During the last decade, the investors have come to believe that no matter what - the market only grows, in a long term. Long-term investment in index funds (like S&P 500) has somewhat proven to be the most profitable strategy. But do you know that the nature of the stock market is to grow as a bubble and eventually burst?

We are currently in a pandemic situation. The economy is struggling, unemployment is rising, and there is a lot of uncertainty. On top of that the S&P 500 recovered so quickly from the mini-crash in Mar 2020, and it looks like it have entered a bubble.

Let’s quickly explain the nature of the stock market. There are consistent patterns that emerge in every bubble in history and these consistent patterns are emerging again right now. Unfortunately – every time the investors believe in “but now it’s different” mantra, repeating the same mistakes again and again.

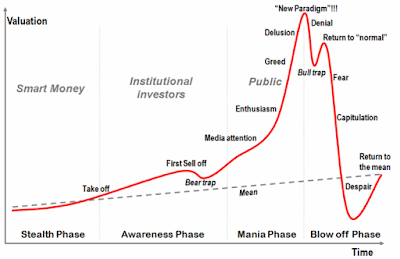

Above you see a chart representing the life-cycle of the stock market. This chart shows the stages of every bubble in history. It starts with the early stealth phase. Next comes the awareness phase as the investments begin to attract attention. Followed by the mania phase – where the bubble grows extensively. Finally the blow-off phase or the so-called crash.

The chart shows perfectly well - how every single bubble in history has grown and burst.

Above is an example of the dot-com bubble. Notice how the charts are pretty much identical. Did people learn from previous bubbles? Well, not so much it seems, at least not enough to avoid it playing out the stock market in the same way again and again.

Above is another example. We have the notorious Bitcoin bubble. This time it's overlaid on the stages of our bubble charts and we can see how closely it does follow it. It is clearly the same pattern so whether it was the "dot-com bubble" or the "Bitcoin bubble" the truth is the majority of the investors never learn and the same patterns are repeated over and over.

Every now and then new technology is invented, it changes the world and the majority of investors think “this time is different”. It’s also important to note that the burst of the bubbles are not always the end. For example the Bitcoin is obviously very contentious as it has shown tremendous staying power since the bubble burst, and maybe hasn't had as much time as the others to prove its worth.

The key point is that many investors fall victim to the same patterns because they think “this time is different”. This mantra have caused every bubble in history to get out of hand, and it is a well-documented pattern with lots of analysis.

Finally, keep in mind that we have clear signs that (in Jun 2020) we are currently in the mania phase of the bubble chart and as the charts show - the crash usually isn't too far behind. So, if you are an investor – be careful and don’t get overexcited.

Showing posts with label burst. Show all posts

Showing posts with label burst. Show all posts

Subscribe to:

Comments

(

Atom

)