

The first kind are investing in a company or an ETF or mutual fund or an intermediary that invests in the physical bullion, as we mentioned in the previous point.

You can pull your money together; they hold the physical bullion, and they basically mimic the spot price.

The second way are investing in ETFs or funds that invest specifically in gold futures contracts. These are companies that do exactly what the first example does, except they're not holding the physical gold and they typically don't take delivery. They're literally just betting on the future price of gold.

The third option you have are gold mining companies, which have become very popular over the past few years. You would be investing in ETF that owns a bunch of gold mining companies and is based on how those gold mining companies do.

As an example, a popular gold-holding ETF is Spyder gold shares – GLD. What they do is, as mentioned is they hold the physical bullions. So that ETF is typically going to mimic the spot price as mentioned.

You also have to take into consideration that the capital gains tax is going to be higher than other ETFs. So, when you dispose of your position, you would probably be paying a higher tax potentially up to 28%.

And the 4th option is investing in gold futures or options, and it is for advanced traders only. This is for people that either do this as a living or have been doing it for many years, and they know exactly what they're doing.

3. PROs and CONs of investing in gold

3.1 PROs of investing in gold

Number one is, that gold is a hedge against inflation. With the money printer printing trillions and trillions of dollars, it’s not surprising people lose their confidence in fiat currency. And they go back to something that is a historical store of value.

There's a finite amount of gold and it is considered hard money. This is all to battle decreased purchasing power ever since the US went off the gold standard in 1971.

Number two is all about portfolio diversification. Many people are investing in stuff linked to the financial markets, and gold is an opportunity to bring diversification to your portfolio, outside of just equities or stocks.

So, people need to provide true diversification and introduce that to their portfolio. And you can do that through precious metals such as gold.

And then final advantage is that it is easy to get started. All you need to do is literally go online, pick a reputable merchant and you can literally get started immediately.

ETFs and funds are just as easy as buying a stock so those gold ETF and funds if you already have an open brokerage account you can literally get started in investing in gold in a click of a button just by buying shares of those ETFs or funds.

3.2. The CONs of investing in gold

Number one is that it doesn't earn you anything. It is literally a pet rock, so if you invest in the physical bullion, you're going to throw it somewhere in a safe or at a bank deposit box, and it's literally just going to sit there.

There are no dividends no compound interest and no passive income coming from that investment. It is a double-edged sword, because it's not correlated, and it can't earn you passive income.

Number two is the cost for storage. If you keep it in the house safe – you might get robbed. And you may want to keep it at a bank and even then, although this is rare, what if there's a run on the bank, or what if that bank burns down. Of course, there's insurance, but the point is that the storage could become an issue and if you just want to keep the physical amount of gold in your premises you will also need to invest in some sort of security.

Number three – you are paying premium over spot and then you also have taxes as a collectible when you go to dispose of your position. Basically, the premium we mentioned is anywhere typically from 1-5%, and right now in this environment it's right around 10% and then this is also taxed as a collectible up to 28% of the value.

4. Final thoughts on gold investments

Gold is a great way to diversify your portfolio. It is a good practice for everyone to have at least 5-10% of either gold or precious metals to make up their portfolio.

At times, silver could be also under-priced, but gold has typically considered a better store of value.

The point is to preserve wealth over years – that’s the idea of the precious metals.

And a well-diversified portfolio would be: a little bit of precious metals, a little bit of real estate assets and then you have your typical usual suspects - stocks and bonds. Then with the hype over crypto nowadays – people are calling it virtual gold, but we still have to see if it will stand the test of time.

Also, if the interest rates do not go up in any time in the near future, it means that the gold is extremely valuable asset.

Hopefully, we managed to answer the ‘How to invest in gold’ question, and to give you some hints how you can get yourself started and add gold and other precious metals to your portfolio.

Will the next market crash be worse than 1929 or 2000

Jeremy Grantham is a co-founder and chief investment strategist of Boston’s GMO. Jeremy believes that in 2021 - U.S. stocks have become an epic bubble and will burst so badly to outshine the crashes of 1929 and 2000.

Here is what Jeremy Grantham outlines

1. What happens when the market crashes

I believe that the bull market, started in March 2009, the longest bull market in history, have matured into a speculative fever of rare proportions, a fully-fledged epic bubble. It would be surprising if we have one that long that didn’t end up with animal spirits beginning to freak out a bit.

Achievement like that normally takes a friendly economy and even friendlier FED behavior, but this one managed to do with somewhat wounded economy on a global basis. We even had more spectacular FED and Government friendliness. The usual moral hazard that has been going on since Greenspan arrived the 90s.

The result of that is that confidence has risen and risen and risen until finally people are reaching for the greatest demonstration of confidence, they have had in their investment career. They are borrowing more money to throw it into the market, their belief in the market is profound, the common wisdom is that the FED on your side, how can you lose. And nowadays there appear to be no doubters at all.

The belief is that – all you need is the FED on your side and the stocks will rise forever.

And some of the signs to look for a bubble are, e.g. look at over-the-counter trading. Last Feb it traded about 80mil shares for the month, and it worked its way steadily through the year until Nov, when it was about 380mil. And then in Dec it went to 1.15 trillion shares for the month, having tripled and tripled again in just a month. These are spectacular performances.

My own stock at Quantum scape came into the market at 10 and shot up to 130, and it became bigger than GM or Panasonic. And it is a brilliant company, but it already admitted it won’t be producing any batteries for 4 years. So, no sales, no income for 4 years and yet bigger than GM.

There has been nothing like that in 1929, nothing of that scale. Nothing like that in 2000 either. 1929 run into great depression and global trade problems, so you really want to the first leg down, which was big enough.

The analogy with 2000 is better, and it went down 50% back then. And the reason it went down only 50% and bounced back relatively quickly was because FED came charging into the rescue. And you can have a lot of rescues when you start at a 16% long government bond for example in 1982. You can have a bull market as you go down from 16 to 12 and another bull market from 12 to 8, and 8 to 4.

And now we are down at about 2.5% and you have to realize that most of the easy pickings of saving the game by ramping rates down is behind us. At the lowest rates in history, you don’t have a lot in the bank to throw on the table.

The idea that the real world doesn’t count and all you need is money – to generate real wealth – I am pretty sure most of the people feel it’s an illusion. The situation where we have a deadly virus, and the economy is obviously on its knees and the FED is doing everything it could – and would that be enough to save the system?

In the end the system is about the amount of people working and producing, the amount of capital spending, the quality of education and production of the workforce.

COVID-19 brought spectacular excesses on the part of the FED and the Government writing checks. Unprecedented, and the combination was very powerful.

And the market had the opportunity to crash a couple of times, e.g. in 2018 – the last time. And those bull markets can go on forever. You don’t know how high and how long they could go.

In the back of everyone with bear’s mindset must be surely Japan in 1989. During that time, they managed to get to 65 times the market earnings. It has never previously gone over 25. So, the markets are unpredictable – when we avoid the burst of euphoria.

Tesla is an emblematic as crazy investor behavior. At the same time, anyone who has bet against Elon Musk has lived to regret it so far. Going short is only for experts because you can get into bankruptcy very quickly. My recommendation is to not go short individual stocks.

When you reach such levels of hyper-enthusiasm, the bubble has always, without exception broken in the next few months, not few years.

“You can’t maintain the level of near ecstasy for a long time. It can’t be done because you’ve put in your last dollar. You are all in. What are you supposed to do – beyond that point? Time comes when you can’t borrow any more money and can’t take any more risk.”

How do you keep this level of enthusiasm going indefinitely?

And if the Government is going to write unprecedentedly large checks, then indeed the all-in position can expand one last desperate notch. The sad truth about the so-called stimulus is it didn’t increase capital spending significantly; it didn’t significantly increase the real production. This will lead to an even more spectacular bust.

The flow of dividends and earnings – that’s the only think you can end up eating, and sooner or later the stock market – will once again – sell on the future flow of dividends.

On 23 Mar 20 the FED managed to engineer a revival of the credit market and ultimately a spectacular rebound in stocks. But if we go before COVID you would notice we have already lost considerable power on the economy. We had fewer people working and we had a reduced stream of goods and services.

This is a monetary game, and you can keep these little monetary bubbles going for just so long, as long as you keep confidence rising. And when confidence reach extraordinarily high levels – the history books are clear – it’s very difficult to increase the confidence further.

2. Investing in 0-rate world

Although there are many arguments why the current valuation might be even low, e.g. discounting future cash flow at a lower rate – I don’t find them appealing enough.

Seen 30 years bonds yield dropping down from 16% to about 2%. In about 2000/2001 those were about 4.1/4.2% and we thought this will be the lowest forever and now it is even lower, and negative all over the world. We have got an artificial interest rate structure, driven down into negative territory, e.g. 20% of government bonds have a negative real return. In other words, you pay to lend them your money, not the other way around.

The same happened with cash – it is deeply negative. Many people literally pay the banks to deposit money, instead of earning anything out of that deposit.

Selling everything in the high will work just fine, however there are major discrepancies as there were in 2000, between US tech, which is overpriced. So, the value of the low-growth stocks is about as cheap relative to the high-growth stocks. All of them are at risk at some degree.

The good news is that oversee they don’t have the same bull market and the same overpricing as we in the US. You can go to the emerging markets – they are not that expensive, compared to S&P they are as cheap as ever could be.

As you won’t be able to make a decent return 10-20 years on US growth stocks (they are heavily overpriced now).

The higher you bid up the price of an asset, the lower the long-term return you will get. There is nothing you can do to change the equation. Every day the market goes higher, you know one thing for sure – that the long-term return will be less than it was the day before.

Growth stocks have outperformed (over the course of the bull market) value stocks by almost 400 basis points. What if, after the bubble pops growth, growth is still ahead and there is no redemption for the value investor? It will be historically unprecedented for that to happen.

“I have no confidence and have not had any for over 20 years in price-to-book and P/E and price-to-cash flow, price-to-sales, even, as a measure of true value. A measure of true value is the long-term discounted value of a future stream of dividends.”

A growth-stock is of course worth a higher ratio than the low-growth stock, but that doesn’t mean they can’t be overpriced. And value should be cheap for what you are. You should build-in the growth, build-in the quality.

I am also worried about an inflation. We don’t live in a world where output doesn’t matter, and we can just print paper forever. Sooner or later, this will bring huge inflation, that we haven’t seen in 20 years. Everywhere across the globe the price of critical food and metals is going up. Together with the rapidly declining growth rate in the workforce, towards zero and negative.

So, this is a bad time to be caught over speculating.

It is very difficult to allocate in a world of zero rates, stimulus, declining productivity, potential for inflation. Secondly, of course, diversifying – it’s always a huge advantage, and third – the low-growth stocks in the emerging market world are perfectly reasonable if you need to own stocks, and most people do, that would be the way to go.

It will take trillions of dollars to decarbonize the global system – all those companies, doing that, will raise and grow significantly. Those will dominate everyone’s portfolio. Find a good climate change fund and invest into it.

If you think about investing into Bitcoin or any other cryptocurrency – ask yourself – what is the future value of the dividend stream of it? It is nil, it will never pay you a dividend. If you are desperate, can you eat it? Its entire value is on the greater fool. Bitcoin could be worth a million dollars a unit if you find someone to pay it.

And we could think in a similar way about Gold. The difference is that Gold has had a 12,000-year test, and it passed it very well. And Gold also has some other fallback qualities – it doesn’t tarnish, it’s unique, everything ever made of gold is still around and will be around for a very long time. On top of that Gold is heavily used in manufacturing and production of expensive goods and materials. Bitcoin lacks all those.

Bitcoin is 100% faith. Come the next market phase where faith is at a minimum, what do we think will happen to something whose entire reason for existing is faith and nothing but faith?

3. What US government is doing for the economy

Ironically, I believe that Alan Greenspan is responsible for the current situation we are. The FED policy of acting and talking along the lines of moral hazard played a tremendous role.

Alan bragged that he contributed to the strength of the economy through the wealth effect. And there is such effect indeed. If you have the market doubled – 3 or 4% of that gets spent and helps the economy. But the cost of this is tremendous – we live in a real world of people and production and overinflating the value of something does not justify the little growth.

In the end it will all get to a negative wealth effect when the market regulates itself.

Another example are SPACs. Those should be a completely illegitimate instrument. They are just an excuse for people with reputation and marginal ethics to raise a lot of money and take 20% of it for themselves, and a complete rip-off in the sense that the professional hedge funds always liquidate before taking any real risk. And of course, SPACs will make money in the late stages of the bubble, but if you look at the first six years, they had a sub-average return for taking all the risk.

SPACs don’t have enough legal requirements, enough restraints, enough checking. They’re a thoroughly reprehensible instrument and should be disallowed.

The IPO should also be reformed. IPO is a license to reward the fidelities of the world at open. Direct listing made a little easier would be the way to go, but SPACs are terrible.

If you are looking for the very early warning signs of a bubble breaking you find the stocks that have done the best, some particular SPACs, and Tesla, and Bitcoin – and you see that they start to have these big daily drops, and then they recover, and they drop, and they recover.

And the market in 2000 didn’t go together – they took out pets.coms and shot them, the rest of the market continued to go up. Then they took out the junior growth stocks and shot them and the market kept going up, and then they took medium growth stocks and shot them too, and finally by the summer they were shooting the ciscos and the entire tech part of the market. And that had been 30% at the market peak of the total market cap. And yet the S&P by September was at the co-equal high of March which meant that the other 70% had continued to rise.

So bubbles don’t necessarily break on mass, but having sliced off the tech, and the dot coms, then finally the 70% like a giant iceberg rolled over on mass and went down for two and a half years by 50%.

4. US capitalism crisis

The right way to fix the economic inequality is to stop nurturing the moral hazard, and start leading and managing through a monetary policy as opposed to fiscal policy.

By simply pushing up asset prices, you make it difficult to impossible for people to get into the game. The purchase of a house is too expensive, the purchase of anything in stocks is much higher per unit of dividend.

Secondly, the compounding of wealth is reduced. If you have a 6% yield on your assets, you can reinvest them and you can double your money in 12 years. If you turn it into a 3% yield by doubling the price, you are worth more on paper but in real life you only eat the dividends and now they are 3% a year and you double your money in 24 years. So, in 48 years, you are down to a quarter of what you would have been, and so on.

And the gap becomes ruinously wide. The higher the asset price, the lower the rate at which you can compound wealth. And the rich get richer, as you price down the yield, and the poor get squeezed. You are not creating any real value; you are not creating more production and government spending is quite different.

Instead of writing check to everybody, if we write checks for particular infrastructure – we will be doing necessary investing. If we invest into an efficient grid – everybody benefits. So, the Government should come with a strong public spending program, emphasized at the repairing bridges and roads, and green infrastructure, research, training and retraining of people for green jobs.

A corporation in the mid 60s felt it had responsibilities to its workers, it was on the cusp of starting a nice pension fund, a defined benefit. The corporation felt the duty towards the city and the country. All of that is largely gone, but it didn’t go overnight. The idea that the corporation should only care about maximizing profits is a terrible business formula.

If you say as an individual ‘My only interest is to maximize my advantages,’ which is what they say at the corporate level, you are a sociopath. And we are not, as individuals, like that. A lot of us do the odd altruistic act and those are incredibly important in the long run.

Why Bill Gates sold out his stocks (Mar ’21)

We all know who Bill Gates is. He's one of the richest men in the world with a net worth of around 127 billion dollars. He did this through creating his own company Microsoft, but he also did it through very smart investing.

Lately Gates is making some very interesting investment moves. His recent 13 filings he sold and reduced 11 stock positions and he bought just one.

Let's take a look at some of these:

1. Uber the worldwide ride-hailing company - he sold a hundred percent of his position.

2. Boston properties - he did the same thing he reduced it by a hundred percent, selling 1.1 million shares.

3. Alibaba - one of China's biggest companies here sold in his recent 13th filings a hundred percent of his position.

4. Google or Alphabet (same thing) he reduced by 50%.

5. Amazon - he sold all his shares.

6. Apple – even it was not immune to the wrath of Gates investment decisions – 50% gone.

These are big moves that Gates is making. Normally when an investor sells some of his position, it's normally a couple of percent. If it's 5%, it is usually a big deal.

And Bill Gates, he's selling 100% out of his positions like Uber and Alibaba, and 50% out of big stocks like Amazon, Apple, and Google these are big moves.

Some of his other moves include

7. Liberty group - the communications company, it was reduced by 25%

8. Great Berkshire Hathaway - was reduced by 10.6%

9. Canadian national railway - the only small sale of 0.86%

And if we take a look at all of the stocks that he bought in the first quarter of 2021 it was just one a stock called Schrödinger a healthcare stock.

And what the investors really want to know is why has Gates made such big sales in these massive companies.

One of Gates’s patterns is that with a lot of stocks he sold – he did it when they're very high in price which a lot of investors avoid.

Uber, that's currently selling for 56 dollars a share, market cap is over 100 billion and it's not even generating any profits.

Amazon price wise has gone up more than 400% over the past five years. It's got a p/e of 72. That's considered very high and not good.

Apple is up over 350%, p/e ratio is 33.

Google or Alphabet is up 170% with the same p/e ratio as Apple of 33.

These stocks that Bill Gates is rushing out of, you'd have to say, he thinks they're overvalued. It's not like he's selling them because he's desperate for cash, his net worth is over $127 billion dollars.

Most probably Gates is worried about a market crash.

if you look at a lot of stocks in the market their prices are up to crazy levels, and we’re sure Bill

Gates and his investment manager Michael Larsen have been closely looking at this market.

As per the latest report they have decided to dramatically trim or exit some of their positions.

We've seen a lot of crazy behavior in the market, people just seem to have so much spare money on them and what do they do with it - they put it into stocks

Bill gates is not a fan of this uneducated investing style he linked it to a casino. He said ‘we don't think of the stock market as just performing a casino-like role, we have restrictions on gambling activities’

The current situation reminds us of the 1930s, to some degree so with all this crazy behavior that was seen in the market, Gate says it reminds him of the 1930s, something which Ray Dalio has also pointed out before

What happened back then was you had the roaring twenties, when everyone was putting their leftover cash into the market, because they thought it could only go one way and that's up but then in the late 20s and 30s, we saw one of the biggest market crashes that the world has ever seen.

That’s a big reason why Gates has decided to trim his positions.

So, look at the only position that Gates is buying - Schrödinger the drug discovery and material science company.

Schrödinger - they use computer simulation to design different medicines and drugs to help cure diseases. They also use computer stimulation to design different types of materials too.

And Bill Gates is someone who is well educated in healthcare and he’s invested in a relatively small company, five billion dollars in market cap.

They sell for 76 dollars a share, and revenue wise they're doing pretty good as well. Their revenue has been growing steadily over the past couple of years, as they look to discover new drugs.

Schrödinger earnings are decreasing and that's just because they are reinvesting every single dollar.

Back in 2018 Bill Gates was asked if in the near future there will be another financial crisis, similar to the 2008? And Gate said “yes, it is hard to say when, but this is a certainty.”

With the amount of stocks that he has sold recently there is a lot of people questioning if that when is 2021?

Let's look at some statistics of the overall market in 2021.

1. The market cap to GDP ratio. Warren Buffett said on it that it's probably the best single measure of where valuation stand at.

And it is very high right now, it's eighty percent higher than the zero percent equal fair value market range, and it's miles above what it was in the 2008 financial crisis

It's even higher than what it was in the 2000 internet bubble.

And we all know what happened to stocks after that. This indicator says prices are high and is very worrying sign.

2. Looking at the market p/e ratio it tells a similar story. It's currently sitting at the 40 mark now. This is near the 2000 technology bubble but not quite as high as what things were in the 2008 housing bubble.

Nevertheless, a market p/e ratio of 40 is high if you consider the average that it has been throughout history - that's 15. So, it's more than double that, and therefore Bill Gates portfolio right now is conservative.

His top 10 stocks that makes up 95 percent of his overall portfolio are value-oriented safe place

His number one position even though he sold some is still Berkshire Hathaway.

Next it goes Waste management, Caterpillar (conservative), Canadian national railway (conservative), Walmart, Ecolab, Crown castle, Fedex, UPS - all conservative.

And the last one is Schrödinger. Apart from Schrödinger which is his 10th largest position that is a very safe portfolio.

When looking at Bill Gates’s stock positions - he's got a very guarded and cautious portfolio for the current market conditions and we should keep a close eye on the upcoming future as it might not be so bright for the stock market.

Should I invest in Bitcoin in 2021

Hello dear money-loving friends. And today we will be sharing another dose of wisdom related to Bitcoin and the Bitcoin market. Our guest star today is Ben Armstrong, also known as BitBoy crypto. Ben is an expert in crypto currency and started investing in Bitcoin in 2012. Today he is teaching crypto currency enthusiast in the crypto secrets over his portal and YouTube channel.

So, without further ado here is what he will share with us:

Whether you are brand new to Bitcoin or you've been here for a while, this article is for you, especially if you are interested in investing in Bitcoin in 2021 and beyond.

Keep in mind there's no simple guidebook that guarantees 100% successful investment into Bitcoin, nevertheless we will try our best to explain the fundaments and the tricks.

You are most likely reading this because you want to make money in cryptocurrency. And the safest and most surefire bet to do that with is the oldest crypto, Bitcoin.

It still stands true despite the fact there's a lot of noise about other cryptocurrencies.

Let me start by answering the question – where can you buy bitcoin? For people wanting to get started in Bitcoin, the easiest two places to do that are with Binance.US and Coinbase.

And now let’s cover the basics.

1. What is Bitcoin?

Before we talk about investing in Bitcoin, we have to understand what Bitcoin is.

You will hear almost everyone to say that Bitcoin is a digital currency. That's the standard company line. And that’s what the idea was in the beginning.

But, It isn’t a currency. Same way gold isn't a currency.

Now, you could go into a car dealership with a few gold bars and maybe trade it for a ride, but it isn’t going to be the dealership's first choice.

They want currency, not an asset. Bitcoin is a digital asset. Think of it like a stock, a bond, gold, oil shares, etc.

But it's a special kind of asset, called a store of value.

You can take money, put it into Bitcoin and hypothetically, it should maintain a level of value.

The volatility of Bitcoin, which we'll talk about later, can make this a tricky proposition because I'm sure as you've heard, the price goes way up and way down.

You don't see these types of swings with most store of value assets.

It wasn't always this way with Bitcoin though. It was spurred out of the 2008 financial crisis.

An anonymous person dubbed Satoshi Nakamoto penned what we now know as the Bitcoin whitepaper.

The guy wrote a paper describing a new currency he wanted to create. The title was "Bitcoin: A Peer-to-Peer Electronic Cash System".

The original intention of Bitcoin was for it to be a currency we could all send directly to each other without the need of a third party like a bank or a credit card processor.

It was time to do something different than "the way it was always done before". This would be a decentralized currency ran on something called blockchain technology.

No one party or entity could have access to make changes to the network, meaning it would be extremely secure and private.

But over time, Bitcoin has morphed into something else.

While it's still decentralized, it's no longer private. Companies like Chainalysis have discovered

ways of tracking transactions.

And the dream of being electronic cash is over, in my opinion. Why?

Because people realize today that Bitcoin works best when they hold it, not spend it. And that volatility is not likely to change anytime soon.

Bitcoin has become the modern version of gold. Digital gold, as we call it.

But unlike gold, there's a known finite supply. Part of the secret recipe for Bitcoin's success has been the fact there are only 18.6 million of them in circulation, and there will ever only be 21 million coins.

And they won't all make it into the circulating supply until 2140, 120 years from now.

Of course, new coins come into the supply through what we call Bitcoin mining.

It's basically specially designed computers solving hard math problems, in order to earn fractions of a Bitcoin.

With gold, while, of course, literally there is a finite supply in the universe, we have no idea what that is.

There could be thousands of tons of gold under the sea floor, and we know that there are millions, if not billions, of tons of gold floating around in our own solar system, much less the universe.

Space mining is coming eventually. But with Bitcoin, not only we do know the supply, we also know the schedule at which it comes into the supply.

The fact is we've never seen an asset in the history of mankind that was specially designed to be the optimum form of money on the planet.

And while the value proposition of Bitcoin has changed from money to a store of value, the same thing rings true.

This is the greatest asset we've ever seen in the history of the world.

2. The question is: did you miss the boat on Bitcoin?

That’s a very tough question and can both be answered with yes and no.

Let's get one thing out of the way here. Bitcoin is the greatest appreciating asset in history. It's made over 100,000% gains since 2011.

The actual overall gains can't even really be calculated. I mean, at one time, you get four Bitcoin for a penny.

Hard to even process that. Bitcoin basically broke the investment paradigm. In the last three years alone, it's up 421%.

So, while the opportunity at the absolute largest gains in world history may be over, Bitcoin still offers you better investment opportunities than anything on the stocks or bonds market.

But think about this. By the end of Feb ‘21, literally any person ever who's invested in Bitcoin is in profit.

And yes, the price is pretty high at over $50,000 right now, but for most of us in crypto full time, we believe the price is going to be a minimum six figures by the end of this year.

I believe, it will be closer to $300,000. But, of course, that's not financial advice.

Still a long way to go from that. One thing though you have to understand about Bitcoin is that it goes in cycles.

So, even if you buy it now and it goes down, as long as you don't sell at a loss, history has shown that it will continue climbing much higher.

Honestly, I'm starting to believe that if companies, governments, and investment funds continue adopting Bitcoin that in 10 to 20 years, we could be looking at a $10 million-Bitcoin.

Having the opportunity to own one Bitcoin can bring generation-changing wealth in the future.

Only the truly elite will own one full Bitcoin. You may have heard of other cryptocurrencies, such as Ethereum, Chainlink, Cardano, XRP, Bitcoin Cash or others.

These are what we call altcoins, or any coin other than Bitcoin. To be totally honest with you, my personal portfolio is loaded down with altcoins, and I advocate a lot for them.

Altcoins offer much more reward than Bitcoin, but they also boast much more risk than Bitcoin.

And this is where the volatility of Bitcoin really shines. You see, we like volatility in crypto. It's what gives us life-changing money.

But some people simply cannot handle that risk. Bitcoin plays out pretty much the same way every four years though.

It's based on something we call:

3. Bitcoin halving

This is where the amount of Bitcoin produced through mining gets cut in half.

In the beginning, there were 50 Bitcoin produced per block mined.

In 2012, it cut down to 25 BTC. Then in 2016, to 12.5 BTC. Then last year, on May 11, 2020, the Bitcoin halving dropped the amount to 6.25 BTC per block.

That equals about 900 Bitcoin per day currently produced.

In 2024, that will be cut to about 450 Bitcoin per day.

By the last Bitcoin cycle in 2136 to 2140, there will only be one-half of one Bitcoin produced total!

So, the supply and demand principles of the Bitcoin halving scheduled every 200,000 blocks means the value proposition of Bitcoin should continue to increase following those halving events.

The only thing is about a year and a half after the halving when Bitcoin investing is at its peak, the supply shock of the halving wears off, and the price starts dropping.

The retail frenzy ends. People start selling off their Bitcoin, plummeting the price.

These are the types of things you need to know as an investor. Bitcoin drops an average of 85-87% every bear market.

Every four years. The current Bitcoin bull run according to the historical Bitcoin cycles should end around September or October of 2021.

So, you need to be prepared. You can do as the kids say and HODL through the bear market, which lasts about two years, or sell at the top, like the smart kids, and wait for prices to drop to buy more for the next Bitcoin bull run in 2024.

But this cycle could be different because of companies like MicroStrategy, Tesla and PayPal.

These companies have bought tons of Bitcoin and will not sell it in the bear market.

So, we could see a less volatile drop, maybe 60% instead of 87%.

But other cryptocurrencies, the altcoins, don't have that same level of corporate and institutional buying happening.

Ethereum, the No. 2 overall cryptocurrency, certainly does have some level of institutional buying, but virtually none of the coins below it do.

On average, altcoins drop 95% in a bear market. Sometimes 99%.

The point is while the rewards of being early on some other coins are very high, the risk of losing almost everything is guaranteed unless you sell at the right time.

The volatility to the downside is really what separates Bitcoin from other cryptocurrencies and makes it the "safest" bet.

4. If you still would like to get into Bitcoin and/or crypto, here is how to do it

There are basically three ways.

Number one and the best way is to buy Bitcoin directly on a site or exchange where you have the opportunity to own your own asset, not let it sit in the hands of others.

The two places I have already suggested buying Bitcoin from directly for United States citizens are Binance US and Coinbase.

If you buy your Bitcoin directly with your debit card, credit card or bank account, you also have the option to withdraw it to what we call a Bitcoin wallet.

This could be a hot wallet, which is an online web-based wallet, or a cold storage wallet.

These are mostly USB hardware devices, but there are a few other types like paper wallets. Owning your own Bitcoin is important.

A second way to invest in Bitcoin is through third party apps and sites like Robinhood and PayPal.

By investing in Bitcoin and through these places, you're basically investing in a derivative version of Bitcoin.

You own them on paper, but you cannot withdraw these assets.

You make money on the gains or lose money on the downward moves of Bitcoin, but you cannot ever move your Bitcoin somewhere else.

This is probably the worst way to invest in Bitcoin because you have zero ownership.

And a third way to invest in Bitcoin is through the Grayscale Bitcoin Trust on the stock market. The ticker is GBTC.

Each share of the stock is backed by actual Bitcoin that Grayscale owns.

This means that Grayscale actually owns the Bitcoin behind their shares.

Investing in the Bitcoin stock is a great way for traditional investors to get into Bitcoin and crypto.

From the crypto enthusiast's perspective, these types of investment vehicles are bridges to get investors to a place where they understand the potential of crypto.

This leads them to study more of it, and many end up realizing the importance of owning their own Bitcoin.

5. The most important aspect in Bitcoin investment

Remember the Bitcoin cycles. This bull run will come to an end.

And when it does, you have to be prepared to move out of the markets and invest into what we call stablecoins.

These are coins where the price is stable no matter what the direction of the overall crypto market is.

Another option is you can move into other assets like cash, gold or stocks while the Bitcoin market drops and consolidates.

This will allow you to pick new entry points and you could go from owning one Bitcoin to possibly owning 5 to 10 Bitcoin if you time it right.

When the next bull run comes around in 2024, you could be poised to change your financial future, for you and your family.

Best investments in 2021 and beyond

Hello our money-making, and money-loving friends. Today we will be staring a young bright start who teaches Personal Finance, Productivity and Minimalism. He is also an investor himself and always giving great investment advice.

He is Nate O’Brien, and here is what he says about himself:

For as long as I can remember, I’ve had a passion for personal finance, productivity, and personal development. In 2017, I started one of my first YouTube channels from my college dorm room at Penn State University. The goal was to teach as many people as possible about the inner workings of personal finance while keeping the content 100% free.

Nowadays his channel subscribers are over 1 million and he is producing invaluable content. And here are Nate’s advice for best investments in 2021 and beyond.

(Disclaimer: all the advice are just opinion and are not meant to be taken as a professional advice. Be careful, you may lose money when investing!)

Nate O’Brien:

Hi everyone! Today, I'm going to share five investments that I'm holding for life and maybe you want to consider as well. A quick disclaimer: I’m just a random guy on the Internet so just use the info for entertainment purpose.

Let's start with some of the things that we take into consideration here when I think about investments that I might want to hold for 20 or 30 or 40 years. One of them is the potential longevity of certain industries or companies. What you're going to find is that these five different types of investments it's probably going to be comprised mostly of different types of funds like exchange traded funds or mutual funds. It's not so much speculative penny stocks or companies that I think are going to go to the moon tomorrow or something, it's more about companies that I see a lot of long-term growth potential with.

I. Investing in healthcare

The first one that I've invested into, that I'm probably going hold for a long time is the Vanguard healthcare ETF (VHT) and there's a couple of reasons why I like investing into the healthcare industry. Some of these are obvious, like the fact that healthcare is always going to be something important to most people but also - thinking about different types of industries - the healthcare industry has the best chance of surviving for a long time. In terms of priorities for most of the people healthcare is certainly up there. I like investing into healthcare companies more than energy companies because I feel like there's less of the possibility of becoming totally decentralized in health care industry.

As a contrasting example, if I'm investing into an energy industry ETF or an energy fund that owns a lot of different types of energy stocks, I don't really know where this is going in the future. I don't know how oil and gas companies are going to be looking in 20 or 30 years, but also it could be something that I could see being totally decentralized, where people just have their own solar panels, and there's no massive energy companies that are sort of making money of it.

That’s why I think that the healthcare industry has a lot of growth potential for it but also when we consider the aging population not just of America, but in most of the world - most of the world is getting older – and those are all healthcare consumers.

Also, if we look at one of the largest demographics it's baby boomers in America. Turns out baby boomers have some money and when they get older, they also have a lot of money they're going to be spending on health care. They're going to be opening their wallets and making sure that they are in good health which is going to cost money whether it's physical therapy or different types of medicine. There's a lot of money in health care overall and I can see that trend continuing in the future.

Another reason why I like the healthcare industry and invested in something like this Vanguard healthcare ETF is because it does offer a decent amount of stability. Looking over the last year

And thinking about what happened with the recession and the economy, healthcare was still very prioritized on our list among everything else.

Some of the companies within the Vanguard healthcare fund are

Johnson & Johnson, Pfizer, and Merck. Companies who made vaccines for COVID-19 but also several different biotech companies. We have over 400 companies that are within this ETF. An ETF is an exchange traded fund, it's basically just a big basket of stocks.

Let’s look at different criteria within this healthcare ETF, one of them being that the expense ratio is 0.1% so it's one tenth of one percent. This is what I would consider to be a very low expense ratio. You always want to take these into consideration when you are looking at different types of funds or investments that you are getting into. With the one tenth of a percent expense ratio – it means that if you had one thousand dollars in this fund over the course of a year you would probably be paying about one dollar to Vanguard as their fee to manage the fund for you.

Also looking at overall performance over the past 10 years or so and we can see that it's done well since 2004. Just remember that past performance does not mean future performance just make sure you don't see something and think it went up 20 so it's going to go up 20 next year too. That's not how the stock market works, but overall, I think the Vanguard healthcare ETF has lot of stability.

II. Real estate investment

The second one that I wanted to discuss is investing into real estate. Look, I don't really want to be a landlord, I figured this out for myself. I don't want to be somebody who owns properties, I don't want to have to deal with tenants, but also, I don't want to have to deal with property managers if I buy a property and then somebody else is running it and taking care of it. There are still things that come up that I have to deal with, so I though how to get into real estate without actually having to own a physical property and this is when I looked into something like the Vanguard real estate ETF (VNQ).

Real estate is very much a tangible asset. And something I really worry about a lot in the economy, especially in today's world is inflation. There is always a possibility to have hyperinflation. Think about the fact that more than 22 percent of US dollars were printed in 2020. What's happening right now in the economy is the government is saying ‘hey let's make more stimulus packages it's going to get us more approval’ right it doesn't matter

The problem is that those money are just pulled out of thin air. There is no balance of the budget, e.g. ‘to get the 1.9 trillion dollars, maybe we should cut defense spending or cut different types of spending’. The government is just making more money out of thin air and

If you are holding cash in US dollar in 10 years that's going to be worth a hell of a lot less.

That’s why I love investing in real estate or have some exposure to real estate. Real estate will

probably keep up with inflation (that’s not certain fact), historically it had, because we're not making any more land and there's a lot more people coming onto this Earth every day.

There are a couple of different ways you can invest in real estate. For me, as I mentioned, I just like to go for the Vanguard real estate ETF, but maybe you want to buy physical properties yourself and be a landlord. I have lots of friends who do that, and it is especially good if you have some time on your hands too, and maybe you have a job but you're looking for something extra to do on the side.

You could also get into specific REITs, and REITs are Real estate investment trusts, and you could get into specific REITs that focus more so on specific areas. You might want to buy a REIT for a company that is specifically focused on maybe apartments in Texas or apartments in California or New York apartments. You can invest into those specific companies as well if you think those are going to boom or do well long term.

One thing that I will caution you on is about the future with office buildings and even with retail. I try to focus on some type of residential real estate, people always need a roof over their head, they always need a place to sleep and so. For me that provides some level of stability

The Vanguard real estate ETF hold several different types of real estate, so they own residential they have a lot of different other properties too, and the expense ratio on is 0.1% – 0.2% so also what I would consider to be a very low expense ratio. The fees on it are low and as usual you can buy this on Robinhood or anywhere else.

III. Invest in the most successful US companies

The next I would like to share with you, and it is a great way to get a lot of exposure to the thousand largest companies in America that are publicly traded is the Schwab 1000 fund (SNXFX). It is probably my favorite one and I think this is probably the largest one that I own. It contains the 1000 largest US companies, and you can check that it covers approximately 90% or more of the total US stock market cap so I feel safe being in something like this. Sure, there are times when this fund goes down, if you look at it back in March ’20, it went down just like the rest of the stock market did. It is something that of course I'm holding for a very long period.

Let's just check their top 10 holdings within this fund. It's Apple, Microsoft, Amazon, Facebook, Tesla, Alphabet (which is essentially Google and all their holdings), Berkshire Hathaway, Johnson & Johnson, and then J.P. Morgan Chase so they do own, or more precisely they are kind of having hands in a lot of different types of companies throughout America, and this gives us an overall just kind of broad way to invest into American companies.

IV. Invest in markets outside of US

But let's say that maybe you don't have too much of a bullish feeling about American companies, and maybe you think that America is on the downfall, and there's not a lot of growth left in America, or maybe you don't want to be so exposed to American companies.

So lately I've been shifting outside of American investments and looking for some ones in emerging markets in different parts of the world and that's why the one that I'm going to share with you is what is known as the Vanguard emerging market ETF (VWO). It is going to hold a lot of companies from different areas in the world like China, Brazil, Taiwan, and South Africa. So, a ton of different areas. This is what would be known as an international or global ETF and the expense ratio on it is also 0.1%. Again, very low, that’s what I like about Vanguard funds as you probably already noticed.

Let's check some of the different holdings that this ETF owns. You might notice some of these companies and you might recognize them especially looking at their top 10 holdings here like Alibaba, and maybe you recognize jd.com or Neo which is the popular stock that a lot of people have been investing into so just looking at these you can see probably a good amount of these are based in China, but there are ones from other countries here as well.

The fund is comprised of 5048 different companies, it's one of the largest most diversified ETFs that I've seen out there. Most other ETFs that I'm investing into might have 400 or 500 companies, but this one has over 5 000 which is a lot. And it is both good and bad. The good thing about a fund that holds 5 000 different companies is that maybe there's some companies within there that can really boom and really take off and be the next Amazon, and the bad is there's also going to be kind of not-so-good companies in there as well.

It gives us a lot of exposure, and it gives us some level of stability. Historically thougt these

emerging markets haven’t been performing as well as some different US ETFs that I've checked in the past 10 or 15 years. Nonetheless I still think that there's a lot of room for growth for the next couple of decades, especially in areas where maybe their GDP per capita is still 1/3 of America’s and they still have a lot of room to run to catch up to the GDP per capita in some of those countries. So maybe their growth rate will be a lot faster. Look at a place like india for example, where their growth rate seems to be a lot faster with their GDP growth.

V. Investing in bonds

And the last one I want to mention here it's going to be brief because it's not my favorite but maybe for people who want to be a lot more risk-averse and they're worried about maybe valuations of certain companies we have something like the Vanguard total bond market ETF (BND).

As you can see, I'm kind of a fan of Vanguard funds, I don't buy them through Vanguard though. And this one isn't my favorite, but I still wanted to include it on this list because like I mentioned not everybody wants to be exposed so much to stocks and maybe they want something that's seen as traditionally safer than the stock market. And those are bonds.

Bonds have not been a favorite for most investors in the past couple of years and this is because yields on these bonds have been low, sometimes these yields can be below 1% so it's not that attractive, especially when I factor in the fact that they also have the risk of defaulting on those loans.

Is it even worth that 1% when you average it out, especially when you get some of these different bond market ETFs fail and they can't pay, then you end up losing money? You won’t get your money back. For example, that’s what happened with Puerto Rico back years ago, when they defaulted on a lot of loans.

Don't just think that bonds are totally safe and are like deposits. It's one of the biggest misconceptions.

People mostly believe that bonds are guaranteed money, that it's safer than stocks. And it's not always safer and it depends on who's issuing the bond. If it’s apple or a highly reputable company that’s a good indicator but it also could be a company that's a small cap company with bad reputation. Those are risky because if they're issuing a bond the yield usually would be higher, but also riskier.

The Vanguard total bond market ETF is comprised mostly actually of government bonds, so this is probably just what I would mention is like a kind of a safe bet if you want to just park some money in there but you're not going to really see a lot of growth there.

it's kind of almost fixed like you're getting 2% percent yield, and in the worst-case scenario you may end up losing a lot of that money so I included it only for people who might really want to play it safe with minimum return on investment.

Well, thanks for reading all those thoughts and advice, I appreciate your time and if you found any value make sure you share the article and drop a comment below.

The Stock Market is a bubble - and it will burst

We are currently in a pandemic situation. The economy is struggling, unemployment is rising, and there is a lot of uncertainty. On top of that the S&P 500 recovered so quickly from the mini-crash in Mar 2020, and it looks like it have entered a bubble.

Let’s quickly explain the nature of the stock market. There are consistent patterns that emerge in every bubble in history and these consistent patterns are emerging again right now. Unfortunately – every time the investors believe in “but now it’s different” mantra, repeating the same mistakes again and again.

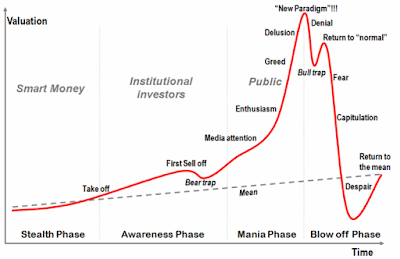

Above you see a chart representing the life-cycle of the stock market. This chart shows the stages of every bubble in history. It starts with the early stealth phase. Next comes the awareness phase as the investments begin to attract attention. Followed by the mania phase – where the bubble grows extensively. Finally the blow-off phase or the so-called crash.

The chart shows perfectly well - how every single bubble in history has grown and burst.

Above is an example of the dot-com bubble. Notice how the charts are pretty much identical. Did people learn from previous bubbles? Well, not so much it seems, at least not enough to avoid it playing out the stock market in the same way again and again.

Above is another example. We have the notorious Bitcoin bubble. This time it's overlaid on the stages of our bubble charts and we can see how closely it does follow it. It is clearly the same pattern so whether it was the "dot-com bubble" or the "Bitcoin bubble" the truth is the majority of the investors never learn and the same patterns are repeated over and over.

Every now and then new technology is invented, it changes the world and the majority of investors think “this time is different”. It’s also important to note that the burst of the bubbles are not always the end. For example the Bitcoin is obviously very contentious as it has shown tremendous staying power since the bubble burst, and maybe hasn't had as much time as the others to prove its worth.