We continue delivering you great articles about successful financial mindset. This time the brilliant ideas are shared by Robert Kiyosaki. Enjoy.

The most obsolete idea is - go to school, get a job, work hard, save money, get out of debt and invest for the long-term in the stock market.

Why would you save money when they're printing trillions of dollars? The gap between the 1% and 99% is massive. It's not just money, you have to step back and look at the bigger picture.

So, what do you do?

In every one of us there's a poor person, there's still a poor person inside me. There's also a middle-class person, and the middle-class person wants security they want that steady paycheck. And there's a rich person. And they're all inside of us except that... It's not taught.

You're taught to go to school, get a job and get a paycheck. Not taught how to get rich. If you've read Rich Dad Poor Dad, my rich dad refused to pay me. He said the paycheck was one of the most damaging things you can take in your life. He says the moment you take a paycheck you're an employee and that's the mindset. So, my rich dad never paid me. It drove my poor dad, you know, a government employee nuts. "You got to pay people, you got to pay people", he used to yell. And rich dad was not saying that the paycheck was bad, he says he didn't want to be a slave to money.

So, as an entrepreneur, you know, if rich dad folded – ‘I just try another company. I don't need a paycheck. I don't need anybody to take care of me. If my government doesn't like me. I move to another country, because they need entrepreneurs there.’

The entrepreneur is not so much the business, the entrepreneur is really the mindset and the skill sets and the different set of rules. You see, I don't operate small business. As it does not operate in the same rules as big business.

Entrepreneur is a mindset first, a skill set and rules. And depending upon whether you're an employee or small business the rules are different, the mindsets are different, the skill sets are different.

If I could say one thing to somebody whose never been an entrepreneur and they're thinking about making the leap of faith into becoming an entrepreneur, well, I'll just tell them the same thing that happened to me. You know, my last paycheck, I still remember it clearly, it was one of the worst and the best days of my life and I was in Puerto Rico, I was working for Xerox and my boss gave me my last… it wasn't a paycheck, it was a bonus check. I think it was about 30,000 bucks… taxable, that's the only problem with that. So, I get this check and I went, "Holy mackerel." You know, I mean, so I was excited, but I was also disturbed. And so this other guy comes up to me, his name was John, and John says to me says to me "you're going to be back." I asked "Why?", and he says, "because you're going to fail." I looked at him and I said, "look... few expletive words… because that's what he did, he left Xerox, failed and he came back. I said, look... you fail and you came back but I'm going to fail and I'm never coming back… and that's the attitude.

If you say, well, if I fail, I'll go back to mommy and daddy, then that's what you'll do. So, if you fail, that's when I became an entrepreneur because I had no money. I had no money for years. Yeah, I didn't have a paycheck. But that's what my rich dad encouraged me to do. He says, when you don't have this paycheck you get hungrier, smarter and it's a test of your character.

Will you become a crook?

Will you become dishonest?

Will you cheat and steal?

… Or will you become a better human being?

So really that's the benefit of becoming an entrepreneur, you really find out who you are when you don't have anything. So, you always have to look at the big picture. Too many people look at, well, what's, what's going to happen to me? When you look at the big picture, you're also going to know that when something bad happens something good is going to happen too. But you got to prepare for whatever is coming. If you think the next 20 years will be like the last 20 years, you're going to get creamed.

You know, when you and I go to the supermarket and we buy a carton of milk we always check for the expiration date. But most people do not check for the expiration date on their brains. Instead of getting out of debt I get into debt. I just refinanced 300 million in debt I went from 5% to 2.5% interest - I made a fortune.

Every month more money comes in because my cost of money has gone down. So, while some financial experts are saying get out of debt, I'm saying learn how to use debt. See when I came back from serving in Vietnam in January of 73 and the first thing my rich dad said to me was, Go to school to learn how to invest in real estate.

It wasn't real estate; it was how to use debt and taxes debt and taxes make the rich richer. Debt and taxes make the poor and middle class poorer. So, all the rich guys who are doctors and lawyers or... you know, those guys, they're getting creamed - and they don't know why. Doctors for examples - they're making more money but the take-home is less.

You know, my doctor just yelled at me, he's happy, he says - Oh, guess what I finally made a million dollars. And I said - well how much you pay in tax? He says, $750,000 in taxes. So, his net was about $400,000. That's not bad, but when I make a million bucks, I keep a million bucks. And the reason is because I don't make it by working for money.

If you work for money your taxed. So that's why lesson number one in ‘Rich Dad Poor Dad’ is the rich don't work for money. What we do instead is we create businesses as entrepreneurs. We acquire real estate. I don't invest in the stock market, and the reason is because as entrepreneur I have more control over my income, how much I make and how much I pay in taxes. And because I'm an entrepreneur as well as an investor in real estate. I pay zero tax.

Every time I make let's say a million dollars as an entrepreneur, I immediately invest it in real estate, and I have a 4 to 1 step up. So, I put a million dollars in real estate, I get four million from the bank. That's why I love banks. But the banks are screwing everybody else you know, terrible but it's good for me.

When money is printed it's good for me, and when money is printed it's bad for people that work for money. This is because, when they print, savers get creamed and people who work for money get creamed. When they print debtors get rich. You see, debt and taxes make the rich richer and debt and taxes make the poor and middle class poorer.

When we have obsolete ideas, we get obsolete results. So, what's happening for most people the idea of going to school, getting a job, working hard, saving money, getting out of debt, buying your house because you believe it's an asset and investing for a long term. It's obsolete.

The world has changed, the world changed in 1971 when President Nixon took us off the gold standard and money became debt. On top of that, the education was more important years ago. Nowadays, it's just obsolete.

You know, there's Moore's law… Moore's law states information doubles every 18 months. In other words, everything is obsolete after 18 months. And this is a recent phenomenon. When you come out of school, you're already obsolete, and that's why I'm the old guy. I meet my friends; I went to Harvard… like what - 50 years ago?"

Today the banks are charging you interest to keep your money. In other words, the banks don't want your money because they've printed too much of it. And that's why there's bubbles and stocks and bubbles in real estate and all this. People are dumping the cash, because as I said in here, ‘Savers are losers and cash is trash’.

And yet people are like: ‘Well, I want a high-paying job.’ Well, that's an obsolete idea. Get out of debt, it's an obsolete idea. You should learn how to get into debt. How to you use debt to get rich. And they'll never teach you about taxes. The reason the 1% is way up there and the 99% are going down is because when they print money - two things happen - inflation and taxes.

And any entrepreneur that thinks ‘I'm just going to make money and start a business and make a lot of money’ they really should smell the roses instead. You know, that's not what the real entrepreneurs are doing. Do you know, there's 28 million small business owners in America and 24 million are one person entrepreneurs? They're called non-employee entrepreneurs. That's what happens when people don't really understand what an entrepreneur does and how money works nowadays. Most people are self-employed, but they're not really entrepreneurs. The self-employed pay the highest taxes of all and nobody tells them that!

It's also called the entrepreneurial spirit but what we're talking about was there's no such thing as a bad economy. We all have an external economy, but we also have an internal economy, and the will power is to change our internal economy.

I can see the good, and I can see the bad. I don't really give a damn. Because I'm going to be rich anyway.

But a poor person with a poor personal economy. All they're going to see is a bad economy. Because they don't know how to make money in any economy. And a middle-class person, they have a middle-class economy. You know what they want is a nice house, a steady paycheck and the job and the car. And when you take their job away to them that's disaster. And since an entrepreneur doesn't have a job anyway, it's no big deal.

All I'm saying to people is what Bucky Fuller taught me. There’re always two sides, and if you think the economy is bad, it's because your economy is bad. If you think that steady employment is important - then you'll see an economy without jobs. It’s always about your economy versus the external economy. Where you control vs where you can't control. And you can control it - it's called an internal focus vs an external focus.

The real entrepreneur has an internal focus but if they fall, they say, ‘Oh, this is good because I'm going to go up higher.’ You know, the average person will fall and say ‘Oh, I'm going to take some Prozac’. Or, they just claim that mistakes don't matter. Mistakes matter, it means you didn't know something.

A real entrepreneur whether they fall, or they just go, they always can go up. They can stand back up and go higher. That no matter what happens to them they got stronger and better, and smarter and happier.

On the contrast - a person with a weak internal mindset is that they're so afraid of what happens, and it generally happens. Like, people who are afraid of losing their jobs they generally lose their jobs.

The entrepreneur first job is control inside here, not outside there. The moment you take that paycheck you're an employee. You've got to be stronger than that. It's about inside control.

‘Rich’ vs ‘Poor’ mindset

Labels:

debt

,

make money

,

mindset

,

poor

,

rich

,

rich mindset

,

robert kiyosaki

Success mindset

Today we will focus on the teachings of one great leader, teacher and author - John Maxwell. Let's reflect on how successful and rich people think compared to the unsuccessful and poor.

I would teach you how to think correctly. The largest gap between successful and unsuccessful people in life is the thinking gap. I'm not talking about being smart, I'm not talking about an IQ, I'm talking about 'how you think', 'how I think'. Successful people think differently than unsuccessful people.

Wise thinking leads to wise living stupid thinking leads to poor living. If you want to have a fulfilled life you have to fill your mind correctly. Right now, you need to focus on today and what I realized so many leaders don't understand is that truly today matters, and we overestimate what we could do tomorrow we over exaggerate what we did yesterday, but we underestimate what we can do right now. The only time you have, the only time I have is now. So, the question for all of us is ‘what am I doing with now?’.

The great leaders they're present in the moment and because of that they maximize the moment so if you're attempted to take that far away glances, well, glance… but get right back to the present moment because today you're preparing to make tomorrow a success.

Well we all want to be motivated and yet so many times we fail to find the secret of motivation and so let me give it to you quickly. JUST DO IT! Motivation is not the cause of action it's the byproduct of action, and there's a lot of difference. If I think motivation is the cause of my action then I'm going to wait to be motivated before I do something but if I realize it's the byproduct of my action than I'll start doing something. Then guess what? Motivation will come and zap you and all of a sudden you feel good, and you're glad you're doing it. You're saying, ‘Wow this is truly wonderful’. So, let it be the byproduct to your life, let it be the foundation for the actions that you take.

Nothing comes to you until you commit yourself. Nothing comes to you if you're just going to try but you're not committed. Nothing comes to you if you're just thinking about it. It's not until you take the action step. It's not until you take the direction, ‘do the thing’ starts to flow through you.

But I'm saying don't cheat yourself out of the possibility of the potential that's on the other side of commitment. Stay with it long enough to find out if there's any fruit in it. You can do goal-setting with a pencil but you have to do go-getting with your legs. You got to take action and it's the action that separates us. The greatest gap in this world is the gap between knowing and doing. Knowing is goal-setting, doing… now that’s goal achieving.

People that are knowledgeable about habits say that it takes 30 days for an action to become a… habit. And habits can be good, and habits can be bad. So, over a period of time you can either be developing habits that are going to help or habits that are going to hurt you. People that grow develop habits that help. The great value of a good habit is you don't have to think about it. That’s why it's a habit. In other words, once you began to, over days and times and periods, begin to practice something that’s good - after a while it becomes automatic to you. It becomes who you are. In fact, I always tell people ‘practice a good habit long enough to make it yours’ and once it's yours now it's automatic. Every day you'll do what you should do.

Often, I have the expression that everything worthwhile is up the hill. That's a fact. You've never heard someone talk about accidental achievements. You've never heard someone that got to the top of the mountain and somebody asked him ‘how did you get there?’, kind of look confused to say ‘I have no idea’. The reason they know how they got there is because they had to walk all the way up the mountain. Nobody lifted them. There were no shortcuts. There's not an elevator, there's not an escalator. It's all effort to get you to the top of the mountain.

What I want you to understand is that inspiration does a lot better when it's coupled with the perspiration. There are a whole lot of people they want to be inspired in great things, but they don't want to do the hard work to achieve those great things. It's not either/or it's both/and. So, I really trust today that you will just kind of roll up your sleeves, look at something you haven't tackled for a while, and dive in! You'll be amazed that once after you do the work you will get inspired. Don't wait to get inspired before you do the work!

Labels:

achievement

,

commitment

,

goal achieving

,

habit

,

just do it

,

mindset

,

power of now

,

start

,

success

How many digits is a bank account number?

We will be answering a question coming from our FB page. A lady is interested in ‘how many digits are there in a typical bank account number?’

And straight to the answer.

In the US the number of digits in a typical bank account number is between 7 and 16 digits. Yes, those numbers depend on the country, the bank, and the type of account you might have with that bank.

The typical account number usually have 10-16 digits. The number is specific to your personal account. If you use a checkbook – the digits will be printed on the bottom of the checks as a second set of numbers, just next to the bank routing number. Another option to find your bank account number is to look at your monthly statements – the number should be printed there.

--

In the UK – the bank accounts are usually made of 6-digit sort code and 8-digit account number. The sort codes' purpose is to identify the bank branch and are usually in the form of 11-11-11. The sort codes usually do not have a check digit. The account numbers have an 8-digit number and contain a specific bank check digit.

All UK bank accounts also have IBANs (International Bank Account Number(s)). IBANs are mandated by the European Union to facilitate international bank transactions. British IBANs have 22 characters mix of digits and letters. IBANs start with ‘GB’, then the 3rd and 4th digits are a pair of modulo-97 check numbers, 5th to 8th positions are reserved for the bank-specific code, positions 9 to 14 consist of the bank sort code characters, and in the end (15th to 22nd) there is the bank account number.

--

In Canada, the basic account info is represented in about 7-digits number. Some banks might use more digits – up to 11. The bank number itself is usually 3 digits, the branch name is about 3 digits, the branch number is 5 digits. And then you have the account number itself (3 digits), branch number (5 digits), and then the bank account number which is about 7 digits.

As usual, you can check those numbers on the bottom of any account checks the bank provided to you. Also, you should be able to check your bank account number digitally, by logging into your bank account online and checking your account information.

The bank account numbers are used by any bank to electronically deposit your payroll or charge your regular payments, etc… If you are trying to transfer funds internationally, there will be some additional numbers to be used to make that possible, to identify your bank on the international payment system.

As a bottom line - banks distinguish between savings, checking, and time deposits by altering the number of digits in any specific account number. As mentioned above, some of the digits will represent the branch of the bank it was opened at, and the others will represent the account holder. the number of digits is important internally to the teller processing the bank account number.

The dark side of a company bankruptcy

Nowadays, in the full unstableness of the market and the economy as a whole, some companies declare bankruptcy, and those are good examples of what is going to happen with your stocks, in a case of any company declaring bankruptcy.

Companies like JCPenney and Hertz and are declaring bankruptcy and you wouldn’t believe what happened to the shares price… It skyrockets instead of crashing down. So, in case of not aware of what usually happens when a company declares bankruptcy, there it is...

There are two options for a company to declare bankruptcy – using Chapter 7 or Chapter 11. If a company declares Ch.11 bankruptcy, what basically happens is – the company is asking for a chance to reorganize and recover. It asks protection from the court from the creditors. If the company survives, your shares may also survive too. But there is a very small chance of that happening. The company may cancel existing shares, making yours worthless. This is what happens in most of the cases. If the company declares bankruptcy under Ch.7, the company acknowledges the inability to function anymore. Rarely, any shareholders get something, as the creditors of the company are served first.

So essentially when a company announces bankruptcy the shares have zero value or close. You might be thinking – what if the company survives bankruptcy in the future and manage to cut costs and reorganize and survive somehow? You might think that the value of the shares will rise significantly. But, in reality, it turns out that the shares are almost always deleted during bankruptcy. The existing shares are just completely wiped out, most of the time. And if the company does survive the business owners, who credited the company in the past just create new shares for themselves. The new shares are not shared with the old shareholders.

A good example of the dark side of a company bankruptcy is the case with United Airlines. They went bankrupt in 2002. And four years later in 2006, the company managed to stabilize, and new shares went public. The same shares are still trading today but none of these new shares were given to the old shareholders. The people who held shares before and during bankruptcy lost everything. For them, it doesn't matter that the company survived.

So, nowadays, as an investor - you buy shares in Hertz, hoping for the company to survive, keep in mind that it probably won’t even matter as if the company does really survive, the business owners will most probably simply issue new shares and none of those will be shared with the old shareholders.

The stock exchange usually delists such shares and tries to stop them from trading. But some companies are fighting the delisting, as they would like to squeeze the most out of the market and the naïve investors.

The bottom line is that owners of common stock often get nothing when a company enters bankruptcy. Those shareholders are usually the last in line for compensation.

The Stock Market is a bubble - and it will burst

During the last decade, the investors have come to believe that no matter what - the market only grows, in a long term. Long-term investment in index funds (like S&P 500) has somewhat proven to be the most profitable strategy. But do you know that the nature of the stock market is to grow as a bubble and eventually burst?

We are currently in a pandemic situation. The economy is struggling, unemployment is rising, and there is a lot of uncertainty. On top of that the S&P 500 recovered so quickly from the mini-crash in Mar 2020, and it looks like it have entered a bubble.

Let’s quickly explain the nature of the stock market. There are consistent patterns that emerge in every bubble in history and these consistent patterns are emerging again right now. Unfortunately – every time the investors believe in “but now it’s different” mantra, repeating the same mistakes again and again.

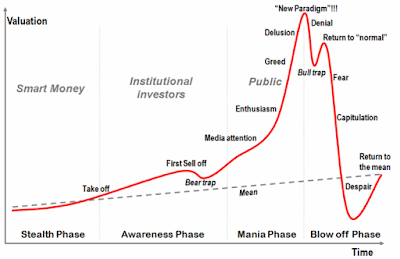

Above you see a chart representing the life-cycle of the stock market. This chart shows the stages of every bubble in history. It starts with the early stealth phase. Next comes the awareness phase as the investments begin to attract attention. Followed by the mania phase – where the bubble grows extensively. Finally the blow-off phase or the so-called crash.

The chart shows perfectly well - how every single bubble in history has grown and burst.

Above is an example of the dot-com bubble. Notice how the charts are pretty much identical. Did people learn from previous bubbles? Well, not so much it seems, at least not enough to avoid it playing out the stock market in the same way again and again.

Above is another example. We have the notorious Bitcoin bubble. This time it's overlaid on the stages of our bubble charts and we can see how closely it does follow it. It is clearly the same pattern so whether it was the "dot-com bubble" or the "Bitcoin bubble" the truth is the majority of the investors never learn and the same patterns are repeated over and over.

Every now and then new technology is invented, it changes the world and the majority of investors think “this time is different”. It’s also important to note that the burst of the bubbles are not always the end. For example the Bitcoin is obviously very contentious as it has shown tremendous staying power since the bubble burst, and maybe hasn't had as much time as the others to prove its worth.

The key point is that many investors fall victim to the same patterns because they think “this time is different”. This mantra have caused every bubble in history to get out of hand, and it is a well-documented pattern with lots of analysis.

Finally, keep in mind that we have clear signs that (in Jun 2020) we are currently in the mania phase of the bubble chart and as the charts show - the crash usually isn't too far behind. So, if you are an investor – be careful and don’t get overexcited.

We are currently in a pandemic situation. The economy is struggling, unemployment is rising, and there is a lot of uncertainty. On top of that the S&P 500 recovered so quickly from the mini-crash in Mar 2020, and it looks like it have entered a bubble.

Let’s quickly explain the nature of the stock market. There are consistent patterns that emerge in every bubble in history and these consistent patterns are emerging again right now. Unfortunately – every time the investors believe in “but now it’s different” mantra, repeating the same mistakes again and again.

Above you see a chart representing the life-cycle of the stock market. This chart shows the stages of every bubble in history. It starts with the early stealth phase. Next comes the awareness phase as the investments begin to attract attention. Followed by the mania phase – where the bubble grows extensively. Finally the blow-off phase or the so-called crash.

The chart shows perfectly well - how every single bubble in history has grown and burst.

Above is an example of the dot-com bubble. Notice how the charts are pretty much identical. Did people learn from previous bubbles? Well, not so much it seems, at least not enough to avoid it playing out the stock market in the same way again and again.

Above is another example. We have the notorious Bitcoin bubble. This time it's overlaid on the stages of our bubble charts and we can see how closely it does follow it. It is clearly the same pattern so whether it was the "dot-com bubble" or the "Bitcoin bubble" the truth is the majority of the investors never learn and the same patterns are repeated over and over.

Every now and then new technology is invented, it changes the world and the majority of investors think “this time is different”. It’s also important to note that the burst of the bubbles are not always the end. For example the Bitcoin is obviously very contentious as it has shown tremendous staying power since the bubble burst, and maybe hasn't had as much time as the others to prove its worth.

The key point is that many investors fall victim to the same patterns because they think “this time is different”. This mantra have caused every bubble in history to get out of hand, and it is a well-documented pattern with lots of analysis.

Finally, keep in mind that we have clear signs that (in Jun 2020) we are currently in the mania phase of the bubble chart and as the charts show - the crash usually isn't too far behind. So, if you are an investor – be careful and don’t get overexcited.

Investing tips by Tony Robbins

We will be presenting 3 key tips for beginner investors and everyone who would like to start investing in the stock market, presented by the greatest coach of all time - Tony Robbins.

Here is what Tony said about investing:

The average person thinks finance is so complex because frankly the industry tries to make it sound complex. They use words that you don't know so you don't know what to do... What happens is we just give them our money and say deal with it.

1. You need to know that you can't wait until you have a ton of money to start investing.

If you can invest in business, even a small amount, you can grow. It doesn’t matter how small it is, the important thing is to automate it.

You got to take a percentage of what you earn and pretend it's a tax. You should not waste that money. It automatically goes straight to the investment account and you never see it as money you can spend. When you save 20% and you compound it, the numbers are incredible. And then the problem is: If you do that first step, but you don't do the second step which is:

2. Become an insider and understand the rules of the money game. I'll give you 2 or 3 of the Myths, really fast:

2.1. One, the myth that someone says give me your money and I'm going to beat the market. Over any ten year period of time, 96% of the mutual funds will not even match the market.

Warren Buffet flat out used to confirm the same trend. 96% of his money, all that money does not go with any mutual fund, it goes straight into the index.

What the index is you get a piece of all the largest companies in the world but it costs almost nothing to get in. You hire someone because you are thinking "I have a family, I have a business, I have a life, I'm not an investor- I'm going to hire someone who's a professional, it makes sense they would do better than me."

Unfortunately that's wrong.

Only 4% of the mutual funds will beat the market. 4% chance of finding the right mutual fund, the chance is so slim that it will happen.

2.2. And, the second myth is after getting terrible performance, people think "Maybe, fees don't really matter" or they'll tell you it's only 1%. And on Forbes, it says the average fee is 3.12%,

1% versus 3% is a big difference. And it really matters - just like you grow by compounding, your fees also compound. If you have 3 people and one gets 1% fees, another 2% the other 3%, and they all get the same return. And, they start out with 100,000 dollars at 35, accumulating for 30 years until they are 65 years old. If it is average 7% compounded, they all get 7% return and when they go to retire, the person who had 1% in fees is going have 574,000 dollars. The person who had 3% in fees will have only 224,000 dollars. This is 77% less money!

If I said to you: "Here's the deal, let's do an investment. You put up all the money, you put up all the money, you put up all the risk, I'll put up no money and I'll put up no risk. If you lose I win, and if you win I win and if you win, over the life of the time I'll get 60% of what you earn." That's a mutual fund with 3%.

3. Instead, you could own the stock market – invest in the S&P500, you could own a piece of all 500 big companies through like the Vanguard 500 and you get the best of all the business - Apple, Exxon, etc… All these companies – you invest into and it cost you only .17%. And if you go to a normal mutual fund you might own the same companies for 3.17%. That's like buying a Honda Accord for $20,000 in the first scenario or $350,000 in the second for the same car.

That happens every day with finances because people don't know how to look at this so when they read the book Money Master the Game: 7 Simple Steps to Financial Freedom that will never happen to them again.

Top tips for Investing in the stock market by Warren Buffett

Sharing the 5 top tips for investing in the stock market, presented by not anybody else, but the one and only – Mr. Warren Buffett himself.

1. I don't know when to buy stocks, but I know whether to buy stocks. Some people should not own stocks as they just get too upset with the price fluctuations. If you're going to do dumb things because your stock goes down, you shouldn't own the stock at all. I mean that if you buy your house at $20,000 and somebody comes along the house and says I'll pay you $50 – well, just don't sell it.

2. The best thing with stocks is to buy them consistently over time you want to spread the risk as far as the specific companies you're in by being versatile and you diversify over time by buying this company stock this month, that company stock next month. Year after year after.

3. If you save money you can buy bonds, you can buy a farm, you can buy an apartment house or buy a part of the American business. And if you buy a 10-year bond now you're paying over 40 times earnings for something which earnings can't grow, and you know if you compare that to buying equities good businesses. I don't think there's any comparison.

4. You are making a terrible mistake if you say out of a game. Probably you think, it is going to be very good over time because you think you can pick a better time to enter the stock exchange market. The later you start, the worse you will be: in terms of knowledge, experience, and money.

5. I know what markets are going to do over a long period of time. They're going to go up, but in terms of what's going to happen in a day or a week or a month or a year, even I've never felt that I knew it and I've never felt that was important. Keep in mind that in 10 or 20 or 30 years, I believe, stocks will be a lot higher than they are now.

Subscribe to:

Comments

(

Atom

)