Hello dear money-loving friends. And today we will be sharing another dose of wisdom related to Bitcoin and the Bitcoin market. Our guest star today is Ben Armstrong, also known as BitBoy crypto. Ben is an expert in crypto currency and started investing in Bitcoin in 2012. Today he is teaching crypto currency enthusiast in the crypto secrets over his portal and YouTube channel.

So, without further ado here is what he will share with us:

Whether you are brand new to Bitcoin or you've been here for a while, this article is for you, especially if you are interested in investing in Bitcoin in 2021 and beyond.

Keep in mind there's no simple guidebook that guarantees 100% successful investment into Bitcoin, nevertheless we will try our best to explain the fundaments and the tricks.

You are most likely reading this because you want to make money in cryptocurrency. And the safest and most surefire bet to do that with is the oldest crypto, Bitcoin.

It still stands true despite the fact there's a lot of noise about other cryptocurrencies.

Let me start by answering the question – where can you buy bitcoin? For people wanting to get started in Bitcoin, the easiest two places to do that are with Binance.US and Coinbase.

And now let’s cover the basics.

1. What is Bitcoin?

Before we talk about investing in Bitcoin, we have to understand what Bitcoin is.

You will hear almost everyone to say that Bitcoin is a digital currency. That's the standard company line. And that’s what the idea was in the beginning.

But, It isn’t a currency. Same way gold isn't a currency.

Now, you could go into a car dealership with a few gold bars and maybe trade it for a ride, but it isn’t going to be the dealership's first choice.

They want currency, not an asset. Bitcoin is a digital asset. Think of it like a stock, a bond, gold, oil shares, etc.

But it's a special kind of asset, called a store of value.

You can take money, put it into Bitcoin and hypothetically, it should maintain a level of value.

The volatility of Bitcoin, which we'll talk about later, can make this a tricky proposition because I'm sure as you've heard, the price goes way up and way down.

You don't see these types of swings with most store of value assets.

It wasn't always this way with Bitcoin though. It was spurred out of the 2008 financial crisis.

An anonymous person dubbed Satoshi Nakamoto penned what we now know as the Bitcoin whitepaper.

The guy wrote a paper describing a new currency he wanted to create. The title was "Bitcoin: A Peer-to-Peer Electronic Cash System".

The original intention of Bitcoin was for it to be a currency we could all send directly to each other without the need of a third party like a bank or a credit card processor.

It was time to do something different than "the way it was always done before". This would be a decentralized currency ran on something called blockchain technology.

No one party or entity could have access to make changes to the network, meaning it would be extremely secure and private.

But over time, Bitcoin has morphed into something else.

While it's still decentralized, it's no longer private. Companies like Chainalysis have discovered

ways of tracking transactions.

And the dream of being electronic cash is over, in my opinion. Why?

Because people realize today that Bitcoin works best when they hold it, not spend it. And that volatility is not likely to change anytime soon.

Bitcoin has become the modern version of gold. Digital gold, as we call it.

But unlike gold, there's a known finite supply. Part of the secret recipe for Bitcoin's success has been the fact there are only 18.6 million of them in circulation, and there will ever only be 21 million coins.

And they won't all make it into the circulating supply until 2140, 120 years from now.

Of course, new coins come into the supply through what we call Bitcoin mining.

It's basically specially designed computers solving hard math problems, in order to earn fractions of a Bitcoin.

With gold, while, of course, literally there is a finite supply in the universe, we have no idea what that is.

There could be thousands of tons of gold under the sea floor, and we know that there are millions, if not billions, of tons of gold floating around in our own solar system, much less the universe.

Space mining is coming eventually. But with Bitcoin, not only we do know the supply, we also know the schedule at which it comes into the supply.

The fact is we've never seen an asset in the history of mankind that was specially designed to be the optimum form of money on the planet.

And while the value proposition of Bitcoin has changed from money to a store of value, the same thing rings true.

This is the greatest asset we've ever seen in the history of the world.

2. The question is: did you miss the boat on Bitcoin?

That’s a very tough question and can both be answered with yes and no.

Let's get one thing out of the way here. Bitcoin is the greatest appreciating asset in history. It's made over 100,000% gains since 2011.

The actual overall gains can't even really be calculated. I mean, at one time, you get four Bitcoin for a penny.

Hard to even process that. Bitcoin basically broke the investment paradigm. In the last three years alone, it's up 421%.

So, while the opportunity at the absolute largest gains in world history may be over, Bitcoin still offers you better investment opportunities than anything on the stocks or bonds market.

But think about this. By the end of Feb ‘21, literally any person ever who's invested in Bitcoin is in profit.

And yes, the price is pretty high at over $50,000 right now, but for most of us in crypto full time, we believe the price is going to be a minimum six figures by the end of this year.

I believe, it will be closer to $300,000. But, of course, that's not financial advice.

Still a long way to go from that. One thing though you have to understand about Bitcoin is that it goes in cycles.

So, even if you buy it now and it goes down, as long as you don't sell at a loss, history has shown that it will continue climbing much higher.

Honestly, I'm starting to believe that if companies, governments, and investment funds continue adopting Bitcoin that in 10 to 20 years, we could be looking at a $10 million-Bitcoin.

Having the opportunity to own one Bitcoin can bring generation-changing wealth in the future.

Only the truly elite will own one full Bitcoin. You may have heard of other cryptocurrencies, such as Ethereum, Chainlink, Cardano, XRP, Bitcoin Cash or others.

These are what we call altcoins, or any coin other than Bitcoin. To be totally honest with you, my personal portfolio is loaded down with altcoins, and I advocate a lot for them.

Altcoins offer much more reward than Bitcoin, but they also boast much more risk than Bitcoin.

And this is where the volatility of Bitcoin really shines. You see, we like volatility in crypto. It's what gives us life-changing money.

But some people simply cannot handle that risk. Bitcoin plays out pretty much the same way every four years though.

It's based on something we call:

3. Bitcoin halving

This is where the amount of Bitcoin produced through mining gets cut in half.

In the beginning, there were 50 Bitcoin produced per block mined.

In 2012, it cut down to 25 BTC. Then in 2016, to 12.5 BTC. Then last year, on May 11, 2020, the Bitcoin halving dropped the amount to 6.25 BTC per block.

That equals about 900 Bitcoin per day currently produced.

In 2024, that will be cut to about 450 Bitcoin per day.

By the last Bitcoin cycle in 2136 to 2140, there will only be one-half of one Bitcoin produced total!

So, the supply and demand principles of the Bitcoin halving scheduled every 200,000 blocks means the value proposition of Bitcoin should continue to increase following those halving events.

The only thing is about a year and a half after the halving when Bitcoin investing is at its peak, the supply shock of the halving wears off, and the price starts dropping.

The retail frenzy ends. People start selling off their Bitcoin, plummeting the price.

These are the types of things you need to know as an investor. Bitcoin drops an average of 85-87% every bear market.

Every four years. The current Bitcoin bull run according to the historical Bitcoin cycles should end around September or October of 2021.

So, you need to be prepared. You can do as the kids say and HODL through the bear market, which lasts about two years, or sell at the top, like the smart kids, and wait for prices to drop to buy more for the next Bitcoin bull run in 2024.

But this cycle could be different because of companies like MicroStrategy, Tesla and PayPal.

These companies have bought tons of Bitcoin and will not sell it in the bear market.

So, we could see a less volatile drop, maybe 60% instead of 87%.

But other cryptocurrencies, the altcoins, don't have that same level of corporate and institutional buying happening.

Ethereum, the No. 2 overall cryptocurrency, certainly does have some level of institutional buying, but virtually none of the coins below it do.

On average, altcoins drop 95% in a bear market. Sometimes 99%.

The point is while the rewards of being early on some other coins are very high, the risk of losing almost everything is guaranteed unless you sell at the right time.

The volatility to the downside is really what separates Bitcoin from other cryptocurrencies and makes it the "safest" bet.

4. If you still would like to get into Bitcoin and/or crypto, here is how to do it

There are basically three ways.

Number one and the best way is to buy Bitcoin directly on a site or exchange where you have the opportunity to own your own asset, not let it sit in the hands of others.

The two places I have already suggested buying Bitcoin from directly for United States citizens are Binance US and Coinbase.

If you buy your Bitcoin directly with your debit card, credit card or bank account, you also have the option to withdraw it to what we call a Bitcoin wallet.

This could be a hot wallet, which is an online web-based wallet, or a cold storage wallet.

These are mostly USB hardware devices, but there are a few other types like paper wallets. Owning your own Bitcoin is important.

A second way to invest in Bitcoin is through third party apps and sites like Robinhood and PayPal.

By investing in Bitcoin and through these places, you're basically investing in a derivative version of Bitcoin.

You own them on paper, but you cannot withdraw these assets.

You make money on the gains or lose money on the downward moves of Bitcoin, but you cannot ever move your Bitcoin somewhere else.

This is probably the worst way to invest in Bitcoin because you have zero ownership.

And a third way to invest in Bitcoin is through the Grayscale Bitcoin Trust on the stock market. The ticker is GBTC.

Each share of the stock is backed by actual Bitcoin that Grayscale owns.

This means that Grayscale actually owns the Bitcoin behind their shares.

Investing in the Bitcoin stock is a great way for traditional investors to get into Bitcoin and crypto.

From the crypto enthusiast's perspective, these types of investment vehicles are bridges to get investors to a place where they understand the potential of crypto.

This leads them to study more of it, and many end up realizing the importance of owning their own Bitcoin.

5. The most important aspect in Bitcoin investment

Remember the Bitcoin cycles. This bull run will come to an end.

And when it does, you have to be prepared to move out of the markets and invest into what we call stablecoins.

These are coins where the price is stable no matter what the direction of the overall crypto market is.

Another option is you can move into other assets like cash, gold or stocks while the Bitcoin market drops and consolidates.

This will allow you to pick new entry points and you could go from owning one Bitcoin to possibly owning 5 to 10 Bitcoin if you time it right.

When the next bull run comes around in 2024, you could be poised to change your financial future, for you and your family.

Showing posts with label bitcoin bubble. Show all posts

Showing posts with label bitcoin bubble. Show all posts

Should I invest in Bitcoin in 2021

The Stock Market is a bubble - and it will burst

During the last decade, the investors have come to believe that no matter what - the market only grows, in a long term. Long-term investment in index funds (like S&P 500) has somewhat proven to be the most profitable strategy. But do you know that the nature of the stock market is to grow as a bubble and eventually burst?

We are currently in a pandemic situation. The economy is struggling, unemployment is rising, and there is a lot of uncertainty. On top of that the S&P 500 recovered so quickly from the mini-crash in Mar 2020, and it looks like it have entered a bubble.

Let’s quickly explain the nature of the stock market. There are consistent patterns that emerge in every bubble in history and these consistent patterns are emerging again right now. Unfortunately – every time the investors believe in “but now it’s different” mantra, repeating the same mistakes again and again.

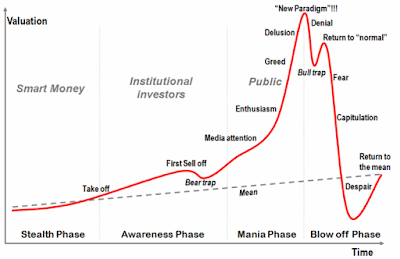

Above you see a chart representing the life-cycle of the stock market. This chart shows the stages of every bubble in history. It starts with the early stealth phase. Next comes the awareness phase as the investments begin to attract attention. Followed by the mania phase – where the bubble grows extensively. Finally the blow-off phase or the so-called crash.

The chart shows perfectly well - how every single bubble in history has grown and burst.

Above is an example of the dot-com bubble. Notice how the charts are pretty much identical. Did people learn from previous bubbles? Well, not so much it seems, at least not enough to avoid it playing out the stock market in the same way again and again.

Above is another example. We have the notorious Bitcoin bubble. This time it's overlaid on the stages of our bubble charts and we can see how closely it does follow it. It is clearly the same pattern so whether it was the "dot-com bubble" or the "Bitcoin bubble" the truth is the majority of the investors never learn and the same patterns are repeated over and over.

Every now and then new technology is invented, it changes the world and the majority of investors think “this time is different”. It’s also important to note that the burst of the bubbles are not always the end. For example the Bitcoin is obviously very contentious as it has shown tremendous staying power since the bubble burst, and maybe hasn't had as much time as the others to prove its worth.

The key point is that many investors fall victim to the same patterns because they think “this time is different”. This mantra have caused every bubble in history to get out of hand, and it is a well-documented pattern with lots of analysis.

Finally, keep in mind that we have clear signs that (in Jun 2020) we are currently in the mania phase of the bubble chart and as the charts show - the crash usually isn't too far behind. So, if you are an investor – be careful and don’t get overexcited.

We are currently in a pandemic situation. The economy is struggling, unemployment is rising, and there is a lot of uncertainty. On top of that the S&P 500 recovered so quickly from the mini-crash in Mar 2020, and it looks like it have entered a bubble.

Let’s quickly explain the nature of the stock market. There are consistent patterns that emerge in every bubble in history and these consistent patterns are emerging again right now. Unfortunately – every time the investors believe in “but now it’s different” mantra, repeating the same mistakes again and again.

Above you see a chart representing the life-cycle of the stock market. This chart shows the stages of every bubble in history. It starts with the early stealth phase. Next comes the awareness phase as the investments begin to attract attention. Followed by the mania phase – where the bubble grows extensively. Finally the blow-off phase or the so-called crash.

The chart shows perfectly well - how every single bubble in history has grown and burst.

Above is an example of the dot-com bubble. Notice how the charts are pretty much identical. Did people learn from previous bubbles? Well, not so much it seems, at least not enough to avoid it playing out the stock market in the same way again and again.

Above is another example. We have the notorious Bitcoin bubble. This time it's overlaid on the stages of our bubble charts and we can see how closely it does follow it. It is clearly the same pattern so whether it was the "dot-com bubble" or the "Bitcoin bubble" the truth is the majority of the investors never learn and the same patterns are repeated over and over.

Every now and then new technology is invented, it changes the world and the majority of investors think “this time is different”. It’s also important to note that the burst of the bubbles are not always the end. For example the Bitcoin is obviously very contentious as it has shown tremendous staying power since the bubble burst, and maybe hasn't had as much time as the others to prove its worth.

The key point is that many investors fall victim to the same patterns because they think “this time is different”. This mantra have caused every bubble in history to get out of hand, and it is a well-documented pattern with lots of analysis.

Finally, keep in mind that we have clear signs that (in Jun 2020) we are currently in the mania phase of the bubble chart and as the charts show - the crash usually isn't too far behind. So, if you are an investor – be careful and don’t get overexcited.

Subscribe to:

Comments

(

Atom

)