Investing tips by Tony Robbins

We will be presenting 3 key tips for beginner investors and everyone who would like to start investing in the stock market, presented by the greatest coach of all time - Tony Robbins.

Here is what Tony said about investing:

The average person thinks finance is so complex because frankly the industry tries to make it sound complex. They use words that you don't know so you don't know what to do... What happens is we just give them our money and say deal with it.

1. You need to know that you can't wait until you have a ton of money to start investing.

If you can invest in business, even a small amount, you can grow. It doesn’t matter how small it is, the important thing is to automate it.

You got to take a percentage of what you earn and pretend it's a tax. You should not waste that money. It automatically goes straight to the investment account and you never see it as money you can spend. When you save 20% and you compound it, the numbers are incredible. And then the problem is: If you do that first step, but you don't do the second step which is:

2. Become an insider and understand the rules of the money game. I'll give you 2 or 3 of the Myths, really fast:

2.1. One, the myth that someone says give me your money and I'm going to beat the market. Over any ten year period of time, 96% of the mutual funds will not even match the market.

Warren Buffet flat out used to confirm the same trend. 96% of his money, all that money does not go with any mutual fund, it goes straight into the index.

What the index is you get a piece of all the largest companies in the world but it costs almost nothing to get in. You hire someone because you are thinking "I have a family, I have a business, I have a life, I'm not an investor- I'm going to hire someone who's a professional, it makes sense they would do better than me."

Unfortunately that's wrong.

Only 4% of the mutual funds will beat the market. 4% chance of finding the right mutual fund, the chance is so slim that it will happen.

2.2. And, the second myth is after getting terrible performance, people think "Maybe, fees don't really matter" or they'll tell you it's only 1%. And on Forbes, it says the average fee is 3.12%,

1% versus 3% is a big difference. And it really matters - just like you grow by compounding, your fees also compound. If you have 3 people and one gets 1% fees, another 2% the other 3%, and they all get the same return. And, they start out with 100,000 dollars at 35, accumulating for 30 years until they are 65 years old. If it is average 7% compounded, they all get 7% return and when they go to retire, the person who had 1% in fees is going have 574,000 dollars. The person who had 3% in fees will have only 224,000 dollars. This is 77% less money!

If I said to you: "Here's the deal, let's do an investment. You put up all the money, you put up all the money, you put up all the risk, I'll put up no money and I'll put up no risk. If you lose I win, and if you win I win and if you win, over the life of the time I'll get 60% of what you earn." That's a mutual fund with 3%.

3. Instead, you could own the stock market – invest in the S&P500, you could own a piece of all 500 big companies through like the Vanguard 500 and you get the best of all the business - Apple, Exxon, etc… All these companies – you invest into and it cost you only .17%. And if you go to a normal mutual fund you might own the same companies for 3.17%. That's like buying a Honda Accord for $20,000 in the first scenario or $350,000 in the second for the same car.

That happens every day with finances because people don't know how to look at this so when they read the book Money Master the Game: 7 Simple Steps to Financial Freedom that will never happen to them again.

Top tips for Investing in the stock market by Warren Buffett

Sharing the 5 top tips for investing in the stock market, presented by not anybody else, but the one and only – Mr. Warren Buffett himself.

1. I don't know when to buy stocks, but I know whether to buy stocks. Some people should not own stocks as they just get too upset with the price fluctuations. If you're going to do dumb things because your stock goes down, you shouldn't own the stock at all. I mean that if you buy your house at $20,000 and somebody comes along the house and says I'll pay you $50 – well, just don't sell it.

2. The best thing with stocks is to buy them consistently over time you want to spread the risk as far as the specific companies you're in by being versatile and you diversify over time by buying this company stock this month, that company stock next month. Year after year after.

3. If you save money you can buy bonds, you can buy a farm, you can buy an apartment house or buy a part of the American business. And if you buy a 10-year bond now you're paying over 40 times earnings for something which earnings can't grow, and you know if you compare that to buying equities good businesses. I don't think there's any comparison.

4. You are making a terrible mistake if you say out of a game. Probably you think, it is going to be very good over time because you think you can pick a better time to enter the stock exchange market. The later you start, the worse you will be: in terms of knowledge, experience, and money.

5. I know what markets are going to do over a long period of time. They're going to go up, but in terms of what's going to happen in a day or a week or a month or a year, even I've never felt that I knew it and I've never felt that was important. Keep in mind that in 10 or 20 or 30 years, I believe, stocks will be a lot higher than they are now.

10 Money questions to answer by age of 30

As usual, we continue our never-ending mission to provide you with the best money-related answers to the top money questions. Today we will cover the top 10 most important money questions you need to answer by 30.

1. What is your net worth?

It is surprising how many young people do not know, neither care about their financial worth. Although it might be true that your personality worth cannot be measured in money, you need to be aware at every moment what is your financial stats. In terms of money – net worth means the monetary sum of all your assets (real estate, car, furniture, cash, saving accounts, investments, stocks) minus all your liabilities (debt, financial obligation, mandatory spending).

Precise calculation of your net worth is not an easy task. You need to consider the current market value of your assets, not the price you bought them for, but the price you can sell for. Calculating and understanding your net worth provides you with complete insight on how you are doing, and helps you elaborate your future financial goals.

2. What is your credit score and why is it important?

(we already deeply answered the money question in What is a credit score? article)

Your credit score number is a three-digit indication to potential lenders of your ability to repay money you borrow. The FICO score is the most commonly used, ranging from 300 (worst) to 850 (best) and is calculated based on the following factors: payment history, length of credit history, credit utilization ratio, the mix of credit types in use and number of credit inquiries.

You should aim for an excellent FICO score It includes anything from 750 to 850. The next category down is between 700 and 749. It is still considered good, but it might not get you approved for the best deal the lender offers Anything below 700 – you should consider fixing and improving before even consider borrowing money. Otherwise, even if you qualify for a loan, you might not be getting the lowest possible interest rates on that loan. Mortgage lenders and credit card companies usually reserve their lowest rates and largest loans for people who have exhibited a quality track record when handling credit.

3. How much money do you have, saved in your emergency fund?

It is advisable to have enough money in your emergency fund to cover your living expenses for you and your family for about 6 months. It might sound a lot, but you will be grateful to have access to the money in bad or even worst-case scenarios – losing your job, coping with emergency repairs, or even medical conditions.

Your first goal should be saving 100USD, then eventually growing the saving to 500-1000USD, until you reach the sum of your 6-months expenses. For some people this could be as low as 1000USD, for others it could go up to 10000USD and above. The worst case that could happen to you is the need to declare bankruptcy (we will cover extensively the disadvantages of bankruptcy, and those are not trivial), due to some extreme event.

4. Where do you put an excessive amount of money; you will need in 1 to 10 years?

Plan carefully your financial future. If you are going to need the money in 1 or 2 years, consider buying a Certificate of deposit. They provide a better interest rate than saving accounts (also have some disadvantages). If your timeframe is longer, consider investing in stocks, shares, and bonds. Just be aware that, while the stock market has historically gone up over time, it can go up or down in the short run. Keep in mind that past performance doesn’t guarantee future returns. While stocks may provide higher growth opportunities than Certificates of deposit and Bonds, you want to allow enough time to ride out the downturns and may consider relocating funds into more conservative options to cope with shorter periods of time. Investing in a mix of stocks and bonds is advisable as it lowers your risk.

5. What dividends and interest money do you get?

Interest money is usually paid by the bank on your deposited money, while dividends are periodically paid by companies to you as a shareholder. Dividends are typically paid in cash or additional stock shares. If you are an investor, this is a good way to collect some income while still investing for higher returns. Always keep in mind that dividends might be subject to taxes.

6. How do you diversify your financial assets?

Diversification means spreading your investments across a variety of assets. Those include cash (in different currencies), real estate, stocks, bonds, certificates of deposits, and so on. You don’t want to be putting all your eggs (erg… we mean ‘money’ :)) in one basket. An example of a good stock market allocation would be to invest in companies in the US and abroad, small, medium, and large, well-established (usually considered safer), and rapidly growing businesses. Ideally, you are aiming for a well-diversified portfolio, including deposits, cash, real estate, other properties, to cover for market fluctuations – when some go down, others go up.

7. When are you going to be debt-free?

Calculating your numbers is only one part of the equation. You also need a solid repayment plan with a solid end date. Create your schedule and include a plan for repaying mortgages, student loans, and other loans. If you managed to secure the best term loans and the rates are very low - you might not need to bother paying your debt faster.

On the topic of the credit cards – be very careful with them. If you only pay the minimums, you’re wasting a lot of money on interest and losing a lot of money you should not. Always be careful with credit cards and always pre-calculate how your financial balance change if you are up to paying more and faster.

8. How much money can you comfortably spend on housing and mortgage?

As a general guideline, experts’ advice is to limit your housing expenses to a maximum of 30% of your income. Many lenders obey that number and don’t even consider approving mortgages unless your proposed home expense compared to income ratio is 30% or less.

It doesn’t matter if you rent, lease, or own the place. Always try to lower your housing costs as upkeep and repayments could become huge and threaten your financial stability.

9. What types of insurance do you have and need?

Again, the experts suggest considering life insurance, home insurance, and automobile insurance as the minimum – in order to avoid sinking down in cases of emergency.

If you own your home or car, often you’re required to have insurance, and the minimum mandatory requirements vary depending on your location and specific case. Renters insurance may seem optional, but sooner or later you will realize that it is essential to protect your personal belongings, not to mention some modern buildings require it. Life insurance is a great way to ensure your relatives will be covered in the worst-case scenario. Consider it – especially if you have kids dependent on you.

10. How much do you save for retirement?

There is no golden money advice, as everyone has different goals for retirement finance, but most of the experts suggest you save between 10 and 20 percent of your annual income. Again, it depends on your vision and goals. Some people prefer investing, instead of putting money into retirement plans. Nevertheless, retirement plans are a good option. If you can’t afford much try to just save something there and increase a little with time when possible.

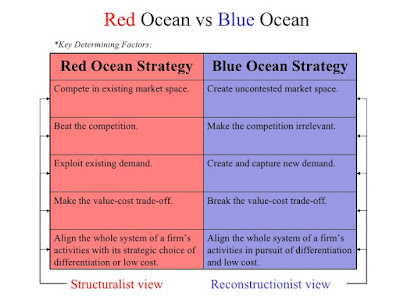

How to make competitors irrelevant

Nowadays many business owners struggle to impress the consumers with their products in the endless sea of competition. Renee Mauborgne and W Chan Kim bring salvation to all of those businesses, experiencing frustration and inability to outcompete the other players on the market.

The book we are going to discuss today is Blue Ocean Strategy, Expanded Edition and we highly recommend it as the ideas and examples are mandatory knowledge for everyone doing business in nowadays oversaturated markets.

An overall belief is: if a business owner wants to be successful the business needs to beat the competition. But Renee Mauborgne and W Chan Kim believe that striving to beat the competition in an established market is a very unwise business strategy, especially if your business tries to compete over an established market (e.g. fast food, health & beauty, fitness markets).

If your business is trying to outperform the competition you are adopting what the authors call “Red ocean business strategy”. Nowadays, thanks to globalization, the widespread access to information, and the major improvements in technology it is very easy for business owners to try their luck into an established market. The consequences are vastly oversaturated markets, and the only business strategy for success in such markets is to compete with the other businesses for market share. Those battles (metaphorically) turn the waters bloody and this is where the term “Red ocean” comes from.

The alternative for the business owners is to sail past the “red oceans” and focus on searching and creating a “Blue ocean business strategy” for untapped market potential. According to the authors, this will greatly increase the new business’ chances of survival and profitability. The authors studied about 110 new businesses, across more than 30 different industries. About 100 out of those businesses adopted “Red ocean business strategy” and only a small number of businesses dared to adopt “Blue ocean strategy” to avoid competition. They searched for (and created) new markets to dominate. After some time, the authors measured the collective profits of all the companies and found out, that the “Red ocean” businesses only accounted for about 40% of the total profits, while the “Blue ocean” businesses managed to generate 60% of the total profits.

Renee Mauborgne and W Chan Kim studied the companies extensively for years and discovered that the “Blue ocean” businesses dominated their respective markets for 10 to 15 years after their initial launch, while many of the “Red ocean” businesses run out of business after a couple of years (or sooner).

As a business owner, you are probably asking “Ok, how could my business use blue ocean strategy and make competitors irrelevant?”. We will provide some examples of companies and how they did it.

Casella wines

They used a “Blue ocean strategy” to find an uncontested ocean of opportunity and dominate the market for over a decade, by creating a new category of wine, and become the best-selling wine in Australian and United States history.

Casella wines set out to create a successful new wine product. They knew the market is oversaturated and competing with existing wine brands in the traditional manner would be extremely difficult. If they have chosen a “Red ocean strategy” they would need to establish the brand over the span of several years and hope to win several awards along the way, hoping to gain the favor of existing wine drinkers. Those should have been a lot of investments leading to some very uncertain results.

Casella wines decided to take a different approach instead, and not only focusing on wine drinkers like most wine businesses. They mainly focused on beer and cocktail drinkers’ consumers in adjacent markets of other alcoholic beverages, who either infrequently drank wine or avoided wine altogether. They approached these non-wine-customers and ask them a few questions. E.g.: why did they avoid drinking wine and what was specifically discouraging them from drinking wine. These non-wine-customers shared many of the same reasons for avoiding wine. One of the most important reasons was that purchasing wine is intimidating, and having to choose from such a large variety of wines makes the process of purchasing wine overwhelming and time-consuming. Another important business discovery was that most non-wine-drinkers find wine unpleasant to drink – as it is either too bitter, harsh, or too sweet. Another reason was that those non-consumers believed wine is simply not so much fun to drink, compared to beer, cocktails, and other beverages. The wine seemed too fancy, traditional, and elitist.

Casella wines business accepted the challenge and set out to make a wine that would appeal to

these frustrated consumers of non-wine-drinkers. At the same time, they kept producing a wine that would be considered high quality to most wine drinkers.

The newborn wine product was called ‘Yellowtail’. The non-wine-drinkers found it very easy to purchase, drink, and enjoy. It was sweet enough to keep their palates fresh and keep them wanting more but not too sweet as to be associated with cheap and low-quality wine.

Casella wines had created a new category of wine that was fun, easy to drink, and relatively high

quality and ultimately caused a large portion of the non-wine-consumers to embrace the new category of wine. The new product provided incredible value; ‘Yellowtail’ was a high-quality innovative product at an incredibly good price. A price that was comparable with most beers and much cheaper than most of the cocktails.

The business strategy to create an innovative new product, while the same keeping costs low is what Renee Mauborgne and W Chan Kim call “value innovation” and it's at the heart of every “Blue ocean business”. To achieve value innovation and discover blue oceans of opportunity Casella wines adjusted four levers during the development of the ‘Yellowtail’ (eliminate, reduce raise, and create).

1. Eliminated the aging process of the ‘Yellowtail’ wine and saved money on oak barrels and storage costs.

2. Reduced the inventory to just two wines. They offered just a white Chardonnay and a red Shiraz. Operating at minimum inventory reduced the cost of their product, while simultaneously increasing the appeal to infrequent or non-wine-drinkers who valued something much simpler.

3. Casella wines raised the freshness and drinkability of their ‘Yellowtail’ wine, so it was easy on the palate like beer and cocktails.

4. Incorporating practices from adjacent markets like the beer industry Casella wines created a new wine label that was simple and somewhat adventurous like many beer labels. The label just had a picture of a kangaroo and stated that the product was from Australia. Casella wines removed information about the age of the wine and there was not any fancy terminology that stressed the art and science of winemaking and confusing the consumers. Casella wines also came up with a bottle that could be used by both white and red wine. The first of its kind, but it was something that the beer industry had been doing for years.

Playing with these four levers allowed Casella wines to create its own wine category of fun, unintimidating, easy-drinking wine and it attracted a whole new group of customers to the wine market in an area of the market that Casella wines could dominate for years to come and due to their “Blue ocean business strategy” they created the category of fun, easy-drinking wine they had a huge head start on the competition, making it extremely hard for competitors to steal any market share from Casella wines.

--

This is the power of “Blue ocean strategy” and there are several businesses which have used the strategy to dominate their market.

Another blue ocean business example is ‘5-hour energy’ (or the alternative Moose Juice Energy Shots)

It is a mini energy drink that you see on the counters of almost every convenience store in the US. ‘5-hour energy’ created the new energy drink market of two bottles, and it maintained a 93% market share of that market category despite competition from major competitors like Coke and Red Bull. Because the business owner created the category and got out to a huge lead on future competitors ‘5-hour energy’ continued to dominate that category nowadays.

if you, as a business owner are interested in finding blue waters for your next business idea and try dominating a market niche for years start by focusing on 1. the frustrations of customers outside of your current market space and 2. look at existing products or services within the market and ask yourself:

1. What can my business eliminate?

2. What can my business reduce?

3. What can my business raise?

4. What can my business incorporate?

… to create something new and attract infrequent or non-current customers.

By pulling these four levers any business owner can gradually develop a product that defies the status quo and creates a new product category that the business will dominate for years. As a business owner, you should stop focusing on how you could beat the competition and start focusing on how you can make the competition irrelevant. That’s what every business owner should learn from the “Blue ocean business strategies”, described in the book Blue Ocean Strategy, Expanded Edition

p.s. As usual, if you would like to support the 'Money Questions' blog - please buy the book and other linked products, using our affiliate links.

Where’s my stimulus money (US)

We continue answering the most relevant questions send to us via FB. Guys, thank you for the great money questions and keep sending them. We will be picking the most pressing ones and answering them here.

Today we will focus on the COVID-19 outbreak financial news, leading to the signed about $2 trillion stimulus package into law some time ago, as a response to the COVID-19 pandemic that has staggered the U.S. economy for the last couple of months.

1. The Internal Revenue Service have already started cutting stimulus checks since mid-April, and it’s already gotten money to nearly 130 million people. Everyone who received the payments should be satisfied as there is 1 200 USD in hand to spend, anyway people want to. This is to battle the massive health and financial consequences of the COVID-19 crisis.

So far IRS paid out about 230 billion USD, according to statistics released in the middle of May. The 2.2 trillion USD relief bill is called the CARES Act. It sets aside 290 billion USD for direct cash payments to individuals and households. The federal agency slated to put approximately 5 million checks in the mail each week, for up to 20 weeks.

There are people, though, still waiting to receive their stimulus money, so here are the most common reasons for still waiting for your stimulus money check.

2. Maybe the IRS doesn’t have your bank-account information on file? Those are approximately 14 million Americans, according to a Federal Deposit Insurance Corp. survey from 2017. And that’s about 6.5% of American households.

If you are one of those, you are urged to open bank account as quickly as possible so you can get your stimulus money quicker. This will not only speed up the process, but also will help you bypassing pricey fees from check-cashing businesses, some of which can charge more than 50 USD to cash a stimulus check for a family, according to a recent analysis.

After opening a bank account, you can submit your bank information to the IRS. If you don’t file tax returns (some people don’t make enough money to file), you will need to submit the account information via an IRS website for people who don’t file tax returns. Here is the web link:

3. People who have filed the need information, but still did not give the IRS their banking information can submit direct deposit information through an IRS tool called Get My Payment (there will also be a Spanish language version in a couple of weeks, according to the IRS). The tracking tool can also show payment status, but some people have complained that the tool doesn’t give them any information.

4. You might not get positive answer – and there are good reasons for it, according to the IRS.

4.1. Common case is - the agency isn’t done processing yours 2019 return. It could also be that you usually do not file a tax return and has submitted non-filer information via the IRS web portal, which is still being processed.

4.2. You make too much money in order to be stimulated. If you are one of those, you might not be getting a 1200 USD stimulus payment.

The Coronavirus Aid, Relief and Economic Security Act, authorized 1 200 USD payed to individuals, making less than 75 000 USD yearly, and 2 400 to married couples earning under 150 000 USD. Over the program the parents will also receive 500 USD for each child (aged under 18). The payments will decline by 5 USD for every 100 above the 75 000 or 150 000 threshold. If you are making over 99 000 USD, you will not qualify. The couples limit is making over 198 000 USD.

If you exceed the income limit, you might still have a chance to get the stimulus money over the next year. That’s because the stimulus payments are an advance credit for next year’s tax season. The credit is just being paid now. And, if you made too much money based on the income-tax returns you have filled for 2019, you could still get the money based on the tax returns you file in 2021 for your income in 2020.

5. Another person is claiming you as a dependent

If you are a young adult, you might be missing out on stimulus money because your parents have claimed you as dependent. When it comes to stimulus checks, the IRS counts a dependent as under age of 18. And it could happen if the IRS is only reviewing a 2018 return. It could be looking back at a point in time when you were a high-school senior when now you are in college.

6. If you have married a green-card holder, it doesn’t necessarily mean a second stimulus check.

If a spouse was married to a green-card holder and present in the United States before they received permanent-resident status, they, too, should be getting a check. But if someone married a green-card holder afterward, they wouldn’t get the same benefit. Receiving a stimulus check shouldn’t usually disrupt a person’s path to citizenship, if they already have a green card. The main rule is that no one is giving you anything, instead it’s something you’re entitled to.

7. Your immigration status could be complicating matters

The government is paying the stimulus checks to U.S. citizens only. The checks are also going to certain categories of non–U.S. citizens. This includes “legal permanent residents,” also known as green-card holders, according to the IRS. Nevertheless, if someone still has a green-card application pending, they may not be getting a stimulus check, at least not any time soon. U.S. Citizenship and Immigration Services (USCIS) field offices, which administer in-person interviews before issuing green cards are closed temporarily until June 3. Whenever the USCIS reopens its offices, it’s likely green cards will be issued at a slower pace, meaning a slower payout of money stimulus to new green-card holders.

8. Glitches in the system could be slowing delivery

Some national tax preparers offer advances on a client’s refund, with the money loaded onto a debit card. Yet that could mean the IRS might not be putting the stimulus money in the right account. The IRS sometimes “created confusion by not always using clients’ final destination bank account information for stimulus payments.”, claimed a bank representative.

That’s why, it is advised for everyone to update their direct-deposit information on the IRS’s Get My Payment tool. But if the IRS already put the money on a Serve or Bluebird card that the customer no longer has, go to that account and ask for a replacement if that’s possible.

9. It is possible a debt collectors to be taking your money

It is important to understand the wording of the CARES Act does not prevent private debt collectors from seizing stimulus checks that suddenly come into a bank account.

A debt-collection trade group said members are “acting with compassion” at this time, but, even still, it noted, collectors wouldn’t know the source of money that suddenly comes into an account. It’s also important to know state laws. Approximately 10 states plus Washington, D.C., and several other cities and counties are enacting orders preventing garnishment of stimulus checks money, according to the National Consumer Law Center.

What is a good business strategy

Yesterday, a business owner asked us for advice on business strategy over our FB page. He wondered what a good business strategy is, and what business strategy should his team adopt, for his company to be more successful and dominate the market. He liked our easy to read and comprehend articles and asked to keep the answer simple and easy to understand.

And here we go – answering “What is a good business strategy and what strategy your team is to adopt for your business to be more successful?”

We are going to explain one of the best models out there, described in the book The Competitive Strategy: Techniques for Analyzing Industries and Competitors

Michael Porter published his famous book in 1980 and most successful companies have used it as the number one guide to dominate markets and smash competitors with style.

There are 3 major elements defining your business strategy, spread over two dimensions. Based on the reach of the market those are: broad or narrow (niche) markets; and based on competitive advantage there are low cost (price) and/or differentiation.

1. In the top left corner, we have the "Cost leadership strategy". Companies, adopting the strategy aim to become the lowest-priced provider for a broad customer base.

To achieve the goal, the business strategy outlines items such as: efficient and lean production methods; closer relationship with suppliers (to get discounts); investing in cutting edge technology to reduce costs; and efficient distribution network.

Examples of such companies are RyanAir, Amazon, and Poundland. All of them tend to operate over large-broad markets and provide the lowest possible price for the largest customer base.

2. In the top right corner, we have the "Differentiation strategy". It's characteristical for the companies doing something completely different and unique and providing unique service and experience to charge premium rates and have the customers pay more.

It is achieved by delivering exceptional quality; astonishing brand value, while at the same time the level of distribution remains wide enough to cover the entire market.

Examples of companies adopting entirely "Differentiation" business models and strategies are Apple, Mercedes-Benz, and Disney parks and resorts. They create unique experiences for their customers and charge high to profit out of them.

3. In the bottom left we have the "Cost focus strategy" in a narrow market. It is used by companies to dominate very niche markets purely by offering the best possible value (in terms of costs) and price.

They achieve this by specific innovations, cost reduction techniques, complete automatization, and removal of anything that generates additional cost.

One of the most successful companies using the cost focus business strategy is Aldi. They offer a very limited variety of products in unappealing warehouses, with a reduced number of employees, and at the same time offer usually the best prices possible. Another completely different example is IKEA, offering stylish and well-designed furniture at a very reasonable price, by producing the materials abroad, and keep the service level at a minimum.

4. The last (bottom-right) quadrant contains the "Differentiation focus strategy". This strategy is characterized by the idea of using uniqueness and differentiation in a niche and focused market.

This is achieved by a high level of innovation, specific and focused customer service and features, valued by a small group of wealthy enthusiasts.

Examples of companies, using such business strategies, are Rolls Royce, Harley-Davidson, and Ducati. They all offer unique experiences and features in their products and charge premium prices for them. On the other side, there are companies like Costa Drive-Thru. They offer the same high-level quality coffee and tea for customers who do not have the time and availability to sit down and would like to have it on the move and would pay for the pleasure.

--

So, the bottom line is – choose carefully the business strategy you would elaborate and follow to match your business vision and goals best. Define if you are aiming for a niche market or broad audience. Also focus on either providing some unique and distinguishable experience, feature, or services – to be able to charge premium, or if your product is more on the mainstream side, you would need to provide it in a cost-efficient manner, lowering the price. The worst option for a business strategy is to stay somewhere in the middle and try to serve customers in all the quadrants. Companies, struggling in terms of business strategy models are Yahoo, BlackBerry, Nokia, Morrisons, Sony. They all failed to innovate at such a level to end up with a unique and differentiating product or service, while at the same time were not able to reduce the costs at such levels to be able to offer the best possible prices on the market.

How debt could help you generate money

Yesterday we got an interesting email from a guy named Tom. He challenges our articles and ideas about saving money and investing savings. Tom is sharing the idea that rich people never save money – they make money out of the money of the others. Borrowing money with low interest and investing them into profitable assets.

Tom really has a good point so in this article we will cover how and why debt could be considered something good and could earn you a fortune.

1. Not everyone has enough capital to start their own business

If you have a brilliant idea or discovered a profitable niche waiting for your savings to grow until you invest in it might be not so clever. In the best-case scenario, somebody might get into the niche or simply steal your idea and make it true, benefiting from it. Timing and execution are the primary reasons behind each success story.

Also, if you have a working business model and you want to expand on it, then basically debt could be a better option to go and get capital instead of waiting for your savings to grow up. This is true, especially if you don’t want to give away equity. A lot of business owners prefer to keep most of the ownership to themselves and build the business from the ground up. After all, it’s their idea, their dream, and their sweat and tears.

2. Borrowing money to invest in real estate

Real estate is thriving most of the time, and although it might be slow and dependent on the country or region, as a rule of thumb a property nowadays cost much more than 20-30 years ago. In some countries and regions, it could be more than 300% increase in the value.

If you want to invest in property, make sure to do some analysis to make you can use it as an investment. So, when you borrow money the tenant or if it is a commercial property then the business owner who is renting it is going to pay you a monthly rent. Using this income, every month you would be able to cover the payments on your debt and probably even have a little bit of cash leftover.

3. Borrow money only if you will be generating wealth out of it

If you know how to use and invest money correctly, by any means debt is your friend. It is important to remember - every time you borrow money you need to understand that you have to have the money to pay for it. Therefore, it's important not to borrow money if you just want to go and buy presents for your family, but only if you are going to invest and make more money out of it. The only time that you should borrow money is if you know that you can create enough cash flow from that debt to pay off the debt.

4. Borrow money when your business has a minimum 30% return out of it

If you own an Amazon business or Shopify, or even a regular convenience store and you know that whatever money you put into the business - you can make a minimum of a 30% return on your capital, so you should be able to pay back your debt with that money and be able to grow faster your investment, than debt is the best way to go.

5. When you borrow money you leave most of your cash for emergencies

You are not depleting your actual cash flow and actual cash so in any case of unforeseen events, you would be able to stabilize faster and not lose your business to an unfortunate event.

If you ever have a down month, or you need to get more supplies or if you need some equipment it's best to have a little bit of money saved for your business. Most markets and environments are unpredictable, and there are always good months and bad months

A good example is the retail business. Usually, the Christmas season is strong, so November and December are usually profitable. At the same time in January the sale drop and then throughout the year they're more or less consistent, depending on the type of business. Some businesses have a strong summer, while others are growing over the winter season.

6. You can use debt when it comes to leasing

There are a lot of business owners who need better machinery or equipment for their business. They are usually expensive, and it is much better for some business types to consider leasing, instead of permanent purchase. Your business will save thousands of dollars if you just lease and will only be paying for the time that you're using the equipment and the machines and when you don't need them anymore, depending on your lease contract, you can return it or you can exchange it.

Very often that's a 100% tax write-off and when it comes to the debt you borrow to pay for the lease it's 100% percent tax write-off so you're getting a tax advantage and you're able to grow your business a lot faster. That’s why many business owners, as Tom mentioned, prefer debt when it comes to growing wealth than anything else

7. You can borrow against the business

That's cool. It is a good idea to keep your personal and your business separate. This is a very strong foundation for your business so your business can borrow on its own merit. When you're borrowing against your business idea then it is possible to have the business as a warranty.

If you try to borrow money on a personal side, the bank will ask you about your credit score (we covered in the previous article). Your credit score needs to be good; you need to have low utilization rates, and you need to have enough income to support the monthly fees and taxes.

The other way to borrow money from the bank is through a balance sheet, from your business.

A balance sheet shows the bank your financial education and if you are borrowing from the bank, they want to check how much cash flow is coming in; what's your business model like; how much debt are you going to be taking on; who's going be paying for that debt.

Therefore, you need a financial statement and balance sheet and if you can show the bank that you did your homework and your financial IQ is good then they can lend you even more money.

--

As a conclusion, it is true that the richest people in the world use debt to generate more money than anything else. After the gold standard removal, and the inflation rate skyrocket – many see money as plain pieces of paper already, without any value. So, having such a mindset helped the rich borrow huge amounts of debt, invest smartly in something more tangible, and generate huge amounts of profit. We would also like to warn you to be careful though. Make sure you have a good plan and profitable place to invest the debt, otherwise it will just be a liability to you and not bring you any benefit.

What is a credit score?

Every time you apply for credit (mortgage or any other loan), the bank (or lender) would like to know what is the risk involved into loaning you money. Usually the lending institution issues a credit report and most of the time part of that report is your credit score. It helps the lenders evaluate your profile and your application for credit.

The credit score is just a number, rating creditors use to assess the risk when making lending decisions. There are two most commonly used credit score providers. The first one is FICO. And the second VantageScore. The components of the credit score are: the debt you currently have; number of credit cards you own and any unpaid amount on them; paying your bills on time; how much of your money is blocked monthly; how much your income is, etc…

The credit score range between 300 and 850, and it affects the financial decision if a loan is going to be granted to you or not. It could even be required and checked by landlords – and if low, there could be a refusal to rent a place. Your credit score influence the amount of credit available to you and the terms (interest rate, period, discounts, etc.) that lenders are going to offer.

A credit score of 700 or above is considered good. An excellent credit score is such of 800 or above. Keep in mind most people credit scores range between 600 and 750. The higher the score, the better credit decisions and more certainly a credit will be given to you.

There are sites online where you may check your credit score for free, anytime you need to. Example of such website is: Clearscore. Your credit score impacts all of your adult financial live, so check it out.

Labels:

credit

,

credit card

,

credit score

,

debit

,

fico

,

loan

,

money

,

vantagescore

Should I keep my money in the bank

Recently, we received a question from a guy who seems to have a lot of money and asks should he keep them in the bank or at home? As usual, we will answer the money question looking at it from different angles and providing the best financial option.

1. Storing money at home is not a good idea

It depends on your income, but in general, if you keep more than 200USD in your house – that’s a bad idea. There are two main reasons for this. You might get robbed, or you might lose your money via an accident (fire, neglect, etc…)

2. You are losing on interest rate

Yes, we know the rate is negligible (nowadays), but even so, every bit is important. Besides, the interest rate might change in the future as currently, it is at minimum for over decades.

3. Money loses value over time

Sad but true. Printing money and “healthy inflation” are the main reasons. The devaluation is actually huge and about 3-5% over each year (could be more during a crisis). One US dollar in 1913 had the same buying power as 26 US dollars in 2020. That’s 2600% devaluation for a little bit more than 100 years period, and it means roughly 260% devaluation per 10 years. The recent 20 years were not so aggressive, so it could be less but probably still about 100% for the recent 10 years.

4. Money is protected in the bank (in many countries)

The banks are the safest place for up to a specific amount of money. In many countries, governments issued protective laws and directives to protect a certain amount of money. In the UK for example, the money is protected by the Financial Services Compensation Scheme (FSCS) for up to 85,000 GBP, per person per firm in 2020.

In the US the Federal Deposit Insurance Corporation (FDIC) insures the money deposited into each bank, up to 250,000 USD for each account.

It is important to remember – if you have more than that limit stored, move the excess to another bank to be fully protected in case of emergency or crisis.

5. Accidentally throwing away cash or leaving it behind

It happens more often than you could imagine. Many people reported they completely forgot about the money stored in the mattress and when throwing it away or leaving the place, the money was gone for good.

In June 2009, an Israeli woman threw out an old mattress. What she was not realizing - it was stuffed with her mother's 1million dollars life savings. The culprit, identified only as Anat, had bought the new bedding as a surprise for her mother. When her mother found out about her gift, she lost consciousness, before revealing the contents of the mattress.

Ontario man forgot about 100,000 CAD inside an old TV. He hid the money decades ago and completely forgot about it. Luckily, the TV was sent for recycling and the employees of the Ontario recycling plant were in shock to find the treasure well hidden, inside the crappy TV.

So, the bottom line is – it’s really a bad idea to keep money at home. It’s much better to keep them safe in the bank or invest using alternatives we will be covering in a future topic.

How to make money during COVID-19 crisis

COVID-19 crisis hit hard the economies of both the developed and developing countries. If you are one of the many staying home, either employed or not it is time to consider the new opportunities to make money. In the previous article “Sectors and companies benefiting from the COVID-19 crisis and national quarantine” we discussed the sectors and companies benefiting from the crisis. Now it’s your time to learn from the winners’ experience and start benefiting yourself.

1. Use your current skills

Any of your skills not involving face-to-face contact would work. Maybe you can sing, write articles, create videos, do graphic designs, teach or just create value by streaming activities. Now is the time to do it. Post over social media or create a simple free page and gather groups and clients.

Streamers earn millions of dollars streaming gaming or any other recreational and educational activities. Try Twitch today and start gathering followers, clients, donors, or patrons for your business or services.

2. Acquire new skills

Now is the perfect time to educate yourself into more profitable skills to serve you over the next decade. Always wanted to be a better investor? Read those books and take those courses you never had the time before. Maybe you wanted to learn how to marketeer your products and services better – there are plenty of free resources online. Never had the time to gather and create clients' e-mail-list – you should be able to now. Or, you are up to a completely new career path as a techie, start learn programming, designing, or engineering – there is no better time.

3. Adjust your mindset and change the way you serve your clients

Be creative.

Fitness gurus use YouTube and Facebook to keep their clients in shape. Makeup artists, singers, and photographers do tutorials and give lessons and offer services online. Master Chefs use Instagram, blogging, and video streaming to show recipes of their latest masterpieces in the kitchen. Have a look at your competitors and partners. What do they do to mitigate the income impact of the COVID-19 crisis and even earn more?

What your clients need the most? How could you serve them without face-to-face contact? Don’t be afraid to experiment, don’t be afraid to create a survey and ask your clients how you could serve them better online.

4. Become a freelancer

Try some freelance work at Freelancer.com or Upwork. They list creative, mostly technical, jobs to be done remotely. If you already have the technical skills, those are your best bet for additional income.

Learn how to create business and action plans. Try planning the rest of the year. Outline everything important to you and your business in the plan – your clients, your main sources of income, your timeline for executing and delivering your services, the budget needed, and the income expected. Put everything in a timeline, and don’t forget that the plan would probably change… and that’s ok. But still, your vision and your goals to achieve the vision should remain as close to the original. There are many templates, tutorials, and guides online – how to create a financial plan and how to adjust it when needed.

Keep in mind – the COVID-19 crisis will sooner or later end, elaborate vision, and plan actions and goals to achieve after the crisis.

6. Train, mentor, and coach

If you are already an expert – do not hesitate to promote yourself as a trainer or mentor for those who would like to learn in your field. Offer discounts to attract trainees or just train for free to gain more popularity and clients later. You can use Skype, MS Teams, Zoom, or any other platform for your teachings.

7. Promote your business with vouchers

People love vouchers and now is the best time your business could benefit from giving away vouchers for your products or services. It works not only online but for businesses like hotels, bars and events. Maybe some clients would like to cancel their reservation? Instead - offer them a discounted voucher to use your service or do the reservation later, up until the end of 2020 or even 2021. This way you are not going to lose business.

At the same time provide gift-cards and vouchers to every client currently using your services. This way their loyalty will increase, and they will keep coming back to your business.

8. Work online as a QA or feedback provider

There are plenty of sites offering opportunities to test products or take surveys and provide feedback. They will pay you for your time. In the meantime, you could use the opportunity to check what the other companies are doing and what products and services they require feedback on. In the long run – this will help you improve your own services and products to earn more money.

9. Sell unused items online

You could eBay your unneeded items at home, not only generating some cash but getting rid of those unnecessary items. Maybe you have an expensive car? Now is the time to get rid of it. Or you have another laptop you barely ever touch – it’s time for it to go for good.

10. Offer services to people in need

There are a lot of people in need and you could either volunteer or work part-time for them. Elderly or vulnerable people, staying at home could need somebody to do some shopping or simply walk their dogs. Although these would not earn a fortune – they are a nice extra additional income for some little time and effort on your side.

Subscribe to:

Posts

(

Atom

)