We all know who Bill Gates is. He's one of the richest men in the world with a net worth of around 127 billion dollars. He did this through creating his own company Microsoft, but he also did it through very smart investing.

Lately Gates is making some very interesting investment moves. His recent 13 filings he sold and reduced 11 stock positions and he bought just one.

Let's take a look at some of these:

1. Uber the worldwide ride-hailing company - he sold a hundred percent of his position.

2. Boston properties - he did the same thing he reduced it by a hundred percent, selling 1.1 million shares.

3. Alibaba - one of China's biggest companies here sold in his recent 13th filings a hundred percent of his position.

4. Google or Alphabet (same thing) he reduced by 50%.

5. Amazon - he sold all his shares.

6. Apple – even it was not immune to the wrath of Gates investment decisions – 50% gone.

These are big moves that Gates is making. Normally when an investor sells some of his position, it's normally a couple of percent. If it's 5%, it is usually a big deal.

And Bill Gates, he's selling 100% out of his positions like Uber and Alibaba, and 50% out of big stocks like Amazon, Apple, and Google these are big moves.

Some of his other moves include

7. Liberty group - the communications company, it was reduced by 25%

8. Great Berkshire Hathaway - was reduced by 10.6%

9. Canadian national railway - the only small sale of 0.86%

And if we take a look at all of the stocks that he bought in the first quarter of 2021 it was just one a stock called Schrödinger a healthcare stock.

And what the investors really want to know is why has Gates made such big sales in these massive companies.

One of Gates’s patterns is that with a lot of stocks he sold – he did it when they're very high in price which a lot of investors avoid.

Uber, that's currently selling for 56 dollars a share, market cap is over 100 billion and it's not even generating any profits.

Amazon price wise has gone up more than 400% over the past five years. It's got a p/e of 72. That's considered very high and not good.

Apple is up over 350%, p/e ratio is 33.

Google or Alphabet is up 170% with the same p/e ratio as Apple of 33.

These stocks that Bill Gates is rushing out of, you'd have to say, he thinks they're overvalued. It's not like he's selling them because he's desperate for cash, his net worth is over $127 billion dollars.

Most probably Gates is worried about a market crash.

if you look at a lot of stocks in the market their prices are up to crazy levels, and we’re sure Bill

Gates and his investment manager Michael Larsen have been closely looking at this market.

As per the latest report they have decided to dramatically trim or exit some of their positions.

We've seen a lot of crazy behavior in the market, people just seem to have so much spare money on them and what do they do with it - they put it into stocks

Bill gates is not a fan of this uneducated investing style he linked it to a casino. He said ‘we don't think of the stock market as just performing a casino-like role, we have restrictions on gambling activities’

The current situation reminds us of the 1930s, to some degree so with all this crazy behavior that was seen in the market, Gate says it reminds him of the 1930s, something which Ray Dalio has also pointed out before

What happened back then was you had the roaring twenties, when everyone was putting their leftover cash into the market, because they thought it could only go one way and that's up but then in the late 20s and 30s, we saw one of the biggest market crashes that the world has ever seen.

That’s a big reason why Gates has decided to trim his positions.

So, look at the only position that Gates is buying - Schrödinger the drug discovery and material science company.

Schrödinger - they use computer simulation to design different medicines and drugs to help cure diseases. They also use computer stimulation to design different types of materials too.

And Bill Gates is someone who is well educated in healthcare and he’s invested in a relatively small company, five billion dollars in market cap.

They sell for 76 dollars a share, and revenue wise they're doing pretty good as well. Their revenue has been growing steadily over the past couple of years, as they look to discover new drugs.

Schrödinger earnings are decreasing and that's just because they are reinvesting every single dollar.

Back in 2018 Bill Gates was asked if in the near future there will be another financial crisis, similar to the 2008? And Gate said “yes, it is hard to say when, but this is a certainty.”

With the amount of stocks that he has sold recently there is a lot of people questioning if that when is 2021?

Let's look at some statistics of the overall market in 2021.

1. The market cap to GDP ratio. Warren Buffett said on it that it's probably the best single measure of where valuation stand at.

And it is very high right now, it's eighty percent higher than the zero percent equal fair value market range, and it's miles above what it was in the 2008 financial crisis

It's even higher than what it was in the 2000 internet bubble.

And we all know what happened to stocks after that. This indicator says prices are high and is very worrying sign.

2. Looking at the market p/e ratio it tells a similar story. It's currently sitting at the 40 mark now. This is near the 2000 technology bubble but not quite as high as what things were in the 2008 housing bubble.

Nevertheless, a market p/e ratio of 40 is high if you consider the average that it has been throughout history - that's 15. So, it's more than double that, and therefore Bill Gates portfolio right now is conservative.

His top 10 stocks that makes up 95 percent of his overall portfolio are value-oriented safe place

His number one position even though he sold some is still Berkshire Hathaway.

Next it goes Waste management, Caterpillar (conservative), Canadian national railway (conservative), Walmart, Ecolab, Crown castle, Fedex, UPS - all conservative.

And the last one is Schrödinger. Apart from Schrödinger which is his 10th largest position that is a very safe portfolio.

When looking at Bill Gates’s stock positions - he's got a very guarded and cautious portfolio for the current market conditions and we should keep a close eye on the upcoming future as it might not be so bright for the stock market.

Showing posts with label stock exchange. Show all posts

Showing posts with label stock exchange. Show all posts

Why Bill Gates sold out his stocks (Mar ’21)

The dark side of a company bankruptcy

Nowadays, in the full unstableness of the market and the economy as a whole, some companies declare bankruptcy, and those are good examples of what is going to happen with your stocks, in a case of any company declaring bankruptcy.

Companies like JCPenney and Hertz and are declaring bankruptcy and you wouldn’t believe what happened to the shares price… It skyrockets instead of crashing down. So, in case of not aware of what usually happens when a company declares bankruptcy, there it is...

There are two options for a company to declare bankruptcy – using Chapter 7 or Chapter 11. If a company declares Ch.11 bankruptcy, what basically happens is – the company is asking for a chance to reorganize and recover. It asks protection from the court from the creditors. If the company survives, your shares may also survive too. But there is a very small chance of that happening. The company may cancel existing shares, making yours worthless. This is what happens in most of the cases. If the company declares bankruptcy under Ch.7, the company acknowledges the inability to function anymore. Rarely, any shareholders get something, as the creditors of the company are served first.

So essentially when a company announces bankruptcy the shares have zero value or close. You might be thinking – what if the company survives bankruptcy in the future and manage to cut costs and reorganize and survive somehow? You might think that the value of the shares will rise significantly. But, in reality, it turns out that the shares are almost always deleted during bankruptcy. The existing shares are just completely wiped out, most of the time. And if the company does survive the business owners, who credited the company in the past just create new shares for themselves. The new shares are not shared with the old shareholders.

A good example of the dark side of a company bankruptcy is the case with United Airlines. They went bankrupt in 2002. And four years later in 2006, the company managed to stabilize, and new shares went public. The same shares are still trading today but none of these new shares were given to the old shareholders. The people who held shares before and during bankruptcy lost everything. For them, it doesn't matter that the company survived.

So, nowadays, as an investor - you buy shares in Hertz, hoping for the company to survive, keep in mind that it probably won’t even matter as if the company does really survive, the business owners will most probably simply issue new shares and none of those will be shared with the old shareholders.

The stock exchange usually delists such shares and tries to stop them from trading. But some companies are fighting the delisting, as they would like to squeeze the most out of the market and the naïve investors.

The bottom line is that owners of common stock often get nothing when a company enters bankruptcy. Those shareholders are usually the last in line for compensation.

The Stock Market is a bubble - and it will burst

During the last decade, the investors have come to believe that no matter what - the market only grows, in a long term. Long-term investment in index funds (like S&P 500) has somewhat proven to be the most profitable strategy. But do you know that the nature of the stock market is to grow as a bubble and eventually burst?

We are currently in a pandemic situation. The economy is struggling, unemployment is rising, and there is a lot of uncertainty. On top of that the S&P 500 recovered so quickly from the mini-crash in Mar 2020, and it looks like it have entered a bubble.

Let’s quickly explain the nature of the stock market. There are consistent patterns that emerge in every bubble in history and these consistent patterns are emerging again right now. Unfortunately – every time the investors believe in “but now it’s different” mantra, repeating the same mistakes again and again.

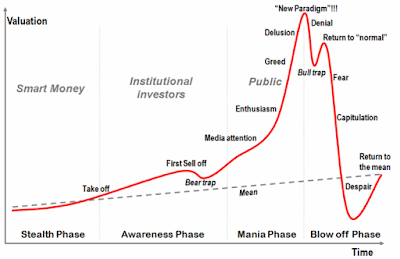

Above you see a chart representing the life-cycle of the stock market. This chart shows the stages of every bubble in history. It starts with the early stealth phase. Next comes the awareness phase as the investments begin to attract attention. Followed by the mania phase – where the bubble grows extensively. Finally the blow-off phase or the so-called crash.

The chart shows perfectly well - how every single bubble in history has grown and burst.

Above is an example of the dot-com bubble. Notice how the charts are pretty much identical. Did people learn from previous bubbles? Well, not so much it seems, at least not enough to avoid it playing out the stock market in the same way again and again.

Above is another example. We have the notorious Bitcoin bubble. This time it's overlaid on the stages of our bubble charts and we can see how closely it does follow it. It is clearly the same pattern so whether it was the "dot-com bubble" or the "Bitcoin bubble" the truth is the majority of the investors never learn and the same patterns are repeated over and over.

Every now and then new technology is invented, it changes the world and the majority of investors think “this time is different”. It’s also important to note that the burst of the bubbles are not always the end. For example the Bitcoin is obviously very contentious as it has shown tremendous staying power since the bubble burst, and maybe hasn't had as much time as the others to prove its worth.

The key point is that many investors fall victim to the same patterns because they think “this time is different”. This mantra have caused every bubble in history to get out of hand, and it is a well-documented pattern with lots of analysis.

Finally, keep in mind that we have clear signs that (in Jun 2020) we are currently in the mania phase of the bubble chart and as the charts show - the crash usually isn't too far behind. So, if you are an investor – be careful and don’t get overexcited.

We are currently in a pandemic situation. The economy is struggling, unemployment is rising, and there is a lot of uncertainty. On top of that the S&P 500 recovered so quickly from the mini-crash in Mar 2020, and it looks like it have entered a bubble.

Let’s quickly explain the nature of the stock market. There are consistent patterns that emerge in every bubble in history and these consistent patterns are emerging again right now. Unfortunately – every time the investors believe in “but now it’s different” mantra, repeating the same mistakes again and again.

Above you see a chart representing the life-cycle of the stock market. This chart shows the stages of every bubble in history. It starts with the early stealth phase. Next comes the awareness phase as the investments begin to attract attention. Followed by the mania phase – where the bubble grows extensively. Finally the blow-off phase or the so-called crash.

The chart shows perfectly well - how every single bubble in history has grown and burst.

Above is an example of the dot-com bubble. Notice how the charts are pretty much identical. Did people learn from previous bubbles? Well, not so much it seems, at least not enough to avoid it playing out the stock market in the same way again and again.

Above is another example. We have the notorious Bitcoin bubble. This time it's overlaid on the stages of our bubble charts and we can see how closely it does follow it. It is clearly the same pattern so whether it was the "dot-com bubble" or the "Bitcoin bubble" the truth is the majority of the investors never learn and the same patterns are repeated over and over.

Every now and then new technology is invented, it changes the world and the majority of investors think “this time is different”. It’s also important to note that the burst of the bubbles are not always the end. For example the Bitcoin is obviously very contentious as it has shown tremendous staying power since the bubble burst, and maybe hasn't had as much time as the others to prove its worth.

The key point is that many investors fall victim to the same patterns because they think “this time is different”. This mantra have caused every bubble in history to get out of hand, and it is a well-documented pattern with lots of analysis.

Finally, keep in mind that we have clear signs that (in Jun 2020) we are currently in the mania phase of the bubble chart and as the charts show - the crash usually isn't too far behind. So, if you are an investor – be careful and don’t get overexcited.

Top tips for Investing in the stock market by Warren Buffett

Sharing the 5 top tips for investing in the stock market, presented by not anybody else, but the one and only – Mr. Warren Buffett himself.

1. I don't know when to buy stocks, but I know whether to buy stocks. Some people should not own stocks as they just get too upset with the price fluctuations. If you're going to do dumb things because your stock goes down, you shouldn't own the stock at all. I mean that if you buy your house at $20,000 and somebody comes along the house and says I'll pay you $50 – well, just don't sell it.

2. The best thing with stocks is to buy them consistently over time you want to spread the risk as far as the specific companies you're in by being versatile and you diversify over time by buying this company stock this month, that company stock next month. Year after year after.

3. If you save money you can buy bonds, you can buy a farm, you can buy an apartment house or buy a part of the American business. And if you buy a 10-year bond now you're paying over 40 times earnings for something which earnings can't grow, and you know if you compare that to buying equities good businesses. I don't think there's any comparison.

4. You are making a terrible mistake if you say out of a game. Probably you think, it is going to be very good over time because you think you can pick a better time to enter the stock exchange market. The later you start, the worse you will be: in terms of knowledge, experience, and money.

5. I know what markets are going to do over a long period of time. They're going to go up, but in terms of what's going to happen in a day or a week or a month or a year, even I've never felt that I knew it and I've never felt that was important. Keep in mind that in 10 or 20 or 30 years, I believe, stocks will be a lot higher than they are now.

Investing, money and stock markets during a national emergency (e.g. coronavirus crisis COVID-19)

It is March 2020, the coronavirus (COVID-19) pandemic is the “scariest bug” on all the media, and most of us are already “imprisoned at home” due to the national emergency quarantine state, declared in many countries across the globe. And of course, it’s not only the healthcare. The major collapse on all the markets has been unprecedented for years. In the mid of March, as measured by most of the indices and markets (e.g. S&P 500) the financial and stock exchange markets officially entered a “bear market” state. In other words, the stock markets have now fallen 20% or more since their recent all-time highs.

Most of the investors have panicked, due to the financial uncertainty, so we have gathered leading economists' opinions to answer the question “What to do with your investments during national emergency crises?”, like the one followed the recent coronavirus (COVID-19) global outbreak.

Joachim Klement (Investment strategist, a trustee of the CFA Institute’s Research Foundation and formerly head of strategy research at UBS Wealth Management), gives the simplest possible answer for most of the investors:

“Just, don’t look at your portfolio. The idea is - nothing that happens today, tomorrow or over the rest of 2020 will matter after 10 years. That “is the most important rule in bear markets. The best way to invest for most investors is to become a “buy and hold investor”. In other words, the best strategy is to buy a well-diversified portfolio that meets the needs of the investor and then stick to it for a very long time, through the ups and downs of the market. At the same time, the investors should avoid getting distracted by short-term market moves.”

The only sensible alternative, Joachim Klement mentions, is to use a highly sophisticated mathematical system. Such a system would support investors in getting out of the market and getting back in. One such respected and popular one, is the trading rule popularized by Cambria Investments’ Mebane Faber. The general advice there is selling stocks as soon as they fall below their 200-day moving average, and not buying them again until they rise back above that level.

“And with the coronavirus emergency state, following that rule,” according to Klement, “would not be possible. As the indices fell decisively below the 200-day average many days ago. Selling now leads in a steep loss in equities and other assets, as nobody can say if markets will go up or down from here (short-term), so investors will realize past losses, and not be in the market for a while. And this will inevitably mean missing the bottom of the market and will get back into the market at a stage when a lot of the recovery has already passed.”

So, he concludes, there is only one sensible option – do not look and don’t worry too much.

--

The same opinion comes from Jim Paulsen (chief investment strategist at the Leuthold Group):

“I think what we need somebody to calm us down, like our mom and dad tell us it’s going to be OK.” He implies that we should not panic and rush into reckless actions, and just have faith the markets will recover after the coronavirus crisis.

--

Gita Gopinath, IMF chief economists, opinion:

“It was hard to predict what might happen. The pandemic did not look like a normal recession. Data from China has shown a much steeper drop in services than a normal downturn would predict. There’s not an easy answer” Ms Gopinath continued, adding: “There should be a transitory shock if there is an aggressive policy response that can stop it, morphing into a major financial crisis.”

Gita Gopinath also concluded - there is no reason why the economic effects of a health crisis should linger, in the way that long periods of slow growth have tended to follow financial crises, as households and companies work off their debts.

--

Kenneth Rogoff (Harvard University professor, (predecessor at the IMF)) said:

“A global recession seems baked in a cake at this point with odds over 90%”

--

Maurice Obstfeld (professor at University of California, Berkeley) opinion:

“Recent events were a wicked cocktail for the global growth. I do not see how, given the events in China, Europe, and the US, you are not going to see a severe slowdown across the globe.”

--

Raghuram Rajan (professor at Chicago Booth School of Business and a former Indian central bank governor), opinion:

“The depth of any economic hit would depend on the authorities’ success in containing the pandemic, which he hoped would be decisive and rapid. Anything prolonged creates more stress for the system.”

“Long outbreak could also lead to a second round of consequences, where workers were dismissed and there was another fall in demand, eroding long-term confidence,” he warned. “These kinds of effects — companies closing down — depend on how prolonged the first round is, and what steps we all take to alleviate that first round. It is up in the air”

--

Olivier Blanchard (senior, at the Peterson Institute) opinion:

“There was no question in my mind that [global economic] growth will be negative for the first six months of 2020. The second half would depend on when peak infection was reached, he said, adding that his “own guess” was that this period would probably be negative as well.”

--

Other representatives of the IMF said that the impact of the virus will be “significant” and that growth in 2020 will be lower than in 2019, which was 2.9%.

--

Erik Nielsen (chief economist of Italy’s UniCredit) noted

“Four consecutive quarters of negative global growth followed the 2008 financial crisis,” but mentioned he expected “the impact of coronavirus to last only a couple of quarters.” But he also predicted that the quarterly fall could be as deep as the 3.2% contraction that the global economy experienced in the first quarter of 2009.

--

Gilles Moec (chief economist at French insurer Axa) mentioned

“Trying to plot the disruption from the virus was almost impossible. Our forecasting models are not set up to deal with this scenario.”

--

Other economists were also clear that the economic effects of coronavirus will be serious. Vítor Constancio (former vice-president of the European Central Bank), said:

“The recession is coming from a demand deficiency and the disturbance on the supply chains. The most affected sectors will be leisure amenities, tourism, travel, transportation, energy, financials.”. Vitor, also added: “It is possible that banks’ risk aversion and lack of market liquidity for bond issuance may affect credit and provoke liquidity squeezes.”

--

We also included the answers of three major questions, coming from financial online groups and boards:

1. How much longer are the stock markets going to decline? How great is the decline going to be?

No one knows, and that’s part of the fear that is feeding the markets to go even lower, sinking into an official “bear market.” The key is how long will this health crisis last? How many people will be impacted? And how quickly can the economy bounce back? Right now, no one has enough data to answer those questions, so the market is pricing in the worst-case scenario. What pretty much every economist and Wall Street type We’ve spoken to has said is:

“The US and the affected countries should do a two-week shutdown, similar to Italy. It will be painful. And it will require government help for people not working and businesses really hurt. But the hope is that would stop the flow of COVID-19 and boost confidence in the government’s response to this crisis.”

2. How worried should we be?

The United States is in a bear market, and it’s almost certain Q2 will be negative growth. The question is whether the United States will go into a recession (two consecutive quarters of negative growth). The reason there is such high concern on Wall Street today is investors don’t think the government response is sufficient — from Congress or the White House. A list of worries includes the coronavirus spread, oil price war, and the inadequate government response. So, the key in the coming days is whether Congress can set aside partisanship and pass a fiscal stimulus bill and whether the White House and Congress can backstop the health system sufficiently to start halting the spread of the virus.

3. What market segments will be most likely to weather the uncertainty we are seeing now? The prediction is for people to keep using their mobile phones and online services, whereas cruise ships will take a while to come back, right?

That’s correct. This is the Clorox and Netflix economy right now. The other somewhat surprising winner in all of this is real estate. Mortgage and refinance applications are through the roof. The 30-year fixed-rate hit an all-time low of 3.29 percent, so housing and home-related stocks and parts of the economy are likely to do well. I was just talking to a roofer. His business is down this week, but he’s got a lot of people calling and telling him they want him at their place as soon as this health crisis subsides.

--

As a final statement – the investors need nerves of steel during the coronavirus-provoked-crisis. The short-term effects of the COVID-19 crisis on the economy can’t yet be measured but are likely to be severe. Nevertheless, worrying too much could lead to a weakening of the immune system, so we advise you to stay on the positive side, be safe and stay at home until the coronavirus provoked crisis is under control and the virus is no longer a threat.

I would like to buy and sell shares online

The article will cover some of the rules for buying and selling shares online.

* The first thing you need is a bank account and also in Internet access on your computer.

* The set-up with most of the traders is free.

* There is usually a small fee for every trade/transaction (about £1-3).

* The trading itself is easy and intuitive. You will be offered a price for the shares requested and have a couple of seconds (10-30) to decide if you would like to complete the trade or not.

* The actual payment transaction is done a couple of days later (depending on your account settings).

* With some traders there are rules of how many times you could reject the offer so you don’t constantly bother them just to check the shares price.

* Some traders also have minimum trade quantity – so you have to buy a minimum of 100 shares for example.

* If you have an account with most of the major banks – you should be able to set up an online trading account with them.

* Do not expect to earn tons of money quickly – it really takes time (and some luck) to be a successful shares trader.

* Keep in mind that you could always lose your money (or at least part of it) – so do not invest money you cannot afford to lose.

* There is always a chance. Nevertheless - you should read analysis and have a strategy for every company you are investing in (to minimize the impact of having bad luck).

Labels:

bank

,

shares

,

stock

,

stock exchange

,

stock market

,

trading

Subscribe to:

Comments

(

Atom

)