As inflation is a very hot topic in the mid of 2021, we've seen the FED saying, ‘this inflation we're seeing now is short term, and there is nothing to worry about’, on the other hand we've seen Warren Buffett talking about how he's seeing big inflation throughout Berkshire Hathaway's businesses. We've also got Michael Burry making a new big-short on bonds.

So how does high inflation affect the investors and what's the best way to deal with a period of high inflation?

All the investors want to do is - commit a certain amount of money to an investment and get more money back at some point in the future. But when we talk about inflation and investing it's more helpful to think of investing like - giving up a certain amount of buying power now, to have more buying power in the future. Like giving up the purchasing power to buy 100 apples now in the hope that we have the purchasing power to buy 150 in the future

While you may make a 20% gain on an investment on paper over a few years if inflation is running rampant, there's a potential that your real return is zero. E.g. you could buy 100 apples before, then you make 20% on your, investment then you sell it, but after that you can still only buy 100 apples now. You've had no gain in purchasing power.

This is what Warren Buffett talked about in 1979. He said that a business with per-share net worth compounded at 20% annually, would have guaranteed its owners a highly successful real investment return, but now such an outcome seems less certain for the inflation rate coupled with individual tax rates will be the ultimate determinant as to whether our internal operating performance produces successful investment results.

It is just as the original 3% savings bond, a 5% passbook savings account, or even an 8% US treasury note have in turn been transformed by inflation into financial instruments that chew up, rather than enhance purchasing power over their investment lives

A business earning 20 on capital can produce a negative real return for its owners under inflationary conditions not much more severe than what presently prevail. And this was in 1979 and the inflation rate was 11%.

Buffett says the combination of the inflation rate plus the percentage of capital that must be paid by the owner to transfer into his own pocket the annual earnings achieved by the business, i.e ordinary income tax on dividends and capital gains tax on retained earnings - can be thought of as an investor's misery index when this exceeds the rate of return earned on equity by the business the investors purchasing power real capital shrinks even though he consumes nothing at all.

Inflation is a crummy time for investors because when you take into account its rate - you can think about the annual percentage loss of purchasing power. If you couple that with either taxes you have to pay on income received through dividends and the capital tax the capital gains tax you have to pay when you sell then your real return on your investment could be negative even if the business is going well.

In 1980 Warren Buffett made the following analogy ‘the average tax paying investor is now running up a down escalator which pace is accelerated to the point where his upward progress is nil.’

And even if you are not an investor inflation can be a crappy time for businesses as well. Inflation eats away at the purchasing power as well and businesses generally need to buy a lot of stuff to keep operating. And if this stuff is now all of a sudden more expensive, they're trapped in a dilemma either they pay the higher price to operate, therefore making less profit or they raise the prices (produce more inflation) and hope that their sales volume doesn't shrink.

Inflation can also put upward pressure on interest rates which can make it harder for companies to access loans or make pre-existing loans more expensive to pay off, and this makes it much harder for the investor to pick great stocks that are going to compound money over time.

Warren Buffett explains what type of businesses tend to do well even in periods of high inflation. Such favored business must have two characteristics:

1. An ability to increase prices rather easily even when product demand is flat and capacity is not fully utilized, without fear of significant loss of either market share or unit volume

2. An ability to accommodate large dollar volume increases in business often produced more by inflation than real growth with only minor additional investment of capital

So, on the first one - an ability to increase prices and face no consequences. The business is feeling higher costs which hurt their margins so why not push those extra costs onto the customer if they can.

And you may think –‘ that is ridiculous, no company could do that, and the customers would just go and buy the cheaper product elsewhere, but not if the company has a moat.

If you're a small production company you've spent money to train all 50 of your employees to use Photoshop and Premiere pro and After effects - that took time, and it took money. Adobe suddenly decides to up the subscriptions ten dollars more per month.

Your company management might be thinking – ‘let's switch to a cheaper alternative, maybe you find a cheaper alternative, twenty dollars a month cheaper, great but it doesn't have all the same features as what the team's already using. Plus, it's going to cost two hundred dollars per employee to train them on the new software, not to mention the downtime your business will experience to get that training done and to switch everybody over.

If you think about the clients - they are already stressing you out, they're trying to get their productions finished, and at the end of the day it's just not worth switching. So, what can you do? You just pay the increased subscription, and you stick with Adobe, and pay more.

Another example: Apple has such a strong brand mode and a strong ecosystem that it's completely normal for them to squeeze a little bit more, and a little bit more out of all their customers each year.

In 2012 iPhone average selling price was just over $600. At the end of 2018, it was almost $800. Nowadays, it's even higher, and that's not even considering the plethora of add-on subscriptions. Apple will somehow force upon you whether it be AppleCare or iCloud or Apple Music, there's no escape and that's the point. So, during inflationary times look to the companies with very strong moats which can raise prices without consequences.

Secondly, you want the business to have an ability to accommodate large dollar volume increases in business with only minor additional investment of capital. So, if your business is not just able to pass on extra costs to the consumer, that means that you're going to have to cope with those costs, which means lower margins to generate your profit. It means you need to be able to increase the amount of business you're doing.

Essentially, what Buffett is saying here is - you want companies that are growing and are also easily scalable. For example - a shipbuilding company would struggle on this point. It costs a lot to build a big ship, you're not going to make huge margins doing it, but it's also very hard to increase the number of ships you're delivering each year. That would take enormous investment, into new shipyards and it'll be slow to wind up.

And if you consider a company like Facebook on the other hand if they can’t pass on the extra cost to their customers (which are the advertisers), they could just choose to bump up the frequency of sponsored posts or of other ads. When a user is scrolling Instagram or Facebook they see three ads, instead of seeing two, and Facebook could do that very easily, and very quickly.

3. And Buffett has one more piece of advice for those seeking the best strategy during a time of inflation. Invest in yourself!

Sometimes there's just no escaping. Stock market investing in these times can be hard, so and given the fact that we're dealing with fairly high levels of inflation what can we do?

To improve your own earning power, know your own talents. Very few people maximize their talents and if you increase your talents, they can't tax it while you're doing it, they can't take it away from you. If you become more useful in your activities your profession - doctor, lawyer, auto repair, etc… - that’s the best protection against a currency that might decline at a rapid rate and the best investment.

And a good passive investment – is an investment in a good business. If you own an interest in a good business, you're very likely to maintain purchasing power no matter what happens to the currency.

Warren Buffett is indirectly acknowledging that it's hard to do well as a stock market investor when inflation just keeps ramping up. It's a bad time and your real return can be zero, so probably a better thing to do is invest in yourself, up-skill so that you can achieve a higher level of income. And your personal buying power would not fall - make yourself more valuable.

Overall, Warren Buffet gives us those 3 invaluable points. Those just come back down to the competitive advantage of you and your business – have a moat, be able to scale quickly and cheaply, and the last one is to invest in yourself.

Warren Buffett: how to invest during high inflation?

How to invest in gold

A question from Facebook. Alan is asking ‘How to invest in gold?.’ Probably Alan has been scared from the money-printing machine and the risk of inflation. And the question is probably in the heads of thousands of our readers.

So, today we will write about the topic on gold investment and how to invest in gold as a beginner. In May 2021 gold has recently hit an 11-year high trading at above $1900 an ounce.

1. Investing in physical bullion

This is the actual metal, and it is going to be either in coin or bar form, typically if you're buying from a reputable source this can be anywhere from a quarter of an ounce all the way up to 400-ounce bricks.

If you can afford a 400-ounce brick of gold, that’s great and as of mid-Jun ’21 this would be at about $750 000.

Physical bullion is priced about 1-10% over spot price. Typically, it's 1-5% percent at any given time but in 2021, with endless money printing, a lot of people are not trusting fiat currency and there's a lot of demand for precious metals ,that's why the price is going up, and now the dealers whether it's a coin shop or an online broker are charging closer to 10$ over spot.

If you don't know what spot price is, say gold is trading at a thousand bucks an ounce for example. If you add 10% premium to that you're probably going to be getting into that gold for about 1100 an ounce.

You also need to buy quality, as the most popular types are coming from mints or they're coming from highly reputable sources. So, you should only be investing in investment grade gold that's the whole point of the investment. You're looking for purity of 99.5% or higher.

Many investors only buy 99.9% or higher, and the most popular ways to invest in this as we mentioned are coins, because of its divisibility and its ability to be stored very easily.

If you want to make a comparison to silver, it's trading at about 1 ounce of gold can buy you about 50 ounces of silver. It means 50-times more space if you are to store silver. So gold is highly divisible and takes less space than silver to store for the same amount of money invested.

You can buy from any reputable online or offline merchant, and check if they discretely and quickly ship to you.

2. Investing in gold ETFs and gold funds

They trade exactly as stocks and ETFs, and are referred as paper-gold. And there are 3 types of these ETFs.

The first kind are investing in a company or an ETF or mutual fund or an intermediary that invests in the physical bullion, as we mentioned in the previous point.

You can pull your money together; they hold the physical bullion, and they basically mimic the spot price.

The second way are investing in ETFs or funds that invest specifically in gold futures contracts. These are companies that do exactly what the first example does, except they're not holding the physical gold and they typically don't take delivery. They're literally just betting on the future price of gold.

The third option you have are gold mining companies, which have become very popular over the past few years. You would be investing in ETF that owns a bunch of gold mining companies and is based on how those gold mining companies do.

As an example, a popular gold-holding ETF is Spyder gold shares – GLD. What they do is, as mentioned is they hold the physical bullions. So that ETF is typically going to mimic the spot price as mentioned.

You also have to take into consideration that the capital gains tax is going to be higher than other ETFs. So, when you dispose of your position, you would probably be paying a higher tax potentially up to 28%.

And the 4th option is investing in gold futures or options, and it is for advanced traders only. This is for people that either do this as a living or have been doing it for many years, and they know exactly what they're doing.

3. PROs and CONs of investing in gold

3.1 PROs of investing in gold

Number one is, that gold is a hedge against inflation. With the money printer printing trillions and trillions of dollars, it’s not surprising people lose their confidence in fiat currency. And they go back to something that is a historical store of value.

There's a finite amount of gold and it is considered hard money. This is all to battle decreased purchasing power ever since the US went off the gold standard in 1971.

Number two is all about portfolio diversification. Many people are investing in stuff linked to the financial markets, and gold is an opportunity to bring diversification to your portfolio, outside of just equities or stocks.

So, people need to provide true diversification and introduce that to their portfolio. And you can do that through precious metals such as gold.

And then final advantage is that it is easy to get started. All you need to do is literally go online, pick a reputable merchant and you can literally get started immediately.

ETFs and funds are just as easy as buying a stock so those gold ETF and funds if you already have an open brokerage account you can literally get started in investing in gold in a click of a button just by buying shares of those ETFs or funds.

3.2. The CONs of investing in gold

Number one is that it doesn't earn you anything. It is literally a pet rock, so if you invest in the physical bullion, you're going to throw it somewhere in a safe or at a bank deposit box, and it's literally just going to sit there.

There are no dividends no compound interest and no passive income coming from that investment. It is a double-edged sword, because it's not correlated, and it can't earn you passive income.

Number two is the cost for storage. If you keep it in the house safe – you might get robbed. And you may want to keep it at a bank and even then, although this is rare, what if there's a run on the bank, or what if that bank burns down. Of course, there's insurance, but the point is that the storage could become an issue and if you just want to keep the physical amount of gold in your premises you will also need to invest in some sort of security.

Number three – you are paying premium over spot and then you also have taxes as a collectible when you go to dispose of your position. Basically, the premium we mentioned is anywhere typically from 1-5%, and right now in this environment it's right around 10% and then this is also taxed as a collectible up to 28% of the value.

4. Final thoughts on gold investments

Gold is a great way to diversify your portfolio. It is a good practice for everyone to have at least 5-10% of either gold or precious metals to make up their portfolio.

At times, silver could be also under-priced, but gold has typically considered a better store of value.

The point is to preserve wealth over years – that’s the idea of the precious metals.

And a well-diversified portfolio would be: a little bit of precious metals, a little bit of real estate assets and then you have your typical usual suspects - stocks and bonds. Then with the hype over crypto nowadays – people are calling it virtual gold, but we still have to see if it will stand the test of time.

Also, if the interest rates do not go up in any time in the near future, it means that the gold is extremely valuable asset.

Hopefully, we managed to answer the ‘How to invest in gold’ question, and to give you some hints how you can get yourself started and add gold and other precious metals to your portfolio.

Why Bill Gates sold out his stocks (Mar ’21)

We all know who Bill Gates is. He's one of the richest men in the world with a net worth of around 127 billion dollars. He did this through creating his own company Microsoft, but he also did it through very smart investing.

Lately Gates is making some very interesting investment moves. His recent 13 filings he sold and reduced 11 stock positions and he bought just one.

Let's take a look at some of these:

1. Uber the worldwide ride-hailing company - he sold a hundred percent of his position.

2. Boston properties - he did the same thing he reduced it by a hundred percent, selling 1.1 million shares.

3. Alibaba - one of China's biggest companies here sold in his recent 13th filings a hundred percent of his position.

4. Google or Alphabet (same thing) he reduced by 50%.

5. Amazon - he sold all his shares.

6. Apple – even it was not immune to the wrath of Gates investment decisions – 50% gone.

These are big moves that Gates is making. Normally when an investor sells some of his position, it's normally a couple of percent. If it's 5%, it is usually a big deal.

And Bill Gates, he's selling 100% out of his positions like Uber and Alibaba, and 50% out of big stocks like Amazon, Apple, and Google these are big moves.

Some of his other moves include

7. Liberty group - the communications company, it was reduced by 25%

8. Great Berkshire Hathaway - was reduced by 10.6%

9. Canadian national railway - the only small sale of 0.86%

And if we take a look at all of the stocks that he bought in the first quarter of 2021 it was just one a stock called Schrödinger a healthcare stock.

And what the investors really want to know is why has Gates made such big sales in these massive companies.

One of Gates’s patterns is that with a lot of stocks he sold – he did it when they're very high in price which a lot of investors avoid.

Uber, that's currently selling for 56 dollars a share, market cap is over 100 billion and it's not even generating any profits.

Amazon price wise has gone up more than 400% over the past five years. It's got a p/e of 72. That's considered very high and not good.

Apple is up over 350%, p/e ratio is 33.

Google or Alphabet is up 170% with the same p/e ratio as Apple of 33.

These stocks that Bill Gates is rushing out of, you'd have to say, he thinks they're overvalued. It's not like he's selling them because he's desperate for cash, his net worth is over $127 billion dollars.

Most probably Gates is worried about a market crash.

if you look at a lot of stocks in the market their prices are up to crazy levels, and we’re sure Bill

Gates and his investment manager Michael Larsen have been closely looking at this market.

As per the latest report they have decided to dramatically trim or exit some of their positions.

We've seen a lot of crazy behavior in the market, people just seem to have so much spare money on them and what do they do with it - they put it into stocks

Bill gates is not a fan of this uneducated investing style he linked it to a casino. He said ‘we don't think of the stock market as just performing a casino-like role, we have restrictions on gambling activities’

The current situation reminds us of the 1930s, to some degree so with all this crazy behavior that was seen in the market, Gate says it reminds him of the 1930s, something which Ray Dalio has also pointed out before

What happened back then was you had the roaring twenties, when everyone was putting their leftover cash into the market, because they thought it could only go one way and that's up but then in the late 20s and 30s, we saw one of the biggest market crashes that the world has ever seen.

That’s a big reason why Gates has decided to trim his positions.

So, look at the only position that Gates is buying - Schrödinger the drug discovery and material science company.

Schrödinger - they use computer simulation to design different medicines and drugs to help cure diseases. They also use computer stimulation to design different types of materials too.

And Bill Gates is someone who is well educated in healthcare and he’s invested in a relatively small company, five billion dollars in market cap.

They sell for 76 dollars a share, and revenue wise they're doing pretty good as well. Their revenue has been growing steadily over the past couple of years, as they look to discover new drugs.

Schrödinger earnings are decreasing and that's just because they are reinvesting every single dollar.

Back in 2018 Bill Gates was asked if in the near future there will be another financial crisis, similar to the 2008? And Gate said “yes, it is hard to say when, but this is a certainty.”

With the amount of stocks that he has sold recently there is a lot of people questioning if that when is 2021?

Let's look at some statistics of the overall market in 2021.

1. The market cap to GDP ratio. Warren Buffett said on it that it's probably the best single measure of where valuation stand at.

And it is very high right now, it's eighty percent higher than the zero percent equal fair value market range, and it's miles above what it was in the 2008 financial crisis

It's even higher than what it was in the 2000 internet bubble.

And we all know what happened to stocks after that. This indicator says prices are high and is very worrying sign.

2. Looking at the market p/e ratio it tells a similar story. It's currently sitting at the 40 mark now. This is near the 2000 technology bubble but not quite as high as what things were in the 2008 housing bubble.

Nevertheless, a market p/e ratio of 40 is high if you consider the average that it has been throughout history - that's 15. So, it's more than double that, and therefore Bill Gates portfolio right now is conservative.

His top 10 stocks that makes up 95 percent of his overall portfolio are value-oriented safe place

His number one position even though he sold some is still Berkshire Hathaway.

Next it goes Waste management, Caterpillar (conservative), Canadian national railway (conservative), Walmart, Ecolab, Crown castle, Fedex, UPS - all conservative.

And the last one is Schrödinger. Apart from Schrödinger which is his 10th largest position that is a very safe portfolio.

When looking at Bill Gates’s stock positions - he's got a very guarded and cautious portfolio for the current market conditions and we should keep a close eye on the upcoming future as it might not be so bright for the stock market.

Should I invest in Bitcoin in 2021

Hello dear money-loving friends. And today we will be sharing another dose of wisdom related to Bitcoin and the Bitcoin market. Our guest star today is Ben Armstrong, also known as BitBoy crypto. Ben is an expert in crypto currency and started investing in Bitcoin in 2012. Today he is teaching crypto currency enthusiast in the crypto secrets over his portal and YouTube channel.

So, without further ado here is what he will share with us:

Whether you are brand new to Bitcoin or you've been here for a while, this article is for you, especially if you are interested in investing in Bitcoin in 2021 and beyond.

Keep in mind there's no simple guidebook that guarantees 100% successful investment into Bitcoin, nevertheless we will try our best to explain the fundaments and the tricks.

You are most likely reading this because you want to make money in cryptocurrency. And the safest and most surefire bet to do that with is the oldest crypto, Bitcoin.

It still stands true despite the fact there's a lot of noise about other cryptocurrencies.

Let me start by answering the question – where can you buy bitcoin? For people wanting to get started in Bitcoin, the easiest two places to do that are with Binance.US and Coinbase.

And now let’s cover the basics.

1. What is Bitcoin?

Before we talk about investing in Bitcoin, we have to understand what Bitcoin is.

You will hear almost everyone to say that Bitcoin is a digital currency. That's the standard company line. And that’s what the idea was in the beginning.

But, It isn’t a currency. Same way gold isn't a currency.

Now, you could go into a car dealership with a few gold bars and maybe trade it for a ride, but it isn’t going to be the dealership's first choice.

They want currency, not an asset. Bitcoin is a digital asset. Think of it like a stock, a bond, gold, oil shares, etc.

But it's a special kind of asset, called a store of value.

You can take money, put it into Bitcoin and hypothetically, it should maintain a level of value.

The volatility of Bitcoin, which we'll talk about later, can make this a tricky proposition because I'm sure as you've heard, the price goes way up and way down.

You don't see these types of swings with most store of value assets.

It wasn't always this way with Bitcoin though. It was spurred out of the 2008 financial crisis.

An anonymous person dubbed Satoshi Nakamoto penned what we now know as the Bitcoin whitepaper.

The guy wrote a paper describing a new currency he wanted to create. The title was "Bitcoin: A Peer-to-Peer Electronic Cash System".

The original intention of Bitcoin was for it to be a currency we could all send directly to each other without the need of a third party like a bank or a credit card processor.

It was time to do something different than "the way it was always done before". This would be a decentralized currency ran on something called blockchain technology.

No one party or entity could have access to make changes to the network, meaning it would be extremely secure and private.

But over time, Bitcoin has morphed into something else.

While it's still decentralized, it's no longer private. Companies like Chainalysis have discovered

ways of tracking transactions.

And the dream of being electronic cash is over, in my opinion. Why?

Because people realize today that Bitcoin works best when they hold it, not spend it. And that volatility is not likely to change anytime soon.

Bitcoin has become the modern version of gold. Digital gold, as we call it.

But unlike gold, there's a known finite supply. Part of the secret recipe for Bitcoin's success has been the fact there are only 18.6 million of them in circulation, and there will ever only be 21 million coins.

And they won't all make it into the circulating supply until 2140, 120 years from now.

Of course, new coins come into the supply through what we call Bitcoin mining.

It's basically specially designed computers solving hard math problems, in order to earn fractions of a Bitcoin.

With gold, while, of course, literally there is a finite supply in the universe, we have no idea what that is.

There could be thousands of tons of gold under the sea floor, and we know that there are millions, if not billions, of tons of gold floating around in our own solar system, much less the universe.

Space mining is coming eventually. But with Bitcoin, not only we do know the supply, we also know the schedule at which it comes into the supply.

The fact is we've never seen an asset in the history of mankind that was specially designed to be the optimum form of money on the planet.

And while the value proposition of Bitcoin has changed from money to a store of value, the same thing rings true.

This is the greatest asset we've ever seen in the history of the world.

2. The question is: did you miss the boat on Bitcoin?

That’s a very tough question and can both be answered with yes and no.

Let's get one thing out of the way here. Bitcoin is the greatest appreciating asset in history. It's made over 100,000% gains since 2011.

The actual overall gains can't even really be calculated. I mean, at one time, you get four Bitcoin for a penny.

Hard to even process that. Bitcoin basically broke the investment paradigm. In the last three years alone, it's up 421%.

So, while the opportunity at the absolute largest gains in world history may be over, Bitcoin still offers you better investment opportunities than anything on the stocks or bonds market.

But think about this. By the end of Feb ‘21, literally any person ever who's invested in Bitcoin is in profit.

And yes, the price is pretty high at over $50,000 right now, but for most of us in crypto full time, we believe the price is going to be a minimum six figures by the end of this year.

I believe, it will be closer to $300,000. But, of course, that's not financial advice.

Still a long way to go from that. One thing though you have to understand about Bitcoin is that it goes in cycles.

So, even if you buy it now and it goes down, as long as you don't sell at a loss, history has shown that it will continue climbing much higher.

Honestly, I'm starting to believe that if companies, governments, and investment funds continue adopting Bitcoin that in 10 to 20 years, we could be looking at a $10 million-Bitcoin.

Having the opportunity to own one Bitcoin can bring generation-changing wealth in the future.

Only the truly elite will own one full Bitcoin. You may have heard of other cryptocurrencies, such as Ethereum, Chainlink, Cardano, XRP, Bitcoin Cash or others.

These are what we call altcoins, or any coin other than Bitcoin. To be totally honest with you, my personal portfolio is loaded down with altcoins, and I advocate a lot for them.

Altcoins offer much more reward than Bitcoin, but they also boast much more risk than Bitcoin.

And this is where the volatility of Bitcoin really shines. You see, we like volatility in crypto. It's what gives us life-changing money.

But some people simply cannot handle that risk. Bitcoin plays out pretty much the same way every four years though.

It's based on something we call:

3. Bitcoin halving

This is where the amount of Bitcoin produced through mining gets cut in half.

In the beginning, there were 50 Bitcoin produced per block mined.

In 2012, it cut down to 25 BTC. Then in 2016, to 12.5 BTC. Then last year, on May 11, 2020, the Bitcoin halving dropped the amount to 6.25 BTC per block.

That equals about 900 Bitcoin per day currently produced.

In 2024, that will be cut to about 450 Bitcoin per day.

By the last Bitcoin cycle in 2136 to 2140, there will only be one-half of one Bitcoin produced total!

So, the supply and demand principles of the Bitcoin halving scheduled every 200,000 blocks means the value proposition of Bitcoin should continue to increase following those halving events.

The only thing is about a year and a half after the halving when Bitcoin investing is at its peak, the supply shock of the halving wears off, and the price starts dropping.

The retail frenzy ends. People start selling off their Bitcoin, plummeting the price.

These are the types of things you need to know as an investor. Bitcoin drops an average of 85-87% every bear market.

Every four years. The current Bitcoin bull run according to the historical Bitcoin cycles should end around September or October of 2021.

So, you need to be prepared. You can do as the kids say and HODL through the bear market, which lasts about two years, or sell at the top, like the smart kids, and wait for prices to drop to buy more for the next Bitcoin bull run in 2024.

But this cycle could be different because of companies like MicroStrategy, Tesla and PayPal.

These companies have bought tons of Bitcoin and will not sell it in the bear market.

So, we could see a less volatile drop, maybe 60% instead of 87%.

But other cryptocurrencies, the altcoins, don't have that same level of corporate and institutional buying happening.

Ethereum, the No. 2 overall cryptocurrency, certainly does have some level of institutional buying, but virtually none of the coins below it do.

On average, altcoins drop 95% in a bear market. Sometimes 99%.

The point is while the rewards of being early on some other coins are very high, the risk of losing almost everything is guaranteed unless you sell at the right time.

The volatility to the downside is really what separates Bitcoin from other cryptocurrencies and makes it the "safest" bet.

4. If you still would like to get into Bitcoin and/or crypto, here is how to do it

There are basically three ways.

Number one and the best way is to buy Bitcoin directly on a site or exchange where you have the opportunity to own your own asset, not let it sit in the hands of others.

The two places I have already suggested buying Bitcoin from directly for United States citizens are Binance US and Coinbase.

If you buy your Bitcoin directly with your debit card, credit card or bank account, you also have the option to withdraw it to what we call a Bitcoin wallet.

This could be a hot wallet, which is an online web-based wallet, or a cold storage wallet.

These are mostly USB hardware devices, but there are a few other types like paper wallets. Owning your own Bitcoin is important.

A second way to invest in Bitcoin is through third party apps and sites like Robinhood and PayPal.

By investing in Bitcoin and through these places, you're basically investing in a derivative version of Bitcoin.

You own them on paper, but you cannot withdraw these assets.

You make money on the gains or lose money on the downward moves of Bitcoin, but you cannot ever move your Bitcoin somewhere else.

This is probably the worst way to invest in Bitcoin because you have zero ownership.

And a third way to invest in Bitcoin is through the Grayscale Bitcoin Trust on the stock market. The ticker is GBTC.

Each share of the stock is backed by actual Bitcoin that Grayscale owns.

This means that Grayscale actually owns the Bitcoin behind their shares.

Investing in the Bitcoin stock is a great way for traditional investors to get into Bitcoin and crypto.

From the crypto enthusiast's perspective, these types of investment vehicles are bridges to get investors to a place where they understand the potential of crypto.

This leads them to study more of it, and many end up realizing the importance of owning their own Bitcoin.

5. The most important aspect in Bitcoin investment

Remember the Bitcoin cycles. This bull run will come to an end.

And when it does, you have to be prepared to move out of the markets and invest into what we call stablecoins.

These are coins where the price is stable no matter what the direction of the overall crypto market is.

Another option is you can move into other assets like cash, gold or stocks while the Bitcoin market drops and consolidates.

This will allow you to pick new entry points and you could go from owning one Bitcoin to possibly owning 5 to 10 Bitcoin if you time it right.

When the next bull run comes around in 2024, you could be poised to change your financial future, for you and your family.

The dark side of a company bankruptcy

Nowadays, in the full unstableness of the market and the economy as a whole, some companies declare bankruptcy, and those are good examples of what is going to happen with your stocks, in a case of any company declaring bankruptcy.

Companies like JCPenney and Hertz and are declaring bankruptcy and you wouldn’t believe what happened to the shares price… It skyrockets instead of crashing down. So, in case of not aware of what usually happens when a company declares bankruptcy, there it is...

There are two options for a company to declare bankruptcy – using Chapter 7 or Chapter 11. If a company declares Ch.11 bankruptcy, what basically happens is – the company is asking for a chance to reorganize and recover. It asks protection from the court from the creditors. If the company survives, your shares may also survive too. But there is a very small chance of that happening. The company may cancel existing shares, making yours worthless. This is what happens in most of the cases. If the company declares bankruptcy under Ch.7, the company acknowledges the inability to function anymore. Rarely, any shareholders get something, as the creditors of the company are served first.

So essentially when a company announces bankruptcy the shares have zero value or close. You might be thinking – what if the company survives bankruptcy in the future and manage to cut costs and reorganize and survive somehow? You might think that the value of the shares will rise significantly. But, in reality, it turns out that the shares are almost always deleted during bankruptcy. The existing shares are just completely wiped out, most of the time. And if the company does survive the business owners, who credited the company in the past just create new shares for themselves. The new shares are not shared with the old shareholders.

A good example of the dark side of a company bankruptcy is the case with United Airlines. They went bankrupt in 2002. And four years later in 2006, the company managed to stabilize, and new shares went public. The same shares are still trading today but none of these new shares were given to the old shareholders. The people who held shares before and during bankruptcy lost everything. For them, it doesn't matter that the company survived.

So, nowadays, as an investor - you buy shares in Hertz, hoping for the company to survive, keep in mind that it probably won’t even matter as if the company does really survive, the business owners will most probably simply issue new shares and none of those will be shared with the old shareholders.

The stock exchange usually delists such shares and tries to stop them from trading. But some companies are fighting the delisting, as they would like to squeeze the most out of the market and the naïve investors.

The bottom line is that owners of common stock often get nothing when a company enters bankruptcy. Those shareholders are usually the last in line for compensation.

The Stock Market is a bubble - and it will burst

We are currently in a pandemic situation. The economy is struggling, unemployment is rising, and there is a lot of uncertainty. On top of that the S&P 500 recovered so quickly from the mini-crash in Mar 2020, and it looks like it have entered a bubble.

Let’s quickly explain the nature of the stock market. There are consistent patterns that emerge in every bubble in history and these consistent patterns are emerging again right now. Unfortunately – every time the investors believe in “but now it’s different” mantra, repeating the same mistakes again and again.

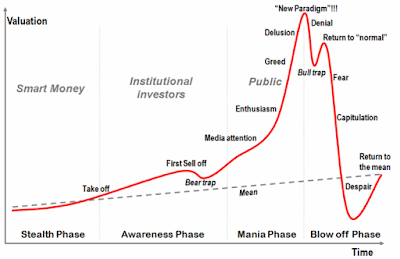

Above you see a chart representing the life-cycle of the stock market. This chart shows the stages of every bubble in history. It starts with the early stealth phase. Next comes the awareness phase as the investments begin to attract attention. Followed by the mania phase – where the bubble grows extensively. Finally the blow-off phase or the so-called crash.

The chart shows perfectly well - how every single bubble in history has grown and burst.

Above is an example of the dot-com bubble. Notice how the charts are pretty much identical. Did people learn from previous bubbles? Well, not so much it seems, at least not enough to avoid it playing out the stock market in the same way again and again.

Above is another example. We have the notorious Bitcoin bubble. This time it's overlaid on the stages of our bubble charts and we can see how closely it does follow it. It is clearly the same pattern so whether it was the "dot-com bubble" or the "Bitcoin bubble" the truth is the majority of the investors never learn and the same patterns are repeated over and over.

Every now and then new technology is invented, it changes the world and the majority of investors think “this time is different”. It’s also important to note that the burst of the bubbles are not always the end. For example the Bitcoin is obviously very contentious as it has shown tremendous staying power since the bubble burst, and maybe hasn't had as much time as the others to prove its worth.

The key point is that many investors fall victim to the same patterns because they think “this time is different”. This mantra have caused every bubble in history to get out of hand, and it is a well-documented pattern with lots of analysis.

Finally, keep in mind that we have clear signs that (in Jun 2020) we are currently in the mania phase of the bubble chart and as the charts show - the crash usually isn't too far behind. So, if you are an investor – be careful and don’t get overexcited.

Investing tips by Tony Robbins

We will be presenting 3 key tips for beginner investors and everyone who would like to start investing in the stock market, presented by the greatest coach of all time - Tony Robbins.

Here is what Tony said about investing:

The average person thinks finance is so complex because frankly the industry tries to make it sound complex. They use words that you don't know so you don't know what to do... What happens is we just give them our money and say deal with it.

1. You need to know that you can't wait until you have a ton of money to start investing.

If you can invest in business, even a small amount, you can grow. It doesn’t matter how small it is, the important thing is to automate it.

You got to take a percentage of what you earn and pretend it's a tax. You should not waste that money. It automatically goes straight to the investment account and you never see it as money you can spend. When you save 20% and you compound it, the numbers are incredible. And then the problem is: If you do that first step, but you don't do the second step which is:

2. Become an insider and understand the rules of the money game. I'll give you 2 or 3 of the Myths, really fast:

2.1. One, the myth that someone says give me your money and I'm going to beat the market. Over any ten year period of time, 96% of the mutual funds will not even match the market.

Warren Buffet flat out used to confirm the same trend. 96% of his money, all that money does not go with any mutual fund, it goes straight into the index.

What the index is you get a piece of all the largest companies in the world but it costs almost nothing to get in. You hire someone because you are thinking "I have a family, I have a business, I have a life, I'm not an investor- I'm going to hire someone who's a professional, it makes sense they would do better than me."

Unfortunately that's wrong.

Only 4% of the mutual funds will beat the market. 4% chance of finding the right mutual fund, the chance is so slim that it will happen.

2.2. And, the second myth is after getting terrible performance, people think "Maybe, fees don't really matter" or they'll tell you it's only 1%. And on Forbes, it says the average fee is 3.12%,

1% versus 3% is a big difference. And it really matters - just like you grow by compounding, your fees also compound. If you have 3 people and one gets 1% fees, another 2% the other 3%, and they all get the same return. And, they start out with 100,000 dollars at 35, accumulating for 30 years until they are 65 years old. If it is average 7% compounded, they all get 7% return and when they go to retire, the person who had 1% in fees is going have 574,000 dollars. The person who had 3% in fees will have only 224,000 dollars. This is 77% less money!

If I said to you: "Here's the deal, let's do an investment. You put up all the money, you put up all the money, you put up all the risk, I'll put up no money and I'll put up no risk. If you lose I win, and if you win I win and if you win, over the life of the time I'll get 60% of what you earn." That's a mutual fund with 3%.

3. Instead, you could own the stock market – invest in the S&P500, you could own a piece of all 500 big companies through like the Vanguard 500 and you get the best of all the business - Apple, Exxon, etc… All these companies – you invest into and it cost you only .17%. And if you go to a normal mutual fund you might own the same companies for 3.17%. That's like buying a Honda Accord for $20,000 in the first scenario or $350,000 in the second for the same car.

That happens every day with finances because people don't know how to look at this so when they read the book Money Master the Game: 7 Simple Steps to Financial Freedom that will never happen to them again.

Investing, money and stock markets during a national emergency (e.g. coronavirus crisis COVID-19)

It is March 2020, the coronavirus (COVID-19) pandemic is the “scariest bug” on all the media, and most of us are already “imprisoned at home” due to the national emergency quarantine state, declared in many countries across the globe. And of course, it’s not only the healthcare. The major collapse on all the markets has been unprecedented for years. In the mid of March, as measured by most of the indices and markets (e.g. S&P 500) the financial and stock exchange markets officially entered a “bear market” state. In other words, the stock markets have now fallen 20% or more since their recent all-time highs.

Most of the investors have panicked, due to the financial uncertainty, so we have gathered leading economists' opinions to answer the question “What to do with your investments during national emergency crises?”, like the one followed the recent coronavirus (COVID-19) global outbreak.

Joachim Klement (Investment strategist, a trustee of the CFA Institute’s Research Foundation and formerly head of strategy research at UBS Wealth Management), gives the simplest possible answer for most of the investors:

“Just, don’t look at your portfolio. The idea is - nothing that happens today, tomorrow or over the rest of 2020 will matter after 10 years. That “is the most important rule in bear markets. The best way to invest for most investors is to become a “buy and hold investor”. In other words, the best strategy is to buy a well-diversified portfolio that meets the needs of the investor and then stick to it for a very long time, through the ups and downs of the market. At the same time, the investors should avoid getting distracted by short-term market moves.”

The only sensible alternative, Joachim Klement mentions, is to use a highly sophisticated mathematical system. Such a system would support investors in getting out of the market and getting back in. One such respected and popular one, is the trading rule popularized by Cambria Investments’ Mebane Faber. The general advice there is selling stocks as soon as they fall below their 200-day moving average, and not buying them again until they rise back above that level.

“And with the coronavirus emergency state, following that rule,” according to Klement, “would not be possible. As the indices fell decisively below the 200-day average many days ago. Selling now leads in a steep loss in equities and other assets, as nobody can say if markets will go up or down from here (short-term), so investors will realize past losses, and not be in the market for a while. And this will inevitably mean missing the bottom of the market and will get back into the market at a stage when a lot of the recovery has already passed.”

So, he concludes, there is only one sensible option – do not look and don’t worry too much.

--

The same opinion comes from Jim Paulsen (chief investment strategist at the Leuthold Group):

“I think what we need somebody to calm us down, like our mom and dad tell us it’s going to be OK.” He implies that we should not panic and rush into reckless actions, and just have faith the markets will recover after the coronavirus crisis.

--

Gita Gopinath, IMF chief economists, opinion:

“It was hard to predict what might happen. The pandemic did not look like a normal recession. Data from China has shown a much steeper drop in services than a normal downturn would predict. There’s not an easy answer” Ms Gopinath continued, adding: “There should be a transitory shock if there is an aggressive policy response that can stop it, morphing into a major financial crisis.”

Gita Gopinath also concluded - there is no reason why the economic effects of a health crisis should linger, in the way that long periods of slow growth have tended to follow financial crises, as households and companies work off their debts.

--

Kenneth Rogoff (Harvard University professor, (predecessor at the IMF)) said:

“A global recession seems baked in a cake at this point with odds over 90%”

--

Maurice Obstfeld (professor at University of California, Berkeley) opinion:

“Recent events were a wicked cocktail for the global growth. I do not see how, given the events in China, Europe, and the US, you are not going to see a severe slowdown across the globe.”

--

Raghuram Rajan (professor at Chicago Booth School of Business and a former Indian central bank governor), opinion:

“The depth of any economic hit would depend on the authorities’ success in containing the pandemic, which he hoped would be decisive and rapid. Anything prolonged creates more stress for the system.”

“Long outbreak could also lead to a second round of consequences, where workers were dismissed and there was another fall in demand, eroding long-term confidence,” he warned. “These kinds of effects — companies closing down — depend on how prolonged the first round is, and what steps we all take to alleviate that first round. It is up in the air”

--

Olivier Blanchard (senior, at the Peterson Institute) opinion:

“There was no question in my mind that [global economic] growth will be negative for the first six months of 2020. The second half would depend on when peak infection was reached, he said, adding that his “own guess” was that this period would probably be negative as well.”

--

Other representatives of the IMF said that the impact of the virus will be “significant” and that growth in 2020 will be lower than in 2019, which was 2.9%.

--

Erik Nielsen (chief economist of Italy’s UniCredit) noted

“Four consecutive quarters of negative global growth followed the 2008 financial crisis,” but mentioned he expected “the impact of coronavirus to last only a couple of quarters.” But he also predicted that the quarterly fall could be as deep as the 3.2% contraction that the global economy experienced in the first quarter of 2009.

--

Gilles Moec (chief economist at French insurer Axa) mentioned

“Trying to plot the disruption from the virus was almost impossible. Our forecasting models are not set up to deal with this scenario.”

--

Other economists were also clear that the economic effects of coronavirus will be serious. Vítor Constancio (former vice-president of the European Central Bank), said:

“The recession is coming from a demand deficiency and the disturbance on the supply chains. The most affected sectors will be leisure amenities, tourism, travel, transportation, energy, financials.”. Vitor, also added: “It is possible that banks’ risk aversion and lack of market liquidity for bond issuance may affect credit and provoke liquidity squeezes.”

--

We also included the answers of three major questions, coming from financial online groups and boards:

1. How much longer are the stock markets going to decline? How great is the decline going to be?

No one knows, and that’s part of the fear that is feeding the markets to go even lower, sinking into an official “bear market.” The key is how long will this health crisis last? How many people will be impacted? And how quickly can the economy bounce back? Right now, no one has enough data to answer those questions, so the market is pricing in the worst-case scenario. What pretty much every economist and Wall Street type We’ve spoken to has said is:

“The US and the affected countries should do a two-week shutdown, similar to Italy. It will be painful. And it will require government help for people not working and businesses really hurt. But the hope is that would stop the flow of COVID-19 and boost confidence in the government’s response to this crisis.”

2. How worried should we be?

The United States is in a bear market, and it’s almost certain Q2 will be negative growth. The question is whether the United States will go into a recession (two consecutive quarters of negative growth). The reason there is such high concern on Wall Street today is investors don’t think the government response is sufficient — from Congress or the White House. A list of worries includes the coronavirus spread, oil price war, and the inadequate government response. So, the key in the coming days is whether Congress can set aside partisanship and pass a fiscal stimulus bill and whether the White House and Congress can backstop the health system sufficiently to start halting the spread of the virus.

3. What market segments will be most likely to weather the uncertainty we are seeing now? The prediction is for people to keep using their mobile phones and online services, whereas cruise ships will take a while to come back, right?

That’s correct. This is the Clorox and Netflix economy right now. The other somewhat surprising winner in all of this is real estate. Mortgage and refinance applications are through the roof. The 30-year fixed-rate hit an all-time low of 3.29 percent, so housing and home-related stocks and parts of the economy are likely to do well. I was just talking to a roofer. His business is down this week, but he’s got a lot of people calling and telling him they want him at their place as soon as this health crisis subsides.

--

As a final statement – the investors need nerves of steel during the coronavirus-provoked-crisis. The short-term effects of the COVID-19 crisis on the economy can’t yet be measured but are likely to be severe. Nevertheless, worrying too much could lead to a weakening of the immune system, so we advise you to stay on the positive side, be safe and stay at home until the coronavirus provoked crisis is under control and the virus is no longer a threat.